- Consumers proceed to guard the $2.10-$2.20 zone, stopping additional breakdown after the pullback.

- Spot outflows and falling open curiosity recommend that the transfer was pushed by quick protecting moderately than new demand.

- XRP must recuperate $2.35 and the EMA cluster to substantiate an precise pattern shift past the corrective pullback.

XRP worth is buying and selling round $2.25 as we speak after stalling under draw back resistance following a pointy rebound from December lows. Though patrons have been energetic across the $2.10-$2.20 zone, the broader construction stays fragile as spot outflows proceed and derivatives positions are reset.

Spot runoff impedes restoration

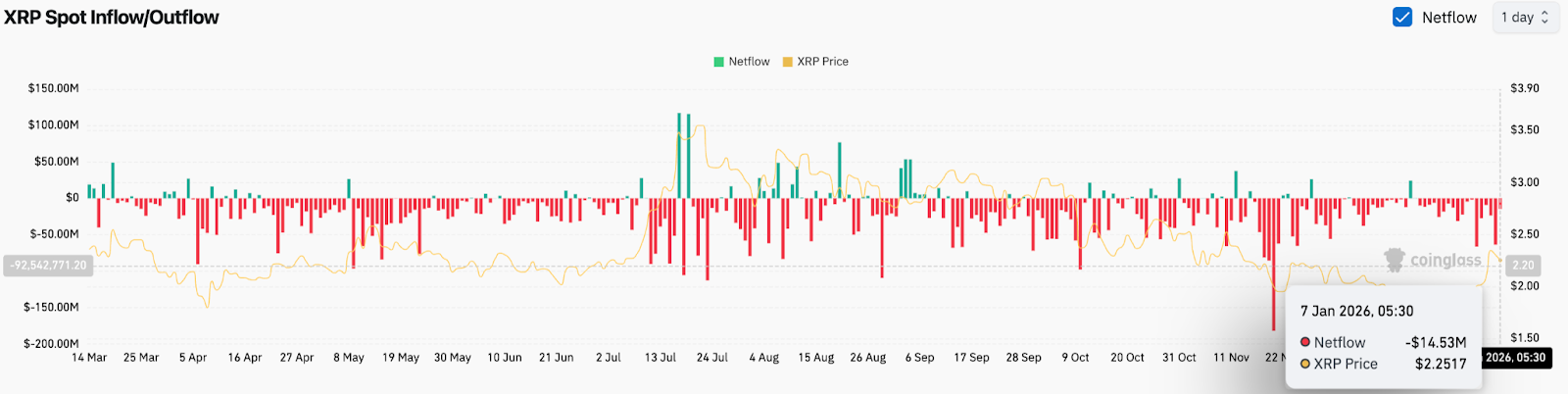

Spot circulation knowledge continues to pattern defensively. XRP recorded web outflows of $14.5 million on January 7, extending the sample of capital leaving the trade throughout upswings moderately than accumulating throughout downswings.

This habits is necessary as a result of bounces will not be accompanied by sturdy inflows. Costs had been raised, however participation didn’t increase. This divergence usually indicators quick protecting or tactical shopping for moderately than conviction in a brand new course.

So long as spot flows stay damaging, any transfer to the upside dangers falling into resistance.

Downtrend line nonetheless defines construction

On the each day chart, XRP continues to be held under the downtrend line that has led the value to fall since its peak in early October. The latest rally stalled across the $2.28 to $2.30 space, coinciding with the decrease facet of that pattern line and the 0.382 Fibonacci degree close to $2.29.

Associated: Ethereum Worth Prediction: ETH Continues Uptrend as Derivatives Exercise Stabilizes

Reinforce the ceiling with EMA construction. XRP is buying and selling under its 50-day EMA close to $2.07, 100-day EMA close to $2.23, and 200-day EMA close to $2.35. The stack varieties a layered resistance moderately than a launching pad.

The rally stays corrective inside a broader downtrend till worth definitively regains this zone.

Derivatives knowledge reveals utilization of cooling

By-product indicators recommend that positioning is being reset moderately than actively constructed. Open curiosity decreased by 6.36% to roughly $4.43 billion, indicating a discount in leveraged publicity following the rebound.

Liquidation knowledge helps that view. Near $25 million in positions had been flushed up to now 24 hours, with the bulk going lengthy. This easing eliminated the overleverage that had constructed up in the course of the late December sell-off.

Associated: Solana Worth Prediction: SOL Worth Tendencies Counsel Power Regardless of Cooling Momentum

Lengthy-short ratios on main exchanges stay skewed in the direction of longs, however the decline in open curiosity suggests merchants are ready for affirmation earlier than reloading danger.

Intraday worth traits present hesitation

On the decrease time frames, we see XRP struggling to construct momentum above $2.30. On the 30-minute chart, the value didn’t maintain above the parabolic SAR resistance close to $2.29, forcing it to consolidate in the direction of the $2.22-$2.25 vary.

The RSI on the intraday chart stays under 50, reflecting hesitation moderately than continuation. Consumers are energetic, however not chasing increased costs.

This habits is appropriate for markets that aren’t but trending and are transitioning from promoting stress to equilibrium.

outlook. Will XRP go up?

Though XRP is stabilizing, the burden of proof stays on the customer.

- Bullish case: A each day shut above $2.35 and subsequent acceptance above $2.60 would verify a pattern change and create room for a broader restoration.

- Bearish case: Failure to maintain $2.20 would point out an exhausted rebound and expose the $2.05 and sub-$2.00 zones.

The rally stays a corrective rebound till XRP regains the EMA cluster and breaks out of the downtrend line. There’s a purchaser, however management has not modified but.

Associated: Bitcoin Worth Prediction: Consumers take a look at $93,000 as stress from spot outflows continues

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply