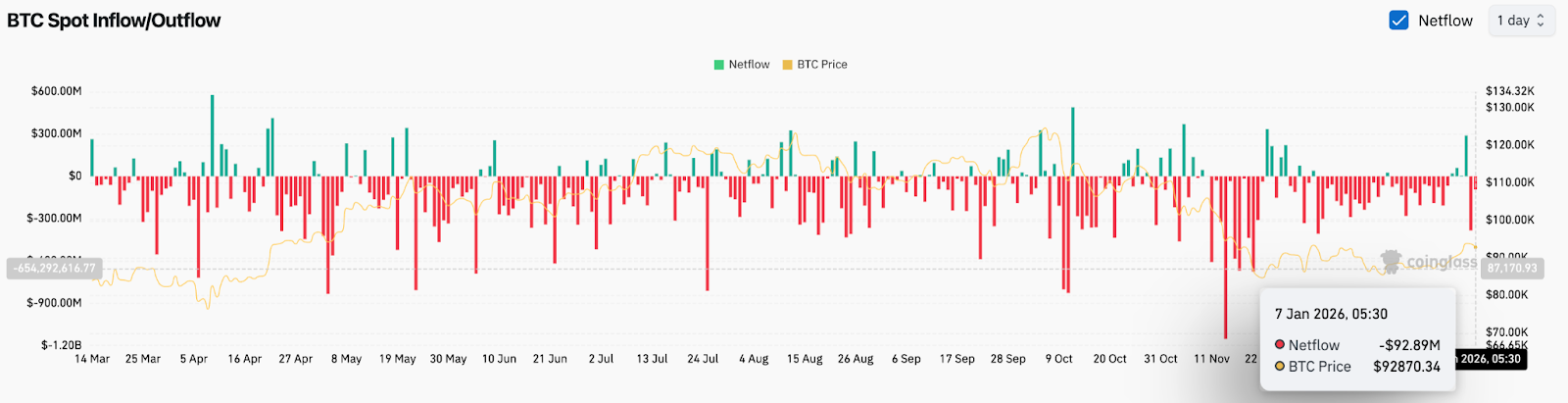

- Spot outflows stay excessive, with $92.9 million leaving the change, with restricted upside follow-through.

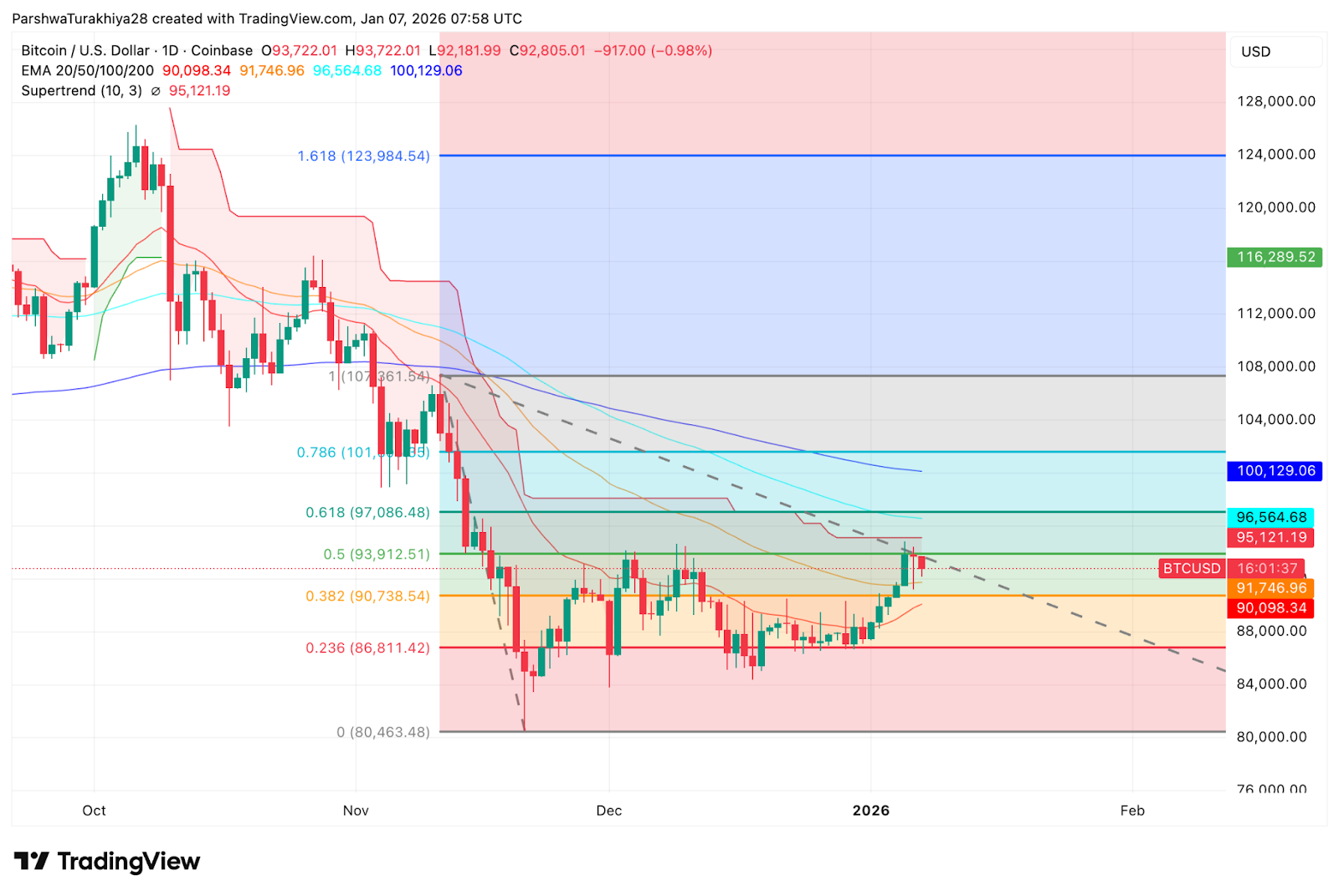

- Bitcoin is capped under the downtrend line and stacked EMA, with sellers in management.

- You will need to preserve the vary between $90,000 and $93,000, however under $90,000 there’s a danger of a fall in direction of $88,000 – $86.8,000.

Bitcoin worth is buying and selling close to $92,800 at this time after failing to interrupt above short-term resistance and retreating right into a fragile consolidation vary. Sellers stay aggressive as repeated spot outflows restrict upside strikes, whereas patrons are targeted on defending the $90,000-$93,000 assist band to keep away from additional declines.

Patrons withdraw as spot outflow continues

Forex move knowledge stays bullish. On January 7, Bitcoin recorded a internet spot outflow of $92.9 million, extending a multi-week sample of capital leaving the market quite than getting into it.

That is essential as a result of regardless of these outflows, costs haven’t elevated. When Bitcoin trades sideways whereas it strikes onto exchanges, it usually displays positioning the place holders turn out to be more and more brief quite than constructing lengthy publicity.

Trendline rejection maintains short-term management by sellers

On the day by day chart, Bitcoin stays pinned under the downtrend line that has capped the value since early November. Any method in direction of this line results in rejection, growing the vendor’s management over the short-term construction.

The EMA configuration provides extra strain. Bitcoin is buying and selling under its 50-day EMA close to $91,700, 100-day EMA close to $96,500, and 200-day EMA under close to $100,100. These averages are actually forming a stacked resistance zone quite than assist.

Associated: JasmyCoin Worth Prediction: JASMY Pattern Stays Constructive as Futures Charges Steadily Return

The supertrend close to $95,100 stays purple, confirming that the broader development has not reversed. Sellers stay within the higher hand till the value decisively closes above that stage.

Intraday construction exhibits weak assist

Decrease time frames spotlight the identical themes. On the 30-minute chart, Bitcoin maintains its intraday uptrend line, however momentum is weakening. The RSI is hovering within the mid-40s to close the 50s, indicating steadiness quite than power. After a short restoration try, the MACD has leveled out, suggesting that upside momentum is weakening.

The value motion round $93,000 has turn out to be extraordinarily essential. Patrons have defended this zone many instances, however every rebound has been smaller than the final. Amplitude loss usually precedes decision.

A full break under $92,000 reveals the $90,700 stage, adopted by a broad demand zone from $88,000 to $86,800. This space is in keeping with earlier consolidation and Fibonacci assist from the current vary.

Macro narrative helps liquidity, however timing is essential

Arthur Hayes’ macro framework stays constructive for Bitcoin within the medium time period, however is in keeping with its present technical weaknesses.

His core argument is easy. US political motivations assist aggressive credit score enlargement by means of 2026 to assist progress and asset costs whereas curbing energy-driven inflation. In that surroundings, the greenback turns into extra liquid and Bitcoin can finally profit as a monetary asset insulated from real-world vitality prices.

Nonetheless, Hayes additionally reveals that the market strikes reflexively. Liquidity can increase throughout worth declines or corrections, particularly if positioning is crowded or flows turn out to be defensive.

That is precisely what the present chart exhibits. Whereas the long-term liquidity backdrop could also be supportive, short-term merchants are decreasing publicity and ready for affirmation earlier than buying and selling once more.

outlook. Will Bitcoin go up?

Bitcoin will stay range-bound with a bearish slope so long as it trades under falling resistance and the 200-day EMA.

- Bullish case: An in depth of the day above $97,000 and subsequent acceptance above $100,000 would point out that patrons have regained management and re-opened the way in which to larger resistance close to $108,000.

- Bearish case: A breakdown under $90,000 would affirm the distribution and the $88,000 to $86,800 zone could possibly be the following draw back goal.

Associated: 2026 Monero Worth Prediction: Privateness Upgrades and Preventing World Bans & July 2027 Deadline

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply