- XRP has surpassed $2 and has outperformed Bitcoin and Etherem in latest market traits.

- Social psychology has recovered from the scare in late December.

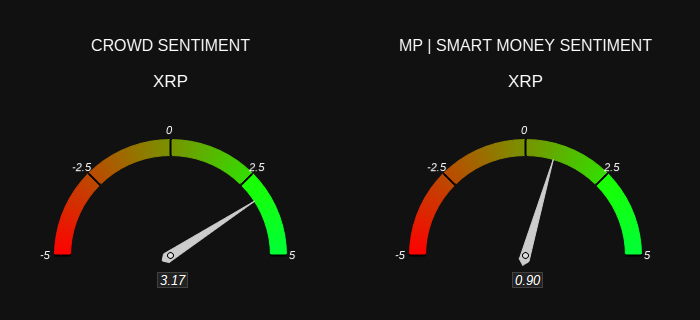

- Retail optimism is rising sooner than sensible cash positioning.

XRP is buying and selling at $2.12, up 2.6% over the previous day because the broader crypto market develops. Sentiment indicators counsel dealer confidence is enhancing following pessimism in late December.

Particularly, XRP has had the strongest appreciation price amongst main cryptocurrencies, exceeding 11% over the previous week. This transfer outpaced positive aspects in Bitcoin, which is buying and selling round $92,370, and Ethereum, which rose above $3,153.

This worth enhance adopted a unstable December during which XRP fell together with the general market downturn. Merchants reacted to uncertainty surrounding the macroeconomic state of affairs, weighing on total altcoin sentiment.

MVRV knowledge reveals combined alerts

On the YouTube podcast “Pondering Crypto,” Santiment analyst Brian Quinlivan reviewed XRP’s market worth versus realized worth (MVRV), a metric used to evaluate holders’ income and losses. He stated the latest rally has introduced XRP’s 30-day MVRV again into barely constructive territory at round 1.5%.

This implies that merchants who bought XRP throughout the previous month are on common near breaking even. Quinlivan stated the degrees had been impartial and never an indication of extreme profit-taking stress.

Lengthy-term holders are nonetheless in a unique place. In keeping with Santiment knowledge, long-term MVRV is close to -18% after falling to -25% on New Yr’s Eve. Quinlivan stated this reveals that many long-term traders are nonetheless carrying unrealized losses. For context, XRP was buying and selling at $3.66 six months in the past and stays down 41% from its peak.

Feelings are improved, however euphoria is averted

Whereas sentiment has improved since late December, knowledge from Santiment reveals it stays beneath ranges generally thought of to be speculative. Quinlivan famous that sturdy rebounds usually fail when optimism builds rapidly and retail merchants rush to purchase.

He added that sustained worth will increase usually tend to happen when expectations stay subdued, and sentiment doesn’t rise sharply with costs.

Up to now, XRP’s restoration has not brought about widespread euphoria and a reversal is unlikely anytime quickly primarily based on sentiment alone.

Widespread danger urge for food returns to cryptocurrencies

Different market gamers see broader adjustments in positioning. Crypto market analyst Swap Hunt stated capital is flowing into each giant property and high-risk tokens on the identical time.

The analyst stated the sample suggests danger urge for food is increasing as merchants anticipate adjustments within the regulatory atmosphere.

Retail optimism outweighs sensible cash

Regardless of the enhancing state of affairs, the most recent sentiment indicators present a widening divergence between particular person merchants and institutional traders. In keeping with latest knowledge, the XRP crowd sentiment stands at 3.17, indicating sturdy retailer optimism. In distinction, sentiment in direction of sensible cash hovers round 0.90, reflecting solely modest confidence in monetary establishments.

Associated: XRP Worth Prediction: Patrons Take Again $2 as ETF Inflows and Provide Tight

Analysts at the moment are centered on whether or not XRP can keep its place above $2 with out triggering an uptick in speculative exercise. If the rally continues, supported by subdued sentiment and enhancing long-term indicators, the rally may very well be extended. On the identical time, with out elevated participation from monetary establishments, retail optimism might rise quickly, limiting near-term upside.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply