- Bitcoin maintains bullish construction above key Fibonacci help

- Falling futures open curiosity takes benefit of a reset relatively than a capitulation or pattern reversal.

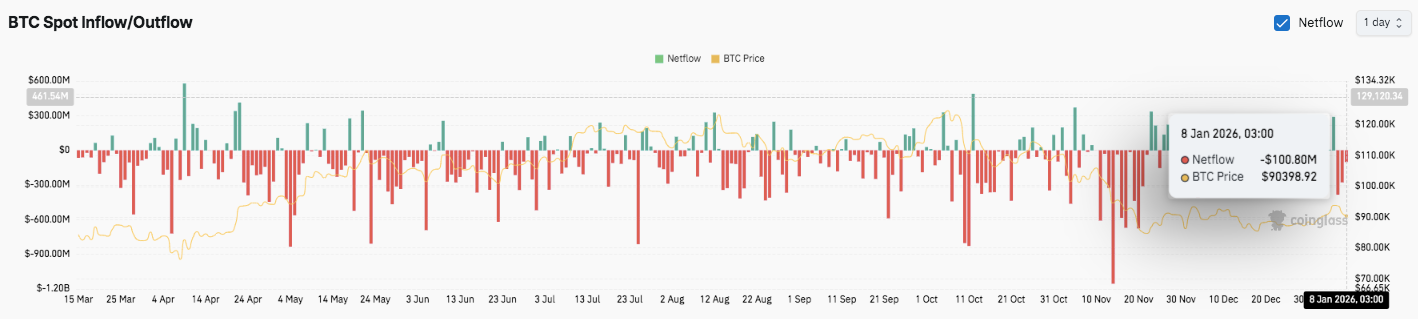

- Persistent spot outflows close to resistance point out hesitation as merchants await conviction

Whereas the near-term outlook for Bitcoin stays constructive, latest worth actions are exhibiting indicators of slowing momentum. BTC moved in direction of the $94,000-$95,000 zone earlier than getting into a rebound part.

Market information means that this motion displays consolidation relatively than pattern exhaustion. Merchants seem like reassessing dangers after repeated rejections close to native highs. Due to this fact, the main target has shifted as to whether the important thing help ranges can maintain the bullish construction.

Current buying and selling motion exhibits that consumers are nonetheless in charge of the broader 4-hour pattern. The worth continues to be above the Ichimoku cloud and the bullish pattern is growing. Nevertheless, momentum indicators are exhibiting a decline in upside energy. Because of this, Bitcoin might have further time to construct help earlier than trying additional upside.

Sustaining a technical construction that exceeds main help

From a structural perspective, Bitcoin stays above a number of key technical zones. The $90,500 to $90,300 vary has emerged as an necessary space. This zone coincides with the 0.618 Fibonacci retracement and former consolidation exercise. So long as the worth stays above this space, the bulls preserve short-term management.

As well as, secondary help is offered within the $89,200 to $89,000 vary. This space is situated close to the 0.5 Fibonacci degree and coincides with Ichimoku cloud help. An additional pullback in direction of $86,400 will nonetheless lead to a high-low construction. Nevertheless, such a transfer would undermine short-term confidence.

Associated: Cardano Worth Prediction: $0.39 Assist Faces Breakout Danger as Sellers Stay in Management

On the constructive facet, resistance stays nicely outlined. The $92,300 to $92,500 zone is your instant barrier. Moreover, the $94,600 to $95,000 vary continues to function a powerful provide space. Previous rejections recommend the vendor stays energetic.

Futures Positioning Indicators Prudent Reset

Along with worth construction, derivatives information supplies necessary insights. Bitcoin futures open curiosity has steadily expanded through the latest rally. This pattern displays elevated leverage and speculative participation. Notably, open curiosity is lowering as the present worth declines.

This divergence means that merchants decreased their publicity after a failed breakout try. Liquidation and danger discount doubtless contributed to this decline. Nevertheless, open curiosity remains to be rising to just about $63 billion. This degree signifies continued involvement by institutional buyers relatively than an exit from the market.

Spot flows replicate slowing demand

Spot market traits additional help the cautious view. The info exhibits continued internet outflows, indicating that property proceed to movement out of exchanges. A number of giant outflow spikes coincided with native worth declines. Moreover, inflows are nonetheless short-term and inconsistent.

The most recent information factors present internet outflows at roughly $100 million. This sample suggests that there’s restricted storage urge for food near resistance. Total, spot flows point out that Bitcoin remains to be within the ready part. Market contributors seem like looking for higher conviction earlier than embarking on their subsequent transfer.

Bitcoin (BTC) technical outlook

Bitcoin’s technical construction stays constructive, with the worth compressed between well-defined help and resistance zones. Though near-term momentum has cooled following the latest bounce close to the highs, vary continuation remains to be preferable to pattern failure in a broad setting.

- High degree: Quick resistance lies between $92,300 and $92,500, halting the rally up to now. A clear breakout may begin a transfer in direction of the important thing provide zone at $94,600-$95,000 on the latest swing excessive. Acceptance above this ceiling will strengthen the bullish continuation sign.

- Cheaper price degree: The main help lies between $90,500 and $90,300, aligned with the 0.618 Fibonacci retracement and former consolidation. Under that, $89,200-$89,000 acts as secondary help close to the cloud and pattern match. A deeper decline would expose $86,400, the final excessive and low ranges to maintain the bullish construction.

- Higher restrict of resistance: The $94,600-$95,000 zone stays a key degree for reversing new upward momentum within the 4H timeframe.

Technically, Bitcoin is consolidating inside a tightening vary after an impulsive rally. This compression displays revenue taking and unwinding of positions relatively than widespread distributions. Derivatives information helps this view, as open curiosity stays traditionally excessive however has eased.

Will Bitcoin rise additional?

Bitcoin’s near-term course is dependent upon whether or not consumers can defend $90,300 and reclaim $92,500 on quantity. If the worth sustains energy above the resistance degree, it may regain upward momentum in direction of $95,000. Nevertheless, if $89,000 will not be sustained, the construction will weaken and the main target will shift to $86,400.

For now, Bitcoin is buying and selling in a pivotal zone. Volatility compression suggests a bigger transfer could also be forming, however worth acceptance and affirmation from flows will decide the subsequent leg.

Associated: Dogecoin Worth Prediction: DOGE Holds Floor Even As Market Enters Key Correction Section

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply