- XRP has rebounded round $1.87-$1.89 however stays under key resistance ranges.

- Derivatives and spot flows point out lowered threat urge for food and selective shopping for.

- Customary Chartered believes it might attain $8 by 2026 as institutional investor curiosity grows.

In distinction to enhancing long-term expectations, technical stress on decrease time frames retains XRP buying and selling close to a key inflection level. On Bitstamp’s XRP/USD 4H chart, the worth motion reveals a cautious rebound after a pointy drop. Nevertheless, the broader construction nonetheless displays a bearish bias.

XRP is buying and selling under main shifting averages and main Fibonacci retracement zones. Subsequently, merchants are nonetheless targeted on affirmation quite than prediction. On the identical time, monetary establishments’ forecasts for 2026 introduce a long-term bullish narrative.

XRP value construction suggests cautious restoration

XRP is at the moment holding close to $1.87-$1.89, which acts as short-term help. This zone helped stabilize costs after the latest value stoop.

Nevertheless, upside progress stays restricted. Quick resistance is close to $1.90, with sellers intervening repeatedly. Moreover, the $1.95-$1.97 space is according to near-term EMA resistance. In consequence, the band’s backlash continues to draw promoting stress.

A extra decisive stage is between $2.03 and $2.05. This space coincides with the 0.5 Fibonacci retracement and the descending 200 EMA. A clear break above this zone might change the short-term momentum.

Associated: 2026 Ethereum Worth Prediction: Gramsterdam Upgrades and Tokenization Dominance Goal $8,000

Furthermore, such a transfer might open up the upside in the direction of $2.17 and $2.29. Till then, XRP will stay vary certain. Failure to guard $1.88 might expose $1.83, adopted by a potential cycle low close to $1.77.

Derivatives and spot flows present declining threat urge for food

XRP futures knowledge reveals the derivatives setting is cooling down. Open curiosity remained subdued by means of most of 2025, reflecting restricted leverage. Importantly, a pointy enlargement appeared in mid-November with a robust breakout in costs.

Through the rally in early December, open curiosity soared to greater than $3 billion. Nevertheless, after that, open curiosity decreased and costs stabilized. Subsequently, merchants are prone to cut back their publicity quite than add new dangers.

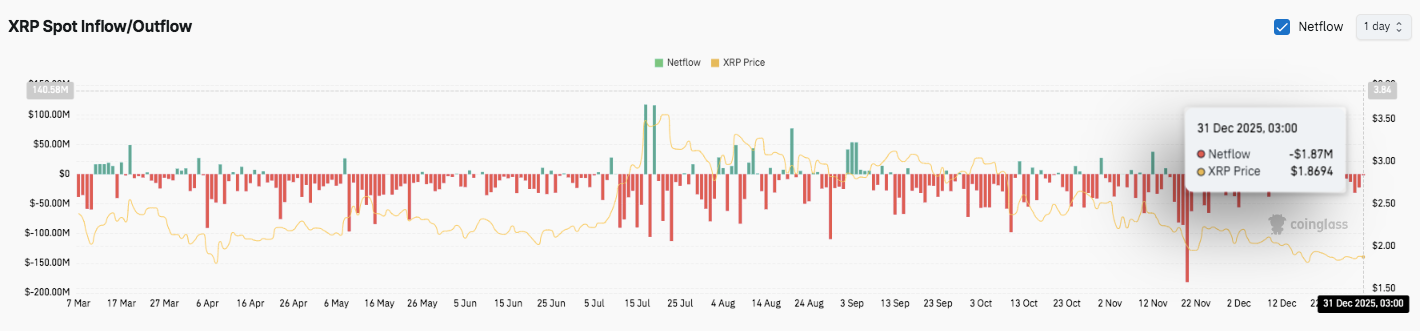

Spot stream knowledge reinforce this warning. Steady web outflows dominate the chart, indicating continued distribution. A brief-term surge in inflows occurred through the mid-year restoration interval. Nevertheless, these influxes failed to keep up momentum. Moreover, the outflow intensified from late November to December. Patrons intervened selectively, however sellers maintained management.

Customary Chartered Tasks will see a significant upward pattern in 2026

Regardless of short-term pressures, the long-term forecast stays constructive. Customary Chartered expects XRP to achieve $8 by 2026, implying an upside of greater than 300%. This outlook displays rising curiosity from institutional buyers.

Moreover, the launch of a number of spot XRP funding merchandise within the US will encourage broader adoption. In consequence, whereas XRP faces near-term technical challenges, the long-term story continues to strengthen.

Associated: Cardano Worth Prediction for 2026: Midnight Launch and Solana Bridge Might Push ADA Above $2.50

Technical outlook for XRP value

The important thing ranges for XRP stay nicely outlined as the worth stabilizes for the subsequent section.

On the upside, fast resistance lies between $1.89 and $1.90, adopted by $1.95 and $1.97, the place the short-term EMA is concentrated. A break above this zone might enable the worth to problem $2.03-$2.05, which coincides with the 0.5 Fibonacci stage and the descending 200 EMA. A decisive transfer above this ceiling would change the medium-term momentum and open the upside in the direction of $2.17-$2.29.

On the draw back, $1.88 stays the primary help for a rebound. A loss at this stage would expose it to $1.86-$1.87, adopted by elevated demand round $1.83-$1.84. Beneath that, $1.77 is the cycle low and is a crucial help that patrons should defend to keep away from a deterioration of the pattern.

The technical image reveals XRP compressing under resistance inside a broader bearish construction. This setting is usually executed previous to a rise in volatility in both path. Momentum indicators and the EMA construction nonetheless favor sellers on the upswing, however help ranges proceed to draw buys on the dip.

Will XRP go up?

The near-term outlook for XRP will rely upon whether or not patrons can defend $1.88 and get well $2.03-$2.05 on sturdy quantity. If profitable, it can enhance the probabilities of a rally in the direction of $2.17.

Nevertheless, a repeated rejection under $1.95 will keep stress and enhance the chance of a return to $1.83 and even $1.77. For now, XRP stays in a pivotal zone the place affirmation quite than prediction will decide the subsequent transfer.

Associated: Solana Worth Prediction for 2026: Firedancer, Western Union USDPT, and $476 Million ETF Influx Goal is Above $350

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply