- BlackRock grouped Bitcoin with Treasury payments and US tech giants in its 2025 outlook.

- IBIT introduced in additional than $25 billion in inflows in 2025, though Bitcoin fell by round 30%.

- Since its inception in January 2024, whole IBIT inflows have reached $62.5 billion.

BlackRock, the world’s largest asset supervisor with practically $13 trillion below administration, ranks Bitcoin alongside U.S. Treasury payments and different U.S. tech shares as certainly one of its prime funding themes for 2025.

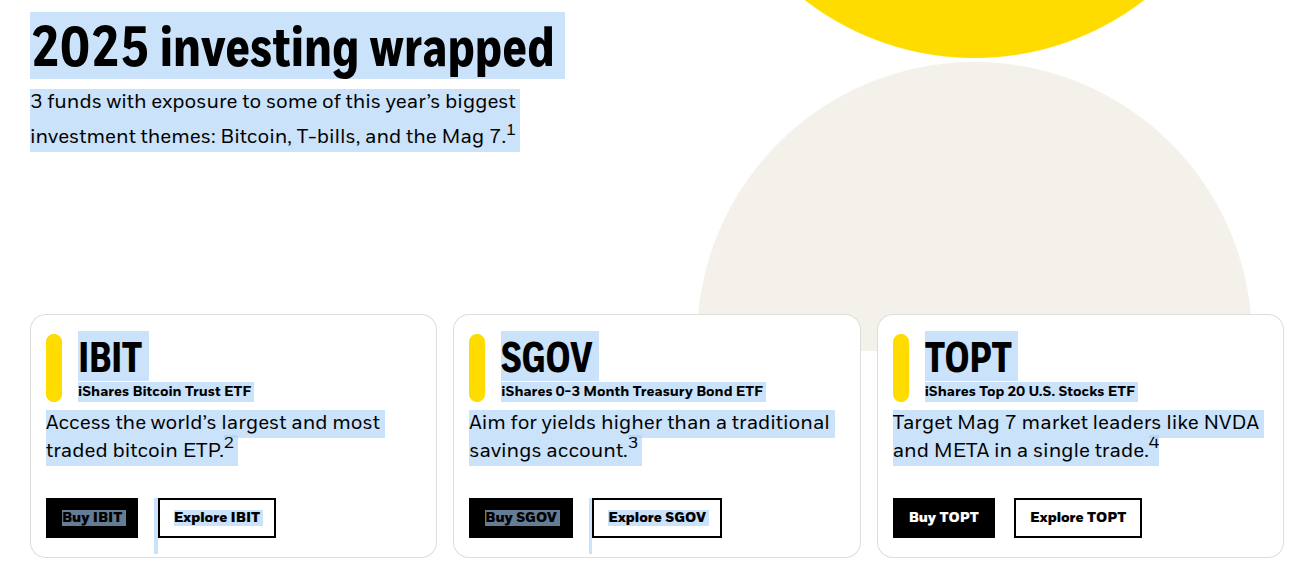

In its year-end outlook titled “Investing in 2025”, BlackRock grouped Bitcoin with two long-standing pillars of conventional finance: short-term authorities debt and large-cap U.S. shares.

Central to this theme is IBIT, BlackRock’s iShares Bitcoin Belief ETF. IBIT was listed subsequent to SGOV, an ETF that tracks U.S. Treasury payments, and TOPT, an ETF targeted on the biggest U.S. tech firms.

BlackRock continues to develop its cryptocurrency choices past Bitcoin. The corporate’s Ethereum ETF, ETHA, has attracted over $9 billion in inflows this yr.

Sturdy inflows regardless of Bitcoin decline

The obvious one is investor demand. Regardless of Bitcoin experiencing a value decline in 2025, IBIT has attracted over $25 billion in internet inflows this yr alone. Although Bitcoin is down about 30% from its October peak, buyers proceed to allocate capital to IBIT.

IBIT at present ranks sixth amongst all ETFs by inflows in 2025, in accordance with market knowledge. In response, ETF professional Nate Geraci stated, “Regardless of IBIT’s weak point this yr, iShares is clearly not panicking about short-term BTC value actions.”

ETF analyst Eric Balchunas stated BlackRock’s Gold ETF (IAU) is up 64%, its largest acquire on file, with greater than $10 billion in inflows this yr.

Nonetheless, BlackRock has listed IBIT, a Bitcoin ETF, as certainly one of its prime funding themes for 2025. This reveals that the corporate stays assured in Bitcoin regardless of the robust efficiency of conventional safe-haven property like gold.

BlackRock at present holds a serious share of the Bitcoin ETF

Since its inception in January 2024, IBIT has seen whole internet inflows of roughly $62.5 billion, considerably outpacing its rival Spot Bitcoin ETF. As of December 19, 2025, the fund held over 775,000 BTC, which means BlackRock controls the vast majority of Bitcoin held in exchange-traded merchandise world wide.

By aligning Bitcoin with Treasury payments and mega-cap tech shares, BlackRock positions it as a part of a balanced funding technique, reasonably than as a peripheral asset. Nevertheless, BlackRock has thus far averted launching ETFs associated to altcoins resembling Solana and XRP.

Associated: Bitcoin value prediction: Bitcoin consolidates under resistance as El Salvador negotiations progress

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply