- Ethereum stays held beneath the downtrend line and the 50-200 EMA cluster, with the broader construction remaining bearish.

- ETF flows remained unfavorable with internet outflows of $19.4 million, at the same time as selective purchases from BlackRock spotlight the heterogeneity of institutional demand.

- Failure to maintain $3,000 dangers an extra decline in the direction of $2,880, whereas the bulls have to get better between $3,296 and $3,490 to alter momentum.

On the time of writing, Ethereum is buying and selling round $3,130 after an unsuccessful try and reclaim the downtrend line and short-term EMA resistance. The market stays below stress as ETF outflows proceed and patrons battle to defend the $3,000 to $3,050 assist zone. The strain is clear. Spot demand is combined, however the technical construction stays favorable to sellers.

Construction stays bearish resulting from trendline rejection

On the each day chart, Ethereum stays pinned beneath a well-defined downtrend line. All restoration makes an attempt over the previous two weeks have stalled beneath this line, reinforcing the road as energetic resistance slightly than a fading sign.

Costs additionally stay beneath the 50-day and 200-day EMAs and are at the moment concentrated across the $3,296 to $3,447 space. This zone has capped the upside momentum many instances. The 100-day EMA stays excessive close to $3,491, supporting the concept that the broader development has entered a correction section slightly than a pause.

Ethereum failed to interrupt above the 0.382 stage close to $3,245 and stays pinned close to the 0.236 retracement close to $3,005. If costs are unable to regain midrange Fibonacci ranges, rallies are likely to fade rapidly. This construction remains to be outlined by falling highs and compressed rebounds, persevering with to place stress on patrons.

Intraday chart reveals unstable stability

Shorter time frames replicate comparable imbalances. On the hourly chart, Ethereum is making an attempt to stabilize above $3,100 after falling sharply earlier this week. Nevertheless, each the supertrend and parabolic SAR stay bearish, with overhead resistance close to $3,150 to $3,180.

Every bounce is shallow and corrective slightly than impulsive. Value has not made a clear excessive inside the intraday construction, suggesting quick masking slightly than new lengthy positions.

So long as Ethereum stays beneath intraday development resistance, any try to maneuver larger shall be inclined to recent promoting. Failure to carry $3,080 will re-expose the $3,000 psychological stage.

Spot stream stays a headwind

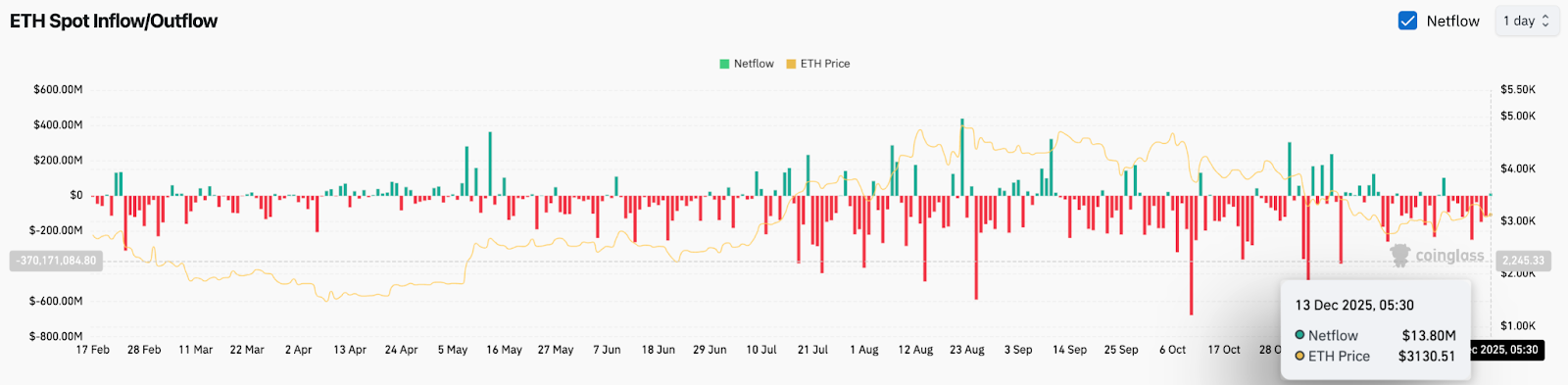

Spot market knowledge continues to development negatively. Current foreign money stream knowledge reveals continued internet outflows, with promoting stress outweighing new accumulations over a number of classes.

The most recent each day print reveals a modest influx of $13.8 million, however the broader development stays in circulation slightly than sustained demand.

ETF flows spotlight numerous positioning

Within the newest session, Ethereum ETF complete flows recorded a internet outflow of roughly $19.4 million. This outflow confirms that some institutional buyers’ publicity continues to ease, slightly than rise.

On the identical time, BlackRock added roughly $23.2 million price of Ethereum, highlighting the disparity in institutional investor flows. Whereas some patrons have stepped in, the broader ETF complicated has not but aligned.

One of these combined conduct typically seems throughout a section of consolidation slightly than a development reversal. Sturdy tendencies sometimes require broad participation throughout the fund, slightly than remoted purchases.

Will Ethereum go up?

Ethereum remains to be in a correction section as trendline resistance and ETF outflows restrict upside momentum.

- Bullish case: A strong each day shut above $3,296 and subsequent restoration to $3,490 would invalidate the draw back construction and open the door to $3,600.

- Bearish case: If the value closes beneath $3,000 for the day, the breakdown is confirmed and the main focus may shift to $2,880 and even $2,750.

Sellers retain management till value regains the foremost EMA and spot stream improves. The subsequent decisive transfer will rely on whether or not patrons are in a position to defend $3,000 or whether or not that stage collapses below sustained stress.

Associated: Ethereum (ETH) value prediction: ETH takes earnings on tight provide sign

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply