- XRP has fallen because the whale sell-off accelerates, pushing the value under key assist at $1.92, growing draw back danger.

- Merchants are shorting XRP as analysts warn of a attainable fall in the direction of $1.

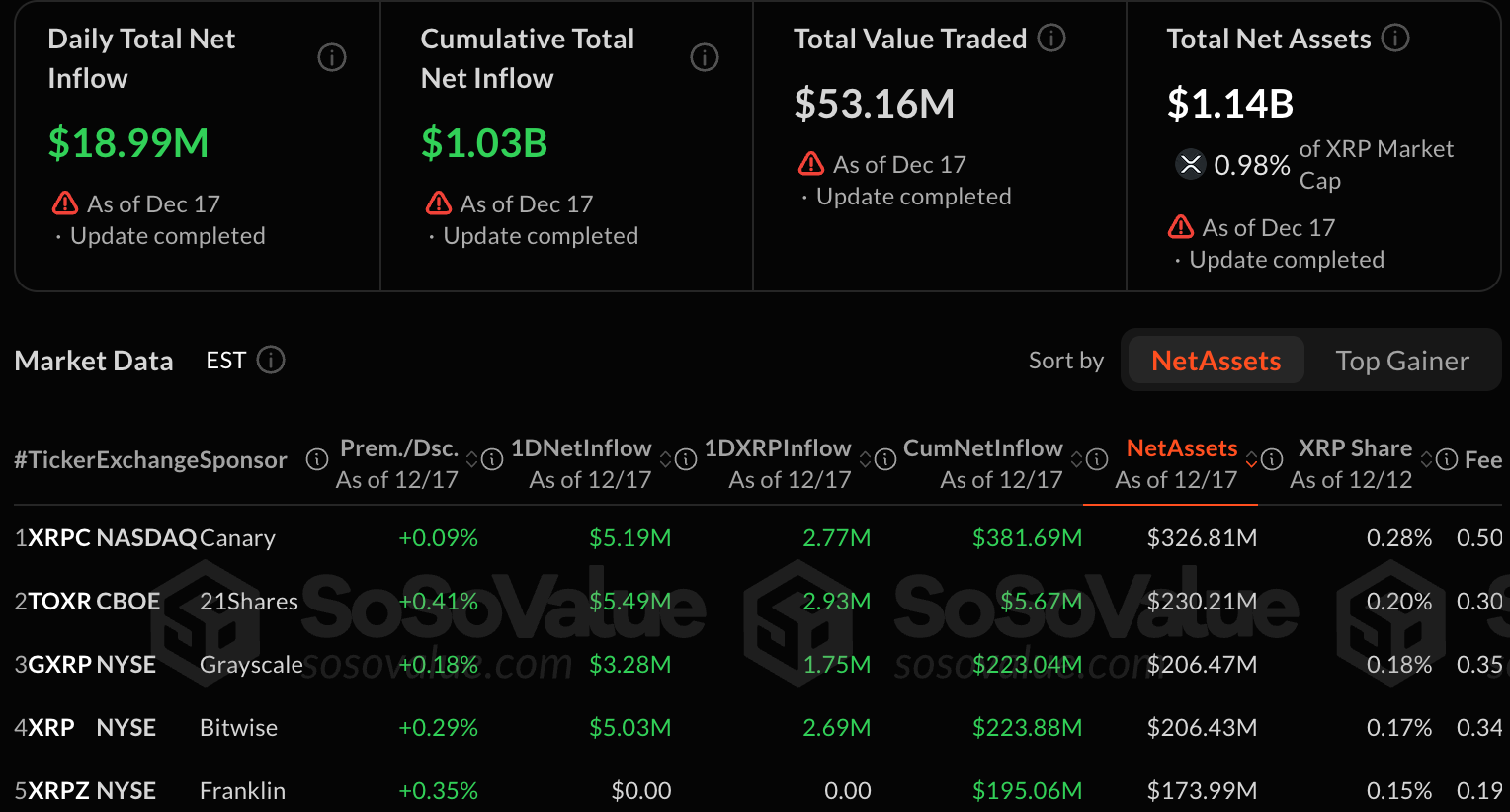

- Regardless of the decline, the Pot XRP ETF has seen regular inflows and at present stands at over $1 billion.

XRP is underneath strain as we speak as promoting exercise intensifies throughout the market. The token is buying and selling round $1.87, down 3% previously 24 hours. Wanting on the broader time-frame, XRP is at present down 7.14% this week and about 15% over the previous month.

The primary purpose for the decline in XRP is aggressive promoting by massive holders. Analyst Ali Martinez just lately warned that XRP may fall to $1 if the present promoting strain continues.

In keeping with Martinez, the whale has landed roughly 1.18 billion XRP previously 4 weeks. In keeping with the information, on November 24, massive wallets held roughly 4.8 billion XRP, however that quantity has since decreased to roughly 3.62 billion XRP. This secure distribution positioned vital downward strain on costs.

Breakdown of key assist ranges, path to $1?

The sustained decline pushed XRP under the important thing assist degree of $1.92, which beforehand served as a short-term ground. Martinez believes that failure to regain this zone will increase the chance of an much more extreme correction.

He believes that if the bearish momentum continues, XRP may revisit the $1 degree. Notably, XRP final traded close to $1 throughout a bull run in mid-November 2024, earlier than reaching $3.66 by July 2025. The coin is at present down 50% from its peak.

Traders quick XRP regardless of $100 forecast

Including to the bearish strain, extensively adopted investor ChartFu has revealed that it’s taking a brief place in XRP. His remarks sparked blended reactions, with some analysts questioning the transfer, whereas others advised higher shopping for alternatives might current themselves at decrease ranges.

What’s attention-grabbing is that Yonghoon Kim, an entrepreneur who claims to have the very best IQ on this planet, has expressed a bullish opinion on XRP, inflicting a bearish voice out there. He just lately advised that high-IQ traders are prone to personal XRP and raised his long-term value goal to $100.

Associated: “IQ 276” XRP prediction sparks debate: Will XRP actually enhance 10x in 2 weeks?

Nonetheless, veteran merchants like Peter Brandt stay skeptical, arguing that XRP bulls typically underestimate the dangers. Supporters counter that XRP appeals to traders who worth funds infrastructure, liquidity and regulatory readability, fairly than short-term hype.

ETF inflows supply a counter-narrative

Regardless of the whale decline and rising bearish temper, XRP nonetheless has sturdy supporters. The Spot XRP ETF continues to document regular inflows and no outflows have been reported to date.

Associated: XRP ETF maintains optimistic inflows for 30 consecutive days: Bullish?

Since its launch in November, the XRP ETF from firms reminiscent of Grayscale, Bitwise, 21Shares, Canary, and Franklin has attracted roughly $1 billion in whole inflows, with whole belongings now exceeding $1.14 billion.

Some traders imagine that sustained institutional demand by ETFs may finally offset whale promoting and set the stage for a rebound, just like what Bitcoin and Ethereum skilled earlier this 12 months.

For now, XRP stays caught between intense promoting strain and robust inflows from institutional traders, leaving its near-term path unsure.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply