- ETH has been struggling beneath $3,083 and dealing with repeated rejections at main transferring averages.

- Bodily outflows and cautious futures recommend merchants are de-risking round $3,000.

- The whale motion signifies a rotation into DeFi tokens quite than an entire liquidation of Ethereum.

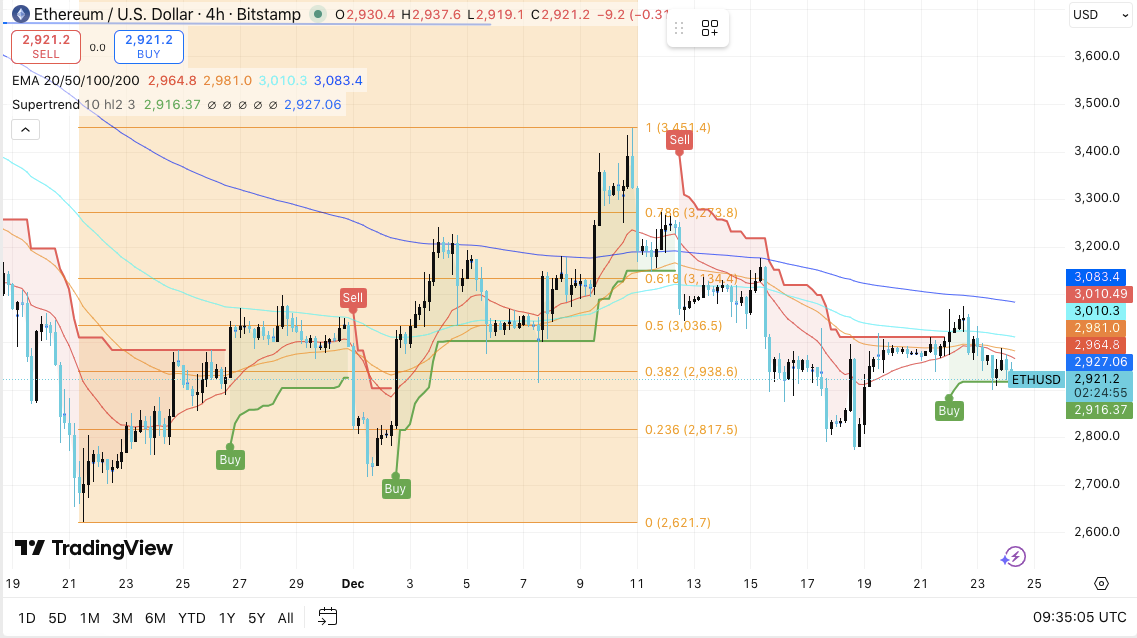

Ethereum is coming into a fragile part as merchants reassess its momentum close to $3,000. ETH entered a correction construction on the 4-hour chart after failing to maintain the rally above the $3,200 space.

The market is presently exhibiting managed promoting quite than panic, suggesting consolidation quite than a pointy pattern reversal. In consequence, merchants stay centered on whether or not the worth can reclaim key resistance ranges or slide into deeper assist zones.

The technical construction has restricted upside.

Ethereum continues to commerce beneath key transferring averages, which is shaping its near-term course. The 50-period EMA close to $2,965 acts as a direct resistance, whereas the 100 EMA close to $2,980 provides to promoting strain.

Moreover, the 200 EMA close to $3,083 stands out as a significant structural flip degree. So long as ETH stays beneath this zone, any makes an attempt to maneuver increased will face repeated rejections.

The resistance layer extends past the transferring common. The $3,135 to $3,200 vary is according to key Fibonacci ranges and former provide. Subsequently, a definitive 4-hour shut above $3,083 is required for the bulls to regain momentum. With out that motion, worth power stays fragile.

Associated: Pi Prediction: Consumers maintain on to $0.2 as market waits for course change

On the draw back, ETH stays above the $2,920 to $2,940 vary, which kinds the decrease finish of the present vary. A clear break beneath this space may expose the $2,875 to $2,820 zone the place upfront demand has emerged. Moreover, the $2,620 degree represents a significant swing low that defines broader structural assist.

Derivatives and flows replicate warning

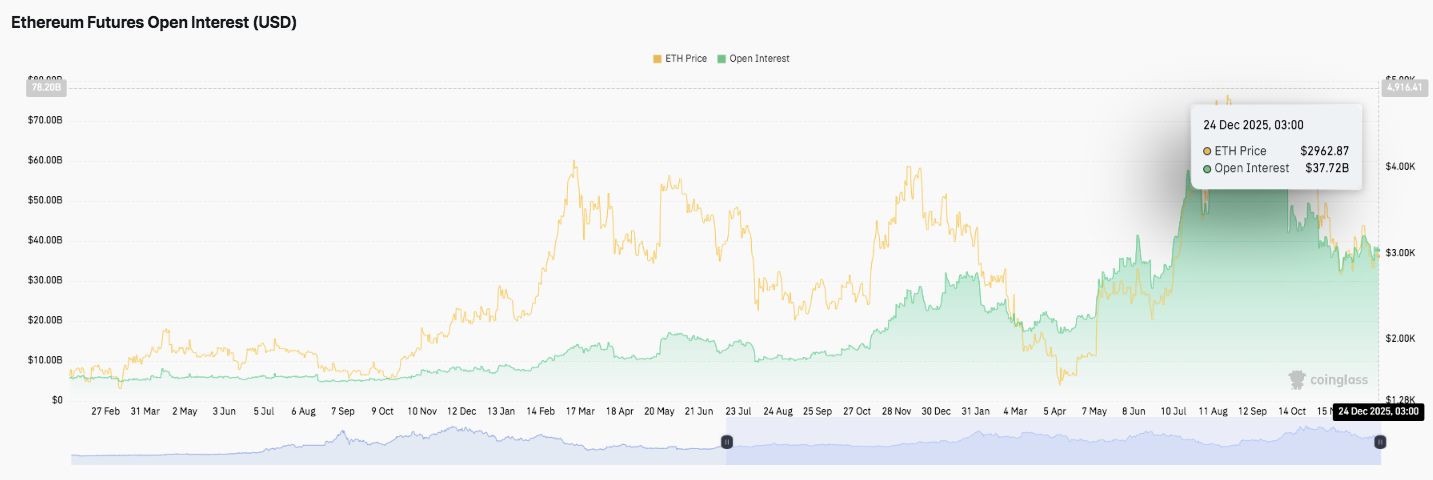

Derivatives knowledge provides one other layer to the outlook. Ethereum futures open curiosity expanded sharply over the past worth rally, suggesting aggressive leverage use.

Nevertheless, the latest stabilization above $35 billion means that merchants are decreasing their threat publicity. Importantly, this sample displays cyclical leverage resets quite than long-term exit conduct.

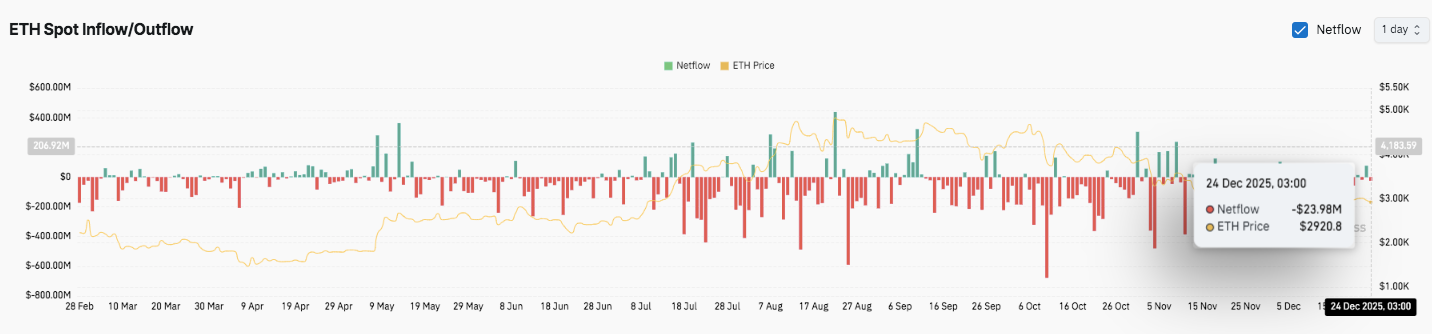

Spot movement knowledge reinforce this cautious pattern. In latest buying and selling, outflows have dominated buying and selling, particularly throughout worth rebounds.

In consequence, merchants look like promoting on power quite than constructing new positions. Moreover, unfavourable internet flows round $3,000 point out that traders are ready for clearer affirmation earlier than reallocating capital.

Whale exercise suggests portfolio rotation

On-chain exercise additionally formed sentiment. Lookonchain reported that BitMEX co-founder Arthur Hayes transferred 682 ETH price almost $2 million to Binance. This transfer follows a earlier ETH sale that totaled 1,871 cash.

Importantly, Hayes directed the funds into DeFi tokens similar to Ethena, Pendle, and ether.fi. This conduct signifies portfolio rotation quite than full threat abandonment.

Associated: Cardano Value Prediction: ADA faces strain as builders push for late-night enlargement

Technical outlook for Ethereum (ETH) worth

Ethereum trades close to key consolidation zones, so key ranges stay well-defined.

On the upside, near-term resistance lies between $2,980 and $3,010, with the 50 and 100 EMAs converging, and promoting strain remaining energetic. A sustained breakout above this cluster would shift focus to $3,083, the 200 EMA, and a key structural reversal degree. Moreover, the upside goal extends to the $3,135 to $3,200 Fibonacci resistance zone that sellers have been beforehand actively defending.

On the draw back, $2,920 to $2,940 serves as a short-term vary flooring and first assist space. The breakdown beneath this zone can be between $2,875 and $2,820, in keeping with the Fibonacci 0.236 retracement and former demand. Failure to maintain this space will increase draw back threat in the direction of $2,620, a key swing low and essential structural assist.

The technical scenario means that ETH stays compressed inside a short-term worth vary quite than a definitive pattern. Value stays beneath the 200 EMA and medium-term momentum stays impartial to bearish. Volatility is lowering and costs typically present stronger directional motion once they escape of a spread.

Will Ethereum rise additional?

Ethereum’s near-term course will rely upon whether or not patrons can get well $3,083 with sturdy quantity and follow-through. A profitable restoration would enhance the bullish construction and open room for increased Fibonacci targets.

Nevertheless, if failure continues beneath this degree, the rally is more likely to be rejected. If $2,920 shouldn’t be sustained, draw back strain may speed up in the direction of $2,820 and probably beneath. For now, ETH stays at an essential inflection level and requires affirmation earlier than the subsequent decisive transfer.

Associated: PIPPIN Value Prediction: Pippin outlook strengthens as whale place tilts considerably

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply