- Bitcoin is clinging to the psychological stage of $90,000 because the construction stays bearish on account of repeated rejections beneath the important thing EMA.

- The ETF’s giant outflows and detrimental spot flows assist distribution relatively than accumulation in the course of the latest rebound.

- A break beneath $90,000 dangers accelerating losses in direction of $86,900, and the bulls must get well $95,100 to regain management.

Bitcoin worth immediately is buying and selling round $90,300 as of January 9, 2026, and stays barely above the $90,000 psychological assist as promoting stress continues. Markets stay tense on account of repeated failures to get well main shifting averages, whereas spot and ETF flows proceed to be directed towards distribution relatively than accumulation.

Rejection of development line leaves construction weak

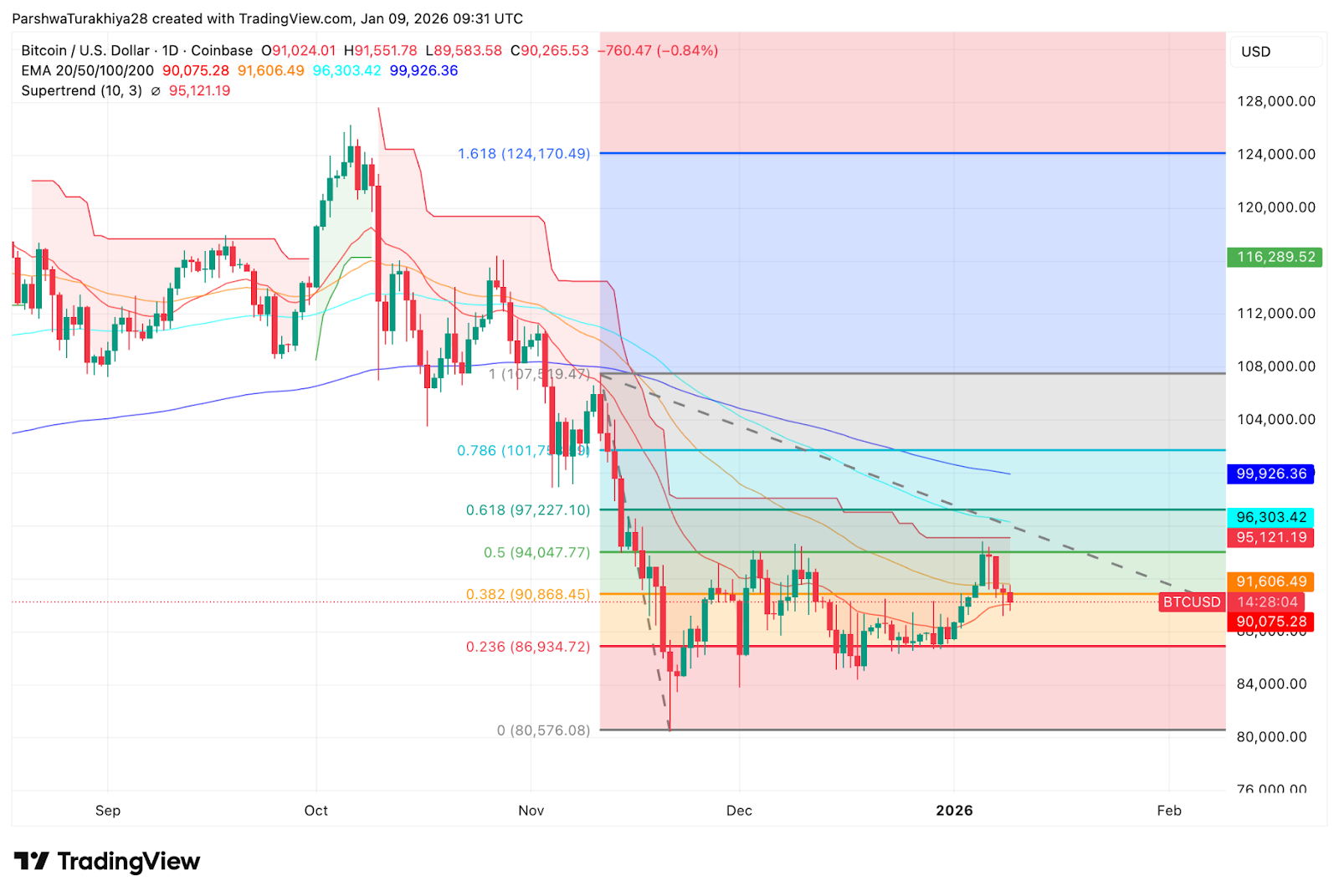

On the each day chart, Bitcoin continues to commerce beneath the downtrend line that has restricted any restoration makes an attempt since late November. The rejection of the development line earlier this week strengthened the bearish construction and pushed the worth again into the decrease Fibonacci retracement zone.

Bitcoin stays beneath the 20-day, 50-day, and 100-day EMAs and is at present concentrated between $90,100 and $96,300. The 200-day EMA close to $99,900 stays properly above the worth, indicating that the broader development has not reset.

The Supertrend indicator continues to indicate a bearish indication, with the set off stage close to $95,100 appearing as dynamic resistance. So long as the worth stays beneath this zone, sellers keep structural management.

Fibonacci ranges outline main danger zones

Bitcoin is at present hovering across the 0.382 Fibonacci retracement at $90,868, a stage that has acted as short-term assist for the previous two periods. This zone is essential. A sustained break beneath this could expose the 0.236 stage close to $86,935, matching the December swing low.

As soon as the worth is exceeded, resistance will increase quickly. The 0.5 retracement close to $94,050 and the 0.618 stage close to $97,227 type a hierarchical provide zone the place the earlier rally has stalled. These ranges must be restored to vary short-term biases.

Till that occurs, costs stay inclined to additional draw back exams.

Momentum maintained however defensive as timeframe declines

The 30-minute chart confirms the shortage of follow-through from consumers. Bitcoin continues to make new highs, with descending resistance pushing it right down to round $92,500. Every rebound to that zone has been aggressively offered.

The RSI stays beneath the impartial 50 stage, reflecting weak momentum. The MACD has returned to detrimental territory after trying a short restoration, indicating that bullish stress is waning.

Brief-term merchants seem like cautious, prioritizing capital preservation over upside positions.

Verify distribution with ETF and spot movement

Stream knowledge reinforces the bearish construction.

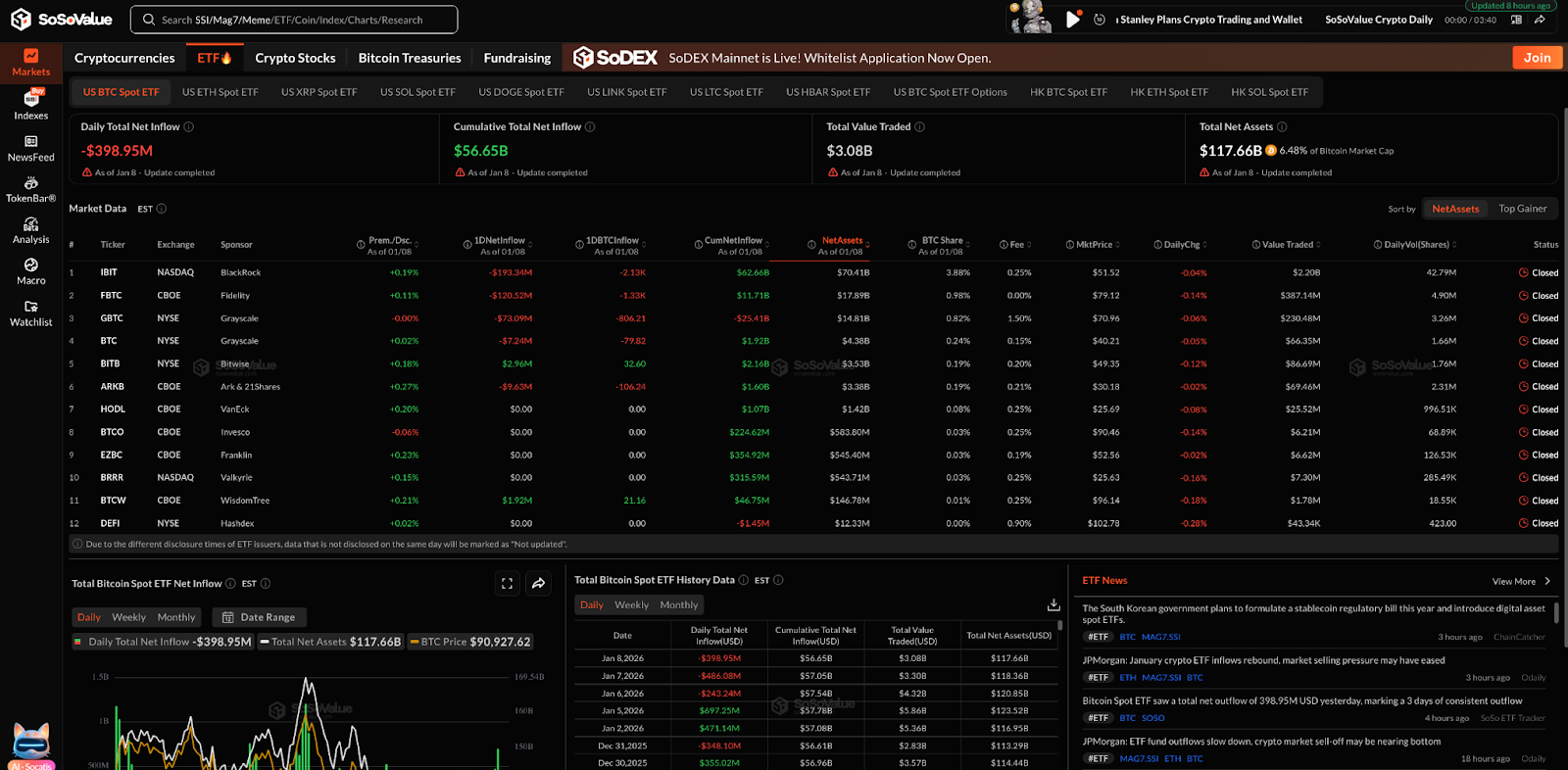

On January 8, 2026, the US Spot Bitcoin ETF recorded web outflows of $398.95 million, marking its third consecutive redemption session. Main merchandise resembling BlackRock’s IBIT and Constancy’s FBTC all recorded web outflows on the day, confirming that institutional publicity was declining relatively than cyclical.

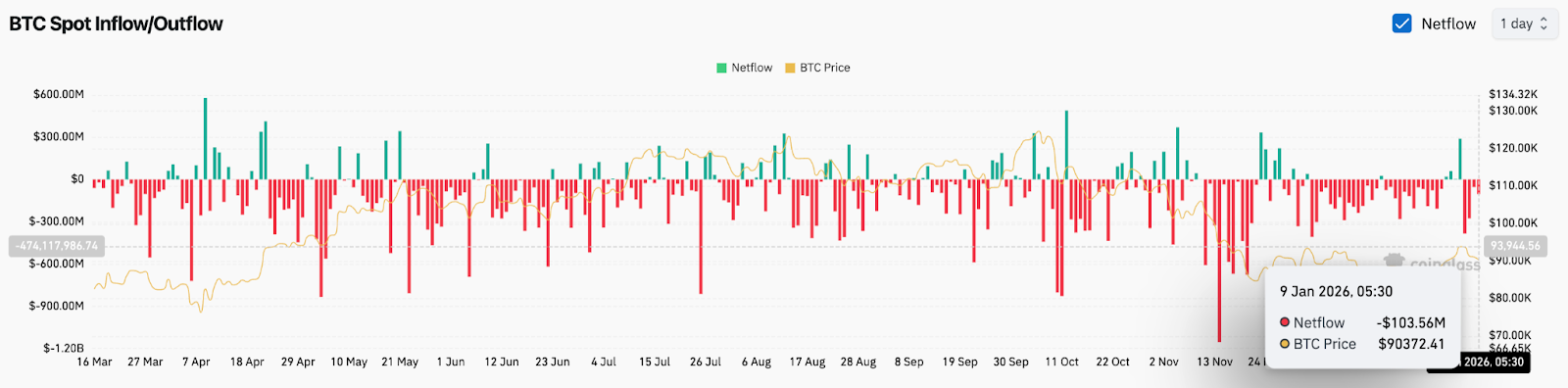

Spot trade knowledge reveals an identical sample. Bitcoin recorded web spot outflows of roughly $103.6 million on January 9 because it moved to exchanges in the course of the worth downturn. This conduct sometimes displays dispersion relatively than accumulation.

When ETF redemptions and spot flows coincide in a downtrend, rallies are inclined to fail rapidly. We have seen this momentum all through the previous week.

outlook. Will Bitcoin go up?

Bitcoin is nearing a important inflection level.

- Bullish case: Consumers would wish each day closes above $92,500 after which again above $95,100 to point a change in momentum. A sustained transfer above $97,200 would invalidate the present correction construction and re-open the trail for the 200-day EMA to maneuver in direction of the $100,000 space.

- Bearish case: If the worth is confirmed beneath $90,000, the promoting will possible speed up in direction of $86,900. Failure to maintain this stage may end in a deeper retracement in direction of $80,500.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply