- SHIB is testing the decrease sure of the long-term descending channel, and the supertrend and SAR stay bearish.

- Intraday momentum stays weak, with RSI under 40 and capital flows failing to substantiate accumulation.

- Spot outflows proceed, and Shibarimusu exercise stays suppressed, which won’t stimulate demand within the quick time period.

The Shiba Inu value is buying and selling round $0.00000718 at the moment after extending its decline inside a well-defined descending channel. Worth is positioned close to the decrease finish of its construction, with consumers trying to gradual the transfer however not forcing a reversal but. SHIB stays below near-term stress as development resistance overhead and spot flows stay detrimental.

Descending channels outline day by day construction

On the day by day chart, SHIB continues to respect the descending channel that has guided the value since late summer season. Every restoration try fails under the channel’s midpoint, and the collection of lows and highs stays intact. The current decline has pushed costs again towards the channel backside, and the main target is on whether or not consumers can as soon as once more defend this zone.

Pattern indicators strengthen the bearish construction. The supertrend stays above the value close to $0.00000839, however the parabolic SAR dot continues to trace above the candlestick, indicating that the development path has not reversed. Till costs return to those ranges, broader settings will stay corrective slightly than constructive.

Associated: Dogecoin value prediction: failed rebound indicators additional draw back danger

Speedy resistance coincides with the midline of the channel round $0.00000800 to $0.00000840, a zone that has been the higher sure for repeated rebounds. Altering the momentum of the day requires acceptance past this realm.

Brief-term compression approaches help

On the 30-minute chart, value is forming a tightening construction between the downtrend line and a shallow uptrend base. This compression displays consumers defending solely the identical help band and repeating sells on small bounces.

The RSI on the intraday chart is round 37, under the impartial 50 line. Momentum has not recovered throughout the current rally, and strikes to maneuver greater are restricted. Every rally happens with weak RSI readings, stopping the value from sustaining above the resistance stage.

Chaikin Cash Movement stays barely detrimental round -0.04, indicating that capital flows aren’t shifting in favor of accumulation. If there is no such thing as a change within the CMF, a short-term rebound will lack help from inflows.

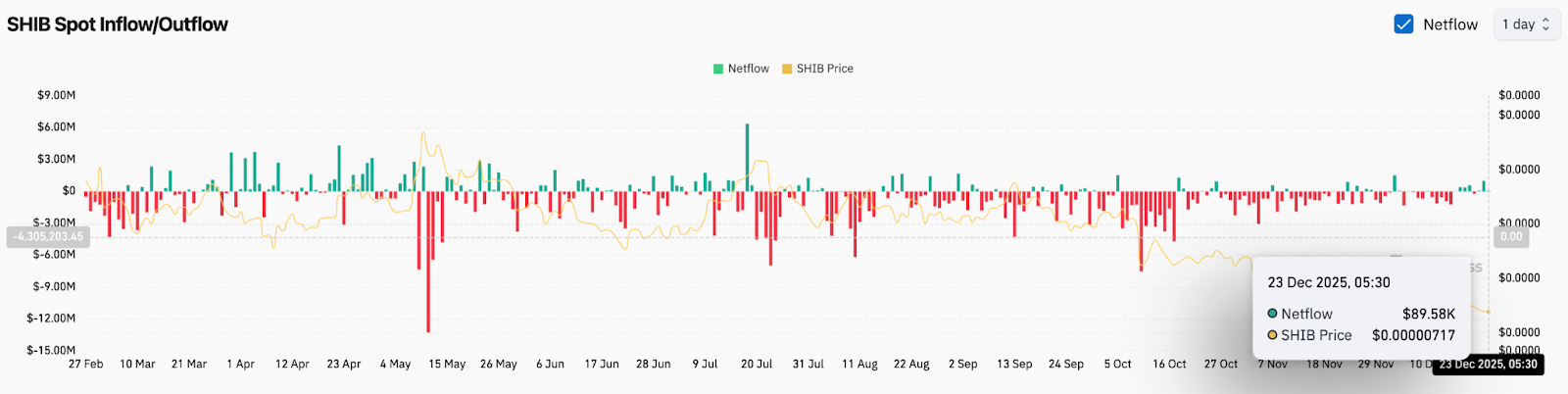

Spot flows proceed to favor sellers

In response to SHIB’s newest statistics, internet outflows have been roughly $89,000 as of Dec. 23, after an influx of $1 million the day past.

Traditionally, SHIB required steady inflows to disrupt descending buildings. That situation has not but emerged.

So long as spot flows stay detrimental, the rebound is more likely to stall close to the resistance zone.

Shibarium actions stay silent

On-chain exercise by means of Sibrium stays restricted. The full quantity locked quantities to roughly $1.46 million, with a day by day DEX quantity of roughly $86,000. These numbers are nonetheless considerably under ranges seen throughout earlier growth phases.

TVL has stabilized after an earlier decline, however the upward development has not resumed. On-chain information is at the moment not a catalyst for value restoration except utilization or liquidity will increase. Fees are additionally minimal, additional reinforcing the shortage of network-driven demand.

outlook. Will Shiba Inu rise?

SHIB continues to be anchored close to help inside the descending channel and development indicators are nonetheless pointing down.

- Bullish case: A maintain above $0.00000700 adopted by a break above $0.00000850 will break the channel and reverse the supertrend. This transfer shifts the main target to $0.00000950.

- Bearish case: A day by day shut under $0.00000700 confirms a continuation inside the channel and opens the draw back in the direction of $0.00000620.

Associated: Monero Worth Prediction: XMR Continues Uptrend Regardless of Pullback as Market Curiosity Expands

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply