- SOL stays excessive above Ichimoku help and maintains short-term momentum

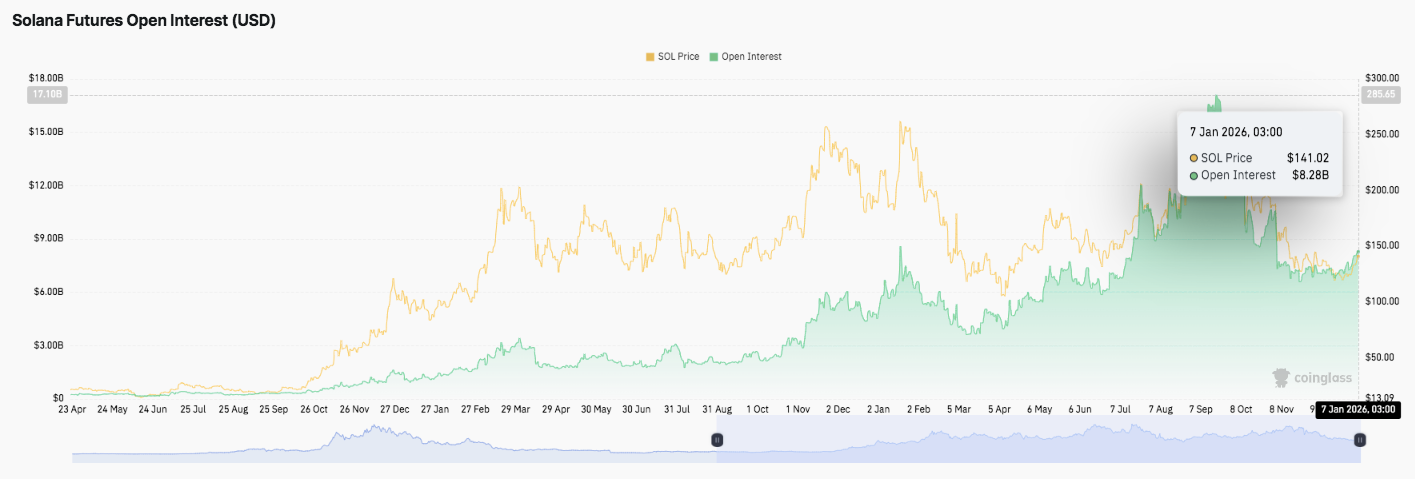

- Futures open curiosity will increase with worth, indicating confidence within the pattern reasonably than overleverage

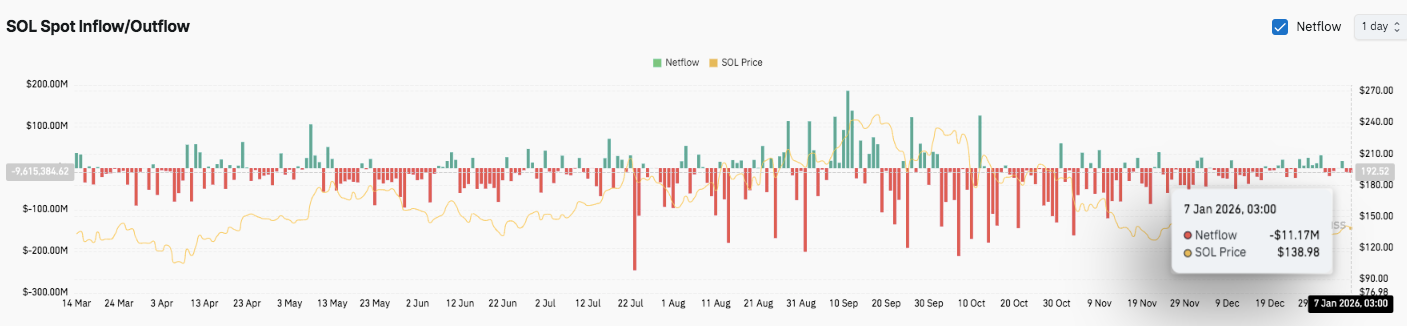

- Whereas spot outflows dominate, inflows decline close to the highs, indicating selective purchaser demand.

Solana stays within the highlight as the value pattern on the 4-hour chart maintains a transparent bullish construction. The token has been respecting greater highs and better lows since late December.

Because of this, merchants at the moment are centered on whether or not momentum can lengthen past the close by resistance zone. Along with technical strengths, derivatives and move information present extra context about near-term route.

The latest restoration follows a pointy rebound from December lows of $117. Since then, patrons have defended the rebound with self-discipline. Moreover, the value is presently buying and selling comfortably above main short-term pattern indicators.

This construction signifies reliability reasonably than speculative spikes. Nevertheless, continued upside nonetheless relies on how Solana behaves close to overhead provides.

Bullish construction is above main pattern ranges

Solana has regained its Ichimoku cloud and continues to outperform key benchmarks. Due to this fact, near-term momentum stays constructive. The candle remains to be supported by each the Tenkan Line and the Reference Line. Moreover, the clouds forward seem thinner, which limits the rapid drag stress.

Value is presently reacting across the $140.50 to $141.00 space. This zone coincides with a serious Fibonacci retracement. Due to this fact, merchants deal with this space as a call level. A clear transfer up may expose a swing excessive of $146.90 to $147.00. Past that, the $150 degree turns into a psychological goal.

Associated: Bitcoin Value Prediction: Consumers take a look at $93,000 as stress from spot outflows continues

On the draw back, patrons proceed to defend the $135.50 to $136.00 space. This degree marks the primary significant pullback zone. Moreover, $132 stays an necessary midpoint from the earlier consolidation. A deeper retracement in the direction of $128 may take a look at the power of the pattern. A failure there would weaken the broader bullish setup.

Futures Positioning Alerts Managed Danger Urge for food

Solana futures open curiosity has steadily elevated over time. Importantly, this progress adopted worth will increase reasonably than a sudden spike in leverage. This habits suggests participation in a pattern reasonably than speculative extra. Open curiosity reached practically $8.3 billion throughout a powerful rally.

Lately, open curiosity has eased barely. Nevertheless, the pullback seems to be occurring in an orderly method. Because of this, merchants look like lowering threat with out giving up lengthy publicity. This sample usually helps pattern persistence. Moreover, managed deleveraging reduces liquidation threat in the course of the consolidation part.

Spot flows replicate selective participation

Spot move information exhibits constant alternate outflows over time. Due to this fact, many holders choose off-exchange storage. Even when the value is rebounding, the pink outflow bar is dominant. This pattern displays confidence reasonably than panic promoting.

Associated: 2026 Monero Value Prediction: Privateness Upgrades and Preventing World Bans & July 2027 Deadline

Nevertheless, quick bursts of influx happen close to native highs. These actions counsel that profit-taking is gaining momentum. Moreover, inflows will not be sustained, indicating restricted energetic demand at excessive costs. Latest web flows have remained barely damaging. Because of this, patrons seem selective and reactive.

Technical Outlook for Solana Costs

Solana’s key ranges stay nicely outlined and the value is buying and selling inside a near-term bullish construction.

Upside ranges are positioned at $140.50 to $141.00 as the primary hurdle, adopted by $146.90 to $147.00 as a key swing excessive resistance. A confirmed breakout above this zone may pave the way in which to the $150 psychological degree.

On the draw back, $135.50 to $136.00 serves as rapid help and $132.00 serves as the subsequent buffer from the earlier consolidation. A deeper decline may expose cloud help between $128.30 and $126.30, the place pattern stability is necessary.

The broader technical image exhibits that Solana stays above the Ichimoku cloud, suggesting managed bullish momentum reasonably than depletion. So long as patrons persist with the mid-$130s, the value construction favors continuation.

Can Solana go greater?

The short-term bias is about holding $135 and decisively closing out $141. Stronger momentum and regular inflows may set off a retest of $147 and doubtlessly $150.

Nevertheless, failure to defend $135 dangers a pullback in the direction of $132 or cloud-based. For now, Solana remains to be in a pivotal zone and any transfer within the subsequent route requires affirmation.

Associated: JasmyCoin Value Prediction: JASMY Development Stays Constructive as Futures Charges Progressively Return

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply