- Bitcoin is buying and selling close to $86,000 as volatility, promoting strain, and ETF outflows hold the market range-bound.

- Analysts are divided on short-term draw back dangers.

- If Bitcoin fails to interrupt above $88,000, it might head in the direction of $83,000-$80,000, regardless of the bullish long-term outlook.

Bitcoin is buying and selling at $86,414 and analysts are debating whether or not the market is more likely to fall. They concentrate on liquidity, market cycles, and continued promoting strain. Buyers are divided on whether or not Bitcoin is primarily a danger asset or a long-term retailer of worth.

Bitcoin present value fluctuation

Bitcoin rose simply 0.1% on the day, however stays unstable, dropping 6.7% over the previous week and 9.6% over the previous month. Sturdy resistance close to $94,000 has stored the worth inside a slim vary.

Some analysts imagine this era of stability indicators a redistribution part, with long-term and institutional traders shopping for from sellers. Whereas short-term value actions could seem bearish, this development suggests the market is absorbing liquidity moderately than heading for a major decline.

Associated: Why Bitcoin stays unstable after the newest US jobs report

Schiff’s warning: Gold will rise, however Bitcoin will disappear?

Economist Peter Schiff stated an increase in gold and silver might precede a crash in Bitcoin, arguing that Bitcoin behaves like a danger asset and tends to fall early in instances of market stress. He warns that traders trying to hedge in opposition to a weak greenback might lose cash on Bitcoin earlier than the greenback truly falls.

Different analysts disagree, arguing that Bitcoin’s function will change relying on market circumstances. Brief-term shocks might trigger shares to fall as traders search money. Nonetheless, throughout a protracted confidence disaster, Bitcoin might transfer away from being a conventional danger asset and function a retailer of worth.

They add that whereas gold protects wealth inside the monetary system, Bitcoin offers mobility and independence from gold.

Promoting strain and market individuals

Bitcoin value is underneath strain from continued promoting. Native governments in China could have offered giant quantities of Bitcoin seized in prison instances, together with cash associated to the 2019 PlusToken rip-off, based on a report.

Most of those holdings are believed to be a lot smaller than the unique 194,000 BTC and are sometimes offered by offshore or over-the-counter markets.

In the meantime, institutional traders, banks, ETFs, and huge traders have been steadily shopping for. Nonetheless, the ETF noticed important outflows, with $358 million outflows on Monday and one other $277.2 million the next day.

Analysts say the market is pretty balanced, with sellers pushed by previous market cycles and patrons centered on long-term fundamentals. Analyst Plan B summarized that about half of the market is promoting whereas the opposite half is including.

Cycles and institutional implementation

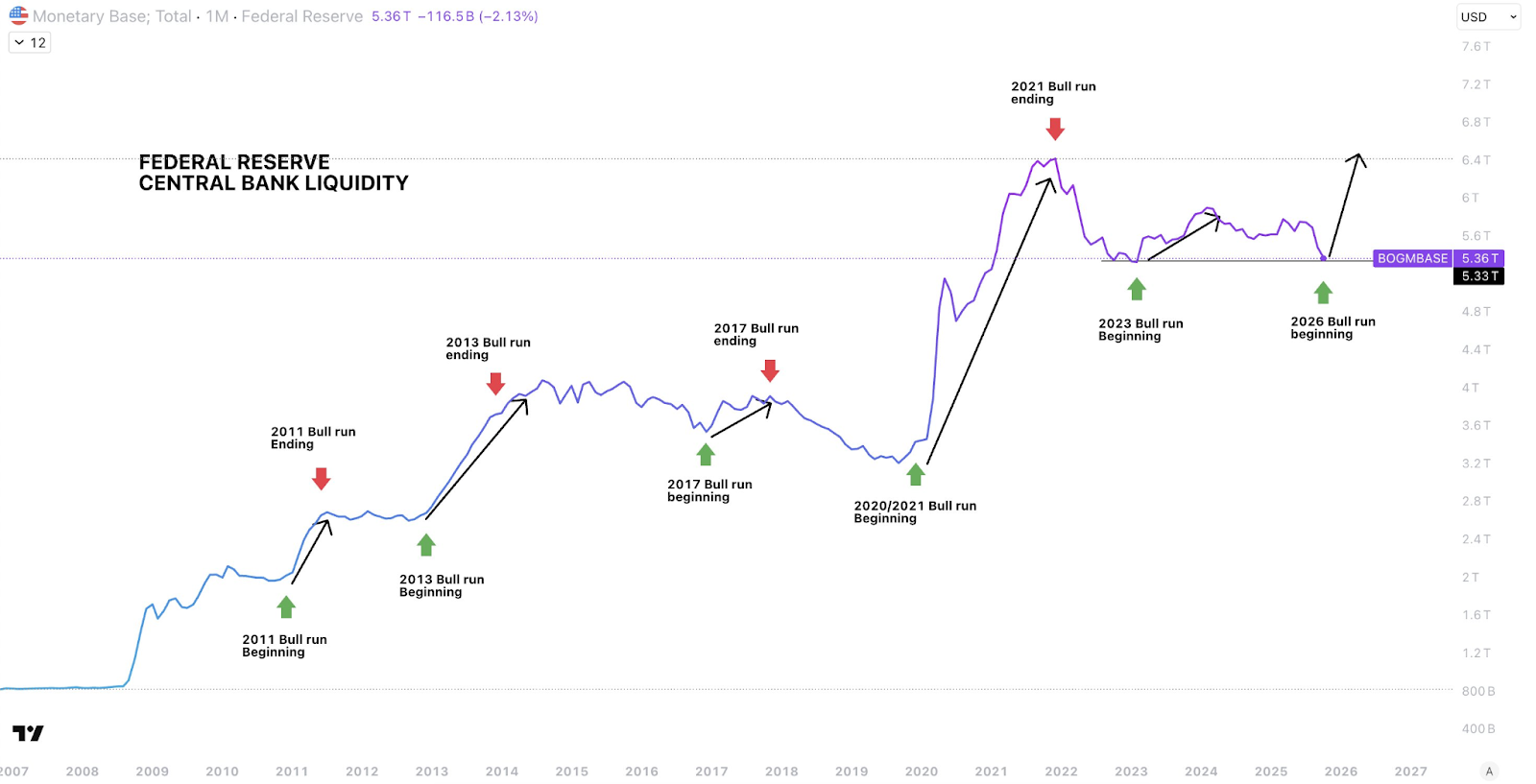

In the meantime, the normal four-year Bitcoin cycle has been known as into query. Analysts like Sycoderick say Bitcoin’s motion is at the moment pushed extra by liquidity and the general economic system than by a set halving cycle. This time, Bitcoin didn’t attain extraordinarily excessive costs, and there was no clear market ceiling.

Institutional adoption can be altering the market. Bitwise CIO Matt Hogan predicts that Bitcoin might attain an all-time excessive in 2026, citing a weakening halving impact, decrease rates of interest, and elevated involvement from institutional traders.

Associated: US employment report error: Payrolls rise by 73,000, Fed lower expectations rise, Bitcoin reacts

Brief-term dangers and outlook for 2026

Regardless of the optimistic long-term outlook, short-term dangers stay. Analyst Michael Van de Poppe says Bitcoin wants to interrupt above $88,000 to verify upward momentum. If that fails, costs might fall again to $83,000 and even $80,000, particularly as macroeconomic pressures proceed.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply