- A POL breakout above a serious EMA indicators a development reversal, however an overshoot suggests a pause.

- Derivatives and spot flows present cautious re-entries, with liquidation threat and upside restricted.

- Open Cash Stack powers Polygon’s fee rails and provides elementary assist for restoration

Polygon’s POL token is receiving renewed consideration as worth energy, derivatives exercise, and infrastructure improvement converge. Latest chart actions point out a decisive restoration after weeks of worth motion.

Along with technological momentum, spot movement enhancements and new ecosystem instruments add context to the market’s near-term outlook. In consequence, merchants are reevaluating dangers as POL assessments greater ranges across the $0.15 zone.

Value construction exhibits indicators of bullish shift

POL worth actions on the 4-hour chart mirror a transparent uptrend. The market rose sharply from the $0.118 space in the direction of $0.149. This transfer happens after an extended sideways part and infrequently precedes a stronger directional break. Importantly, the worth is at present buying and selling above the main exponential transferring averages over the quick and long run.

A correction within the EMA signifies sustained bullish management. The 20-period common continues to behave as dynamic assist close to $0.131. Subsequently, a drop in the direction of this zone might entice patrons if momentum cools. Fibonacci retracement ranges additionally reinforce this construction. The $0.129 and $0.138 zones stay an necessary buffer through the pullback.

Nonetheless, the Donchian channel units the worth above the ceiling. Such situations typically point out short-term fatigue. In consequence, a consolidation or shallow retracement might seem earlier than an additional transfer upwards. Resistance stays concentrated round $0.149, which marks the latest swing excessive.

Derivatives and spot flows point out cautious re-engagement

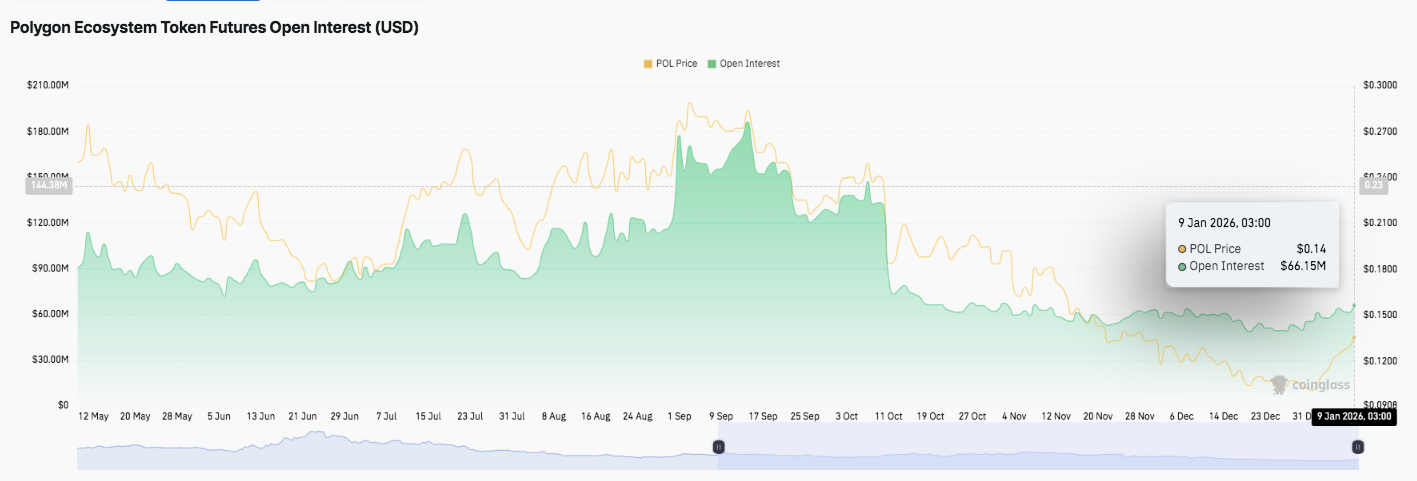

Futures open curiosity provides one other layer to the story. Open curiosity has steadily elevated since midsummer, reaching almost $180 million by early fall. This part coincided with a rising urge for food for hypothesis. Nonetheless, October noticed speedy deleveraging and open curiosity decreased considerably.

Since then, derivatives buying and selling has stabilized at between $55 million and $70 million. Moreover, the latest rally to $66 million suggests merchants are returning cautiously. Leverage stays subdued in comparison with earlier highs. This construction reduces liquidation threat, but in addition limits explosive upside.

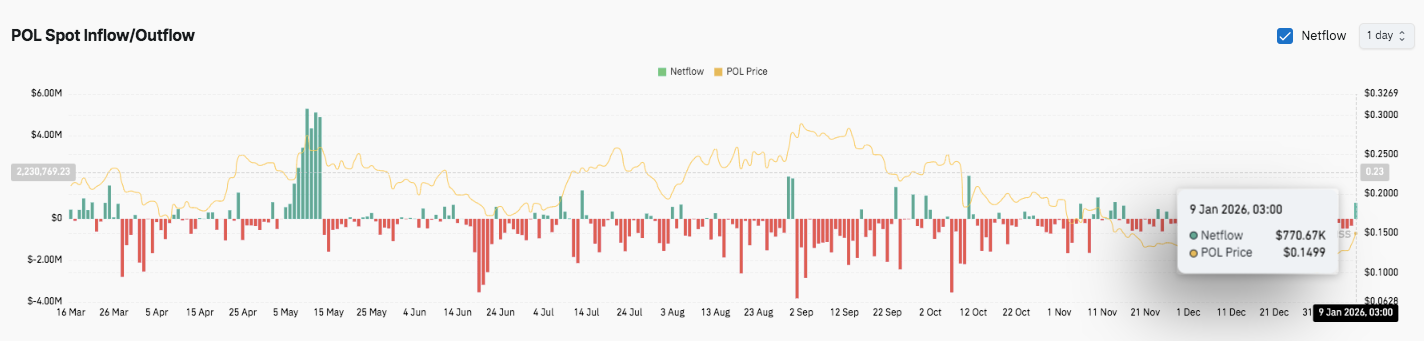

Spot movement knowledge corroborate this measured shift. The ancient times noticed sustained capital outflows and a sudden surge on the promote aspect. Moreover, these flows coincided with a decline in costs. From late November to December, outflows slowed and internet inflows approached equilibrium. The most recent sluggish influx round $770,000 coincides with worth stability round $0.15.

Infrastructure improvement provides primary context

Past the graph, the ecosystem continues to progress. Polygon Labs not too long ago launched Open Cash Stack. The initiative focuses on regulated stablecoin funds and cross-border remittances. Combine compliance, wallets, orchestration, and funds right into a unified framework.

Moreover, this stack goals to attach on-chain and off-chain techniques with out sacrificing interoperability. Builders can onboard customers and combine fee and income options extra effectively. Some elements are already working via companions and additional releases are deliberate.

Technical outlook for Polygon (POL) worth

Polygon’s POL token continues to commerce in a technically delicate zone, with momentum nonetheless constructive however not but conclusive. Value motion within the short-term time-frame signifies that POL is making an attempt to maneuver above the latest breakout ranges round $0.145-$0.149. In consequence, merchants are watching intently to see if patrons can preserve management or if consolidation deepens earlier than a transfer within the subsequent path.

- High stage: Close to-term resistance is close to $0.149 to $0.150, marking the latest swing excessive. A clear breakout of this zone might open the door to $0.158 and $0.165 within the quick time period. Past that, if quantity expands and momentum picks up, there’s nonetheless an opportunity for the pair to develop in the direction of $0.180.

- Cheaper price stage: On the draw back, the primary assist is positioned round $0.138, coinciding with the 0.786 Fibonacci retracement. A deeper pullback might check $0.129-$0.130, the place patrons intervened earlier. Under that, $0.123-$0.118 types a broader demand zone that helps the present construction.

- Higher restrict of resistance: The $0.150 space, near latest highs and the short-term volatility band, stays the important thing stage for a reversal for sustained bullish continuation. Sustaining above this ceiling would strengthen the medium-term development and scale back the danger of vary widening.

From a structural standpoint, the POL seems to be compressed after a pointy impulse motion. The EMA continues to construct positively, supporting the broader uptrend. Nonetheless, worth buying and selling close to Donchian’s higher restrict suggests short-term depletion threat. Subsequently, a consolidation or shallow retracement will stay wholesome for development continuation.

Will the polygon transfer greater?

Polygon’s near-term outlook depends upon whether or not patrons can defend the $0.138 to $0.145 space whereas maintaining strain on the $0.150 resistance. Technical compression means that volatility might proceed to extend.

If the bullish momentum strengthens together with an enchancment in spot flows, POL might subsequent goal $0.158 and $0.165. Nonetheless, if it can’t preserve $0.138, it dangers being reset beneath $0.129. For now, POL is buying and selling in a pivotal zone the place confirmations form the following leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply