- Financial institution of America presently recommends 1% to 4% crypto publicity for its shoppers.

- The financial institution will goal main Bitcoin ETFs beginning January fifth.

- Regardless of main institutional information, Bitcoin worth remained close to $92,000.

Financial institution of America has formally began recommending that prospects make investments 1% to 4% of their portfolios in Bitcoin and cryptocurrencies. This can be a large change. The financial institution manages greater than $3 trillion in belongings and serves 66 million prospects worldwide.

Even a small crypto allocation from such a big investor may imply a whole bunch of billions of {dollars} flowing into digital belongings over time.

Who can make investments and the way?

This recommendation applies to shoppers utilizing Merrill, Financial institution of America Personal Financial institution, and Merrill Edge. Beginning January fifth, Financial institution of America Advisors can even start protecting 4 main Bitcoin ETFs:

- BlackRock IBIT

- Constancy FBTC

- Bitwise BITB

- Grayscale Bitcoin Mini Belief

Advisors can now legally provide crypto publicity if the consumer can tolerate excessive worth volatility.

From “too dangerous” to “ought to personal some”

Only a few years in the past, main banks warned that Bitcoin had no worth and will solely be used for hypothesis. Now those self same establishments are saying one thing utterly totally different. That is what many analysts confer with because the quiet implementation section. No hype. No panic shopping for. Earlier than the group exhibits up, take it sluggish and regular.

So why hasn’t Bitcoin appreciated?

Surprisingly, Bitcoin barely reacted to this information. BTC is buying and selling above $92,000 after a small rally, however there was no explosive motion. Analysts mentioned that in previous cycles, such information may trigger costs to rise greater than 10% in a single day. For now, the subsequent degree that consultants are eyeing is $95,000.

Bullish indicators flashing within the background

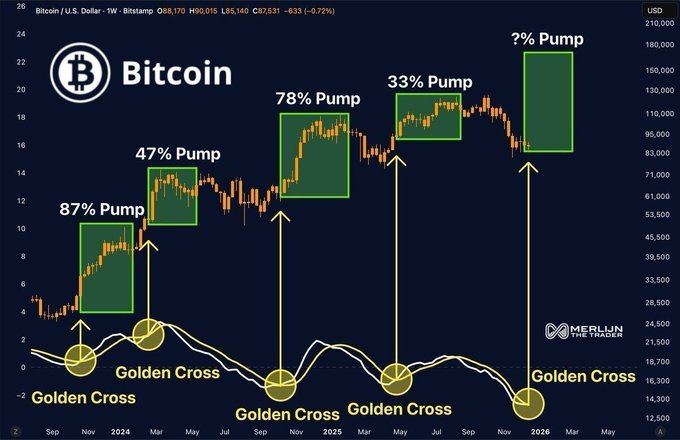

Though the value has calmed down, Bitcoin simply recorded a golden cross. A golden cross is a technical sign that usually seems earlier than a robust rally. Previously, comparable indicators have been adopted by good points of 87%, 47%, 78%, and 33%.

Apparently, these indicators normally seem not when persons are excited, however when they’re nonetheless uncertain and skeptical.

Associated: Why Bitcoin and Main Altcoins Rise After US Motion in Venezuela

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply