- BTC maintains a short-term bullish construction with rising highs and rising averages.

- A serious resistance cluster close to $925,000-$95,000 might trigger elevated volatility.

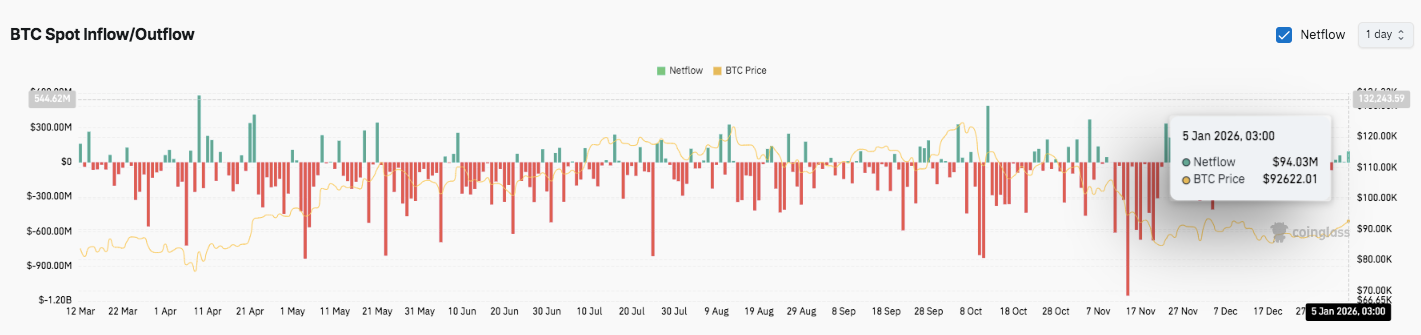

- Spot inflows and steady futures OI are supporting the restoration and purchaser momentum.

Bitcoin prolonged its restoration into early January 2026 as consumers defended larger ranges on the 4-hour chart. Market knowledge exhibits that BTC maintains a bullish construction within the quick time period after recovering from the stoop in late December.

Along with value power, derivatives and spot stream indicators additionally help the restoration story. In consequence, merchants are centered on whether or not Bitcoin can keep its momentum close to the vital resistance cluster.

Brief-term construction signifies purchaser management

Bitcoin continues to document highs and lows over a 4-hour interval. This construction confirms that consumers regained management after regaining midrange Fibonacci ranges. Furthermore, the value is above the rising short-term common, reinforcing the soundness of the development.

The market is at present approaching a dense resistance space the place reactions typically intensify. Subsequently, merchants count on volatility to extend as BTC assessments overhead provide.

Resistance stays layered relatively than remoted. The primary barrier is close to $92,460, the place the 0.786 Fibonacci retracement converges.

Moreover, the $94,650 space marks a earlier swing excessive that capped earlier good points. A sustained rise above that stage might expose the $95,000 psychological zone. Nevertheless, a rejection close to present ranges doesn’t instantly trigger the broader construction to interrupt down.

On the draw back, Bitcoin has some well-defined helps that keep a bullish bias. The $90,700 to $90,400 space combines former resistance with an exponential common rise.

Moreover, the $89,500 stage is in keeping with the 0.5 Fibonacci retracement and short-term construction. Subsequently, this zone is technically vital for momentum merchants.

Associated: Ethereum Worth Prediction: ETH Stays Bullish Construction As Community Imaginative and prescient Expands

If $89,500 can’t be protected, the main focus will shift to the $88,300 to $88,000 area. That space represents the earlier failure stage. In consequence, a deeper pullback might take a look at lows within the $86,800 to $86,400 vary. A break beneath that zone will invalidate the present bullish setup.

Including context with derivatives and spot flows

Derivatives knowledge exhibits that open curiosity in Bitcoin futures is trending upward together with value. Open curiosity elevated steadily via early 2026, reflecting elevated dealer participation. What’s fascinating to notice is that the rise was common relatively than vertical.

This sample means that leverage accumulates with out extreme liquidation threat. Brief-term pullbacks in open curiosity coincide with shallow value corrections, indicating routine place resets.

Spot stream knowledge provides additional nuance. For many of the interval, outflows have been predominant, reflecting the rising distribution. Nevertheless, intermittent inflows occurred close to the consolidation zone.

Associated: Shiba Inu’s 2026 Predictions: Second Quarter Privateness Improve, Preventing Meme Stigma After $4 Million Exploitation

Moreover, we recorded barely constructive internet flows of practically $94 million in early January. This transformation signifies improved demand and decreased gross sales stress. Subsequently, spot exercise is at present supporting short-term value stability.

Technical outlook for Bitcoin value

Within the quick time period, key ranges for Bitcoin stay well-defined as the value consolidates beneath key resistance bands.

Notable upside ranges embrace the primary hurdle at $92,460, adopted by the earlier swing excessive at $94,650. If momentum accelerates, a sustained breakout might prolong into the $95,000 psychological zone.

On the draw back, fast help is situated between $90,700 and $90,400, the place the short-term EMA and former resistance converge. Beneath that, $89,500 marks a key structural stage that coincides with the 0.5 Fibonacci retracement. A loss at this stage would expose us to $88,000, with a broader vary on the draw back, with better threat in direction of $86,800-$86,400.

The technical scenario means that Bitcoin is stabilizing in an uptrend relatively than hitting a ceiling. The EMA continues its bullish development, however the Bollinger Bands point out the potential for elevated volatility.

Will Bitcoin rise additional?

Bitcoin’s near-term outlook depends upon consumers defending $89,500 and forcing acceptance above $92,460. Stronger capital inflows and regular development in open curiosity help the bullish scenario.

Nevertheless, failure to keep up vital help will delay any upside and shift focus to help within the decrease vary. For now, Bitcoin stays in a pivotal zone the place confirmations type the subsequent leg.

Associated: Chainlink 2026 Predictions: Institutional RWA Promotion and CCIP v1.5 Targets $45-75

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply