- DOGE maintains lows above main EMAs and maintains bullish construction for now

- A consolidation beneath $0.148 suggests a lack of momentum moderately than a particular reversal.

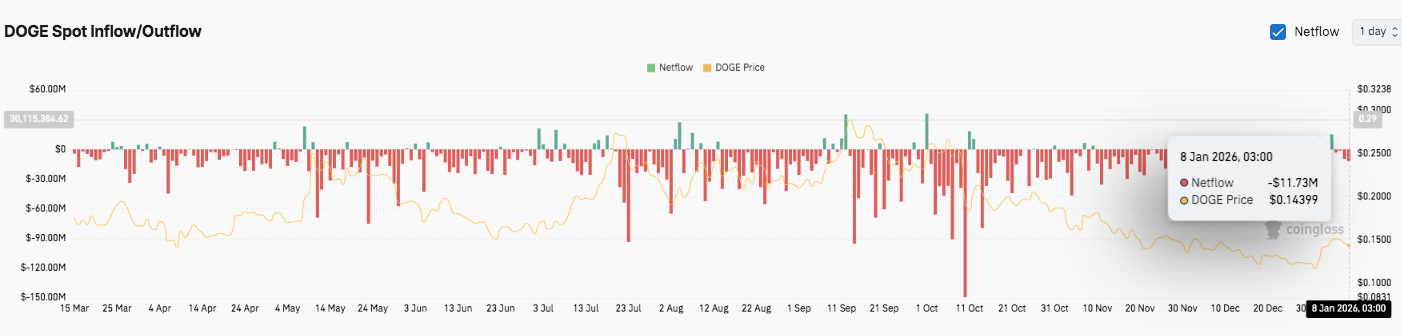

- Lowering open curiosity and foreign money outflows recommend a reset by cautious consumers

Dogecoin is buying and selling at technically delicate ranges as short-term momentum slows after a pointy rally. Latest value motion on Kraken’s 4-hour DOGE/USD chart exhibits that consumers are nonetheless accountable for the broad construction.

Nevertheless, consolidation beneath resistance means that the market is reassessing route moderately than committing to a direct breakout. This pause adopted an impulsive transfer from the $0.115 space in the direction of $0.155, confirming sturdy purchaser participation. Because of this, merchants at the moment are centered on whether or not the assist stage will be maintained throughout this cooling section.

DOGE value construction exhibits energy, however momentum is slowing

Though the upside momentum has weakened, short-term traits stay bullish. DOGE continues to type larger lows and the restoration construction stays intact.

Along with that, the medium-term pattern exhibits stabilization after hitting a low round $0.116. This restoration has moved sentiment away from aggressive promoting strain. Nevertheless, the worth is at present struggling beneath the $0.148 provide zone, leading to a slim buying and selling vary.

Importantly, DOGE is buying and selling above the important thing Fibonacci and EMA clusters, confirming the bullish bias. The $0.141 to $0.142 zone stands out as the primary space that bulls want to guard.

This stage is a mix of the 0.618 Fibonacci retracement and the earlier breakout space. Failure right here will doubtless result in additional setbacks. As well as, there’s a dense EMA cluster within the $0.138 to $0.137 vary, which will increase its significance as demand.

Resistance stays layered and distinct. DOGE faces instant promoting strain close to $0.148, the place the worth has lately stalled. Furthermore, the $0.150 stage has psychological weight, and a restoration might spark new momentum. A affirmation above $0.155 would point out a continuation of the pattern and open the way in which to $0.160.

On the draw back, a managed return to $0.134 would nonetheless keep the broader construction. Nevertheless, a clear breakdown beneath $0.125 would invalidate the bullish setup. Due to this fact, merchants intently monitor these zones for directional clues.

Derivatives and spot flows replicate reset market

Spinoff knowledge provides essential context to your chart construction. Dogecoin futures open curiosity exhibits cyclical growth through the rally and contraction after the height.

The height close to the earlier excessive coincided with the worth chasing leverage. Nevertheless, current knowledge exhibits the worth is hovering round $0.15 and open curiosity is secure at round $1.8 billion. This easing alerts a discount in speculative strain.

Spot movement knowledge helps this view. Sustained internet outflows have dominated current classes, indicating DOGE is exiting the trade. Due to this fact, promoting strain seems to be restricted. The current outflow was almost $11.7 million, at a value above $0.14. Total, this motion signifies cautious accumulation moderately than aggressive hypothesis.

Technical outlook for Dogecoin value

Dogecoin’s value construction stays constructive as key technical ranges stay effectively outlined for the short-term buying and selling window. Costs have continued to carry agency after a robust impulse rally, suggesting compression moderately than depletion.

Prime stage: Speedy resistance lies between $0.1478 and $0.1485, with sellers repeatedly limiting any upside. A clear restoration from this zone might open the door to $0.1500, adopted by a swing excessive of $0.1557. If the worth is confirmed to interrupt above $0.155, the momentum towards the $0.160 space is more likely to speed up.

Cheaper price stage: Preliminary assist is situated between $0.1410 and $0.1420, and this zone is strengthened by the 0.618 Fibonacci retracement and the earlier breakout construction. Beneath that, the $0.1383-$0.1375 EMA cluster stays the important thing demand space. A deeper retrace might take a look at $0.1340, with $0.1255 indicating a last bullish deactivation stage.

Higher restrict of resistance: The $0.1557 excessive represents a key stage that the bulls should reverse to revive pattern continuation and attain larger targets.

From a structural perspective, DOGE seems to be compressing inside a tightening vary following a rise of $0.115 to $0.155. Greater lows stay intact, whereas shorter-term decrease highs recommend consolidation beneath resistance. Because of this, volatility turns into more and more doubtless as costs method the highest of this vary.

Will Dogecoin go up?

Dogecoin’s near-term outlook is determined by whether or not consumers can proceed to defend the $0.141-$0.138 assist zone. Holding this space will preserve the bullish construction intact and permit new makes an attempt to reclaim $0.148 and $0.150. Moreover, easing futures open curiosity and continued spot outflows recommend decrease leverage danger and secure accumulation habits.

Nevertheless, failure to maintain $0.138 will weaken momentum and expose DOGE to a broader retracement in the direction of $0.134. A decisive break beneath $0.125 would reverse the technical bias bearishly and invalidate the restoration construction.

For now, Dogecoin stays at an essential inflection level. Improved compression, outlined ranges and positioning intention to maneuver nearer to directional motion. Affirmation at resistance or failure at assist determines the following leg.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply