- Bitcoin rebounded close to $89,600 and short-term momentum improved above the 20 and 50 EMAs.

- Futures open curiosity is rising, indicating continued leverage demand regardless of latest volatility.

- Macro liquidity help may result in a long-term rally in BTC, reaching $200,000 in 2026.

Bitcoin held regular close to $89,600 on the four-hour chart as merchants weighed technical restoration indicators in opposition to tight liquidity situations. Costs rebounded after efficiently defending latest lows, restoring short-term confidence.

Along with technical positioning, derivatives knowledge and macro liquidity narratives are presently shaping Bitcoin’s broader outlook. Consequently, market contributors are watching to see if the momentum beneficial properties additional or stalls under vital resistance.

Stabilization of short-term structural indicators

Bitcoin has risen above the 20-EMA and 50-EMA, indicating that short-term momentum is bettering from latest weak point. Nonetheless, worth stays under the 100-EMA and 200-EMA, and the broader construction stays range-bound.

Subsequently, the bulls will face fast strain close to the $89,700 to $90,000 provide zone. A decisive transfer above this space may check the $91,200 degree, the place sellers have been intervening.

Associated: XRP Worth Prediction: Downward Channel Holds as ETF Inflows Fail…

Moreover, if a 4-hour shut above the 200 EMA is confirmed, momentum may head in the direction of $94,700. This degree coincides with a significant Fibonacci extension and will invite participation in a stronger development.

On the draw back, Bitcoin continues to depend on help close to $88,000, the place a number of shifting averages converge. Moreover, the $87,450 zone supplies short-term demand near the decrease Bollinger Band. A breakdown under $88,000 may reveal deeper retracement ranges round $85,900 and $83,900. Consequently, merchants stay cautious regardless of the latest worth restoration.

Futures positioning stays robust

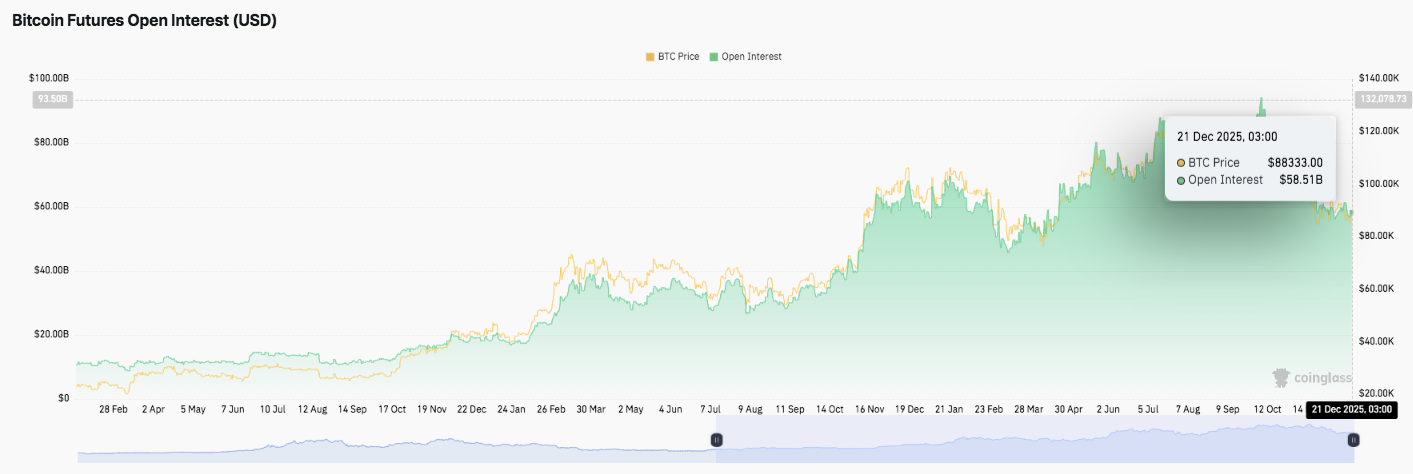

Regardless of latest volatility, open curiosity in Bitcoin futures continues to develop. Open curiosity remained elevated across the $55 billion to $60 billion vary through the pullback. This motion means that merchants held onto leveraged positions fairly than exiting.

Moreover, through the consolidation part at first of the yr, there was a rise in open curiosity together with flat worth actions. This sample usually displays place building fairly than distribution. Importantly, the rise in open curiosity throughout a bull market helps the view that demand for derivatives will persist.

The story of spot flows and liquidity

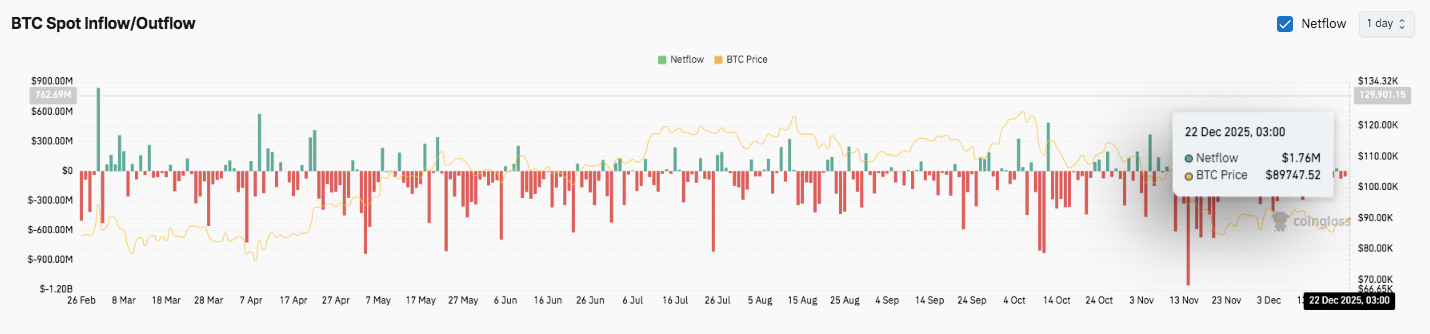

Spot market flows paint a extra balanced image. Early capital inflows had been usually met with fast outflows, suggesting cautious accumulation. Mid-year knowledge confirmed that outflows had been even higher in periods of robust costs, reflecting profit-taking habits. Just lately, internet flows have hovered round neutrality, suggesting a short lived equilibrium between patrons and sellers.

Associated: Cardano Worth Prediction: ADA worth outlook weakens regardless of stabilizing…

Moreover, the macro liquidity debate is presently impacting long-term expectations. Arthur Hayes argues that the Federal Reserve’s Reserve Administration Buy Program works equally to quantitative easing. He sees this transition as a liquidity help mechanism that can delay the affect available on the market.

Consequently, Hayes predicts a robust liquidity-driven transfer that can push Bitcoin in the direction of $200,000 in 2026. BitMEX commentary confirms the elevated give attention to monetary situations as a long-term catalyst.

Technical outlook for Bitcoin (BTC) worth

Bitcoin trades inside a tightening short-term construction, so key ranges stay well-defined.

Upside ranges embrace the primary resistance cluster between $89,700 and $90,000, adopted by $91,200 close to the 200-EMA. A sustained break above this zone may lengthen the rally in the direction of $94,700, and if momentum picks up, $103,400 may act as a better Fibonacci extension.

On the draw back, $88,300 to $88,000 acts as fast help from the EMA cluster. Beneath that, $87,450 and $85,900 stay necessary demand zones. The broader setup means that Bitcoin is compressing inside a spread after recovering from latest lows.

Will Bitcoin go up?

Bitcoin’s near-term route will rely upon whether or not patrons can maintain the $88,000 degree and pressure acceptance above $91,200. Technical compression, steady futures positioning, and subdued spot flows level to elevated volatility forward. A confirmed breakout may revive the bullish momentum, however failure to carry help dangers an additional pullback in the direction of $85,900 and $83,900.

Associated: Monero Worth Prediction: XMR Continues Uptrend Regardless of Pullback as Market Curiosity Expands

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply