- XRP stays capped under the downtrend line and key EMA, preserving the broader construction corrective moderately than bullish.

- ETF flows have turn into risky, with some profit-taking adopted by modest buys on January 7, indicating that institutional traders are selective of their positioning.

- The value is at a crossroads and wishes $2.40 to realize additional momentum, however a break under $2.00 dangers one other drop.

XRP worth as we speak is buying and selling round $2.10 as of January 9, 2026, reversing after a pointy pullback from the downtrend line that outlined the correction since August. The market stays caught between near-term technical pressures and bettering ETF flows, making a slender zone the place route is but to be decided.

On the every day chart, the downtrend construction stays intact.

On the every day time-frame, XRP continues to commerce under a well-defined downtrend line connecting the August and October swing highs. All makes an attempt to rally towards this line have failed, together with the newest try earlier this week round $2.35-$2.40.

XRP can be buying and selling under its 50-day, 100-day, and 200-day EMAs, that are between $2.07 and $2.34. The 20-day EMA close to $2.04 supplies short-term assist however will not be sufficient to power a broader reversal. Parabolic SAR remains to be above worth, confirming that the every day development remains to be in favor of sellers.

So long as XRP stays capped under the downtrend line and the 200-day EMA close to $2.34, any try to maneuver greater stays corrective moderately than trend-forming.

Brief-term charts present stability moderately than enlargement

The two-hour chart reveals that XRP is holding agency after the current rally, with the value holding close to $2.13, close to the mid-Bollinger Band. Volatility is lowering, suggesting that the market is pausing moderately than accelerating.

The RSI for this time-frame is hovering round 40, reflecting weak momentum and lack of lively bull shopping for. The indicator has did not regain the bullish 50 stage and short-term sentiment stays cautious. Costs stay under the higher Bollinger Bands, confirming that upside strain is proscribed for now.

ETF flows turn into unstable after first massive pullback

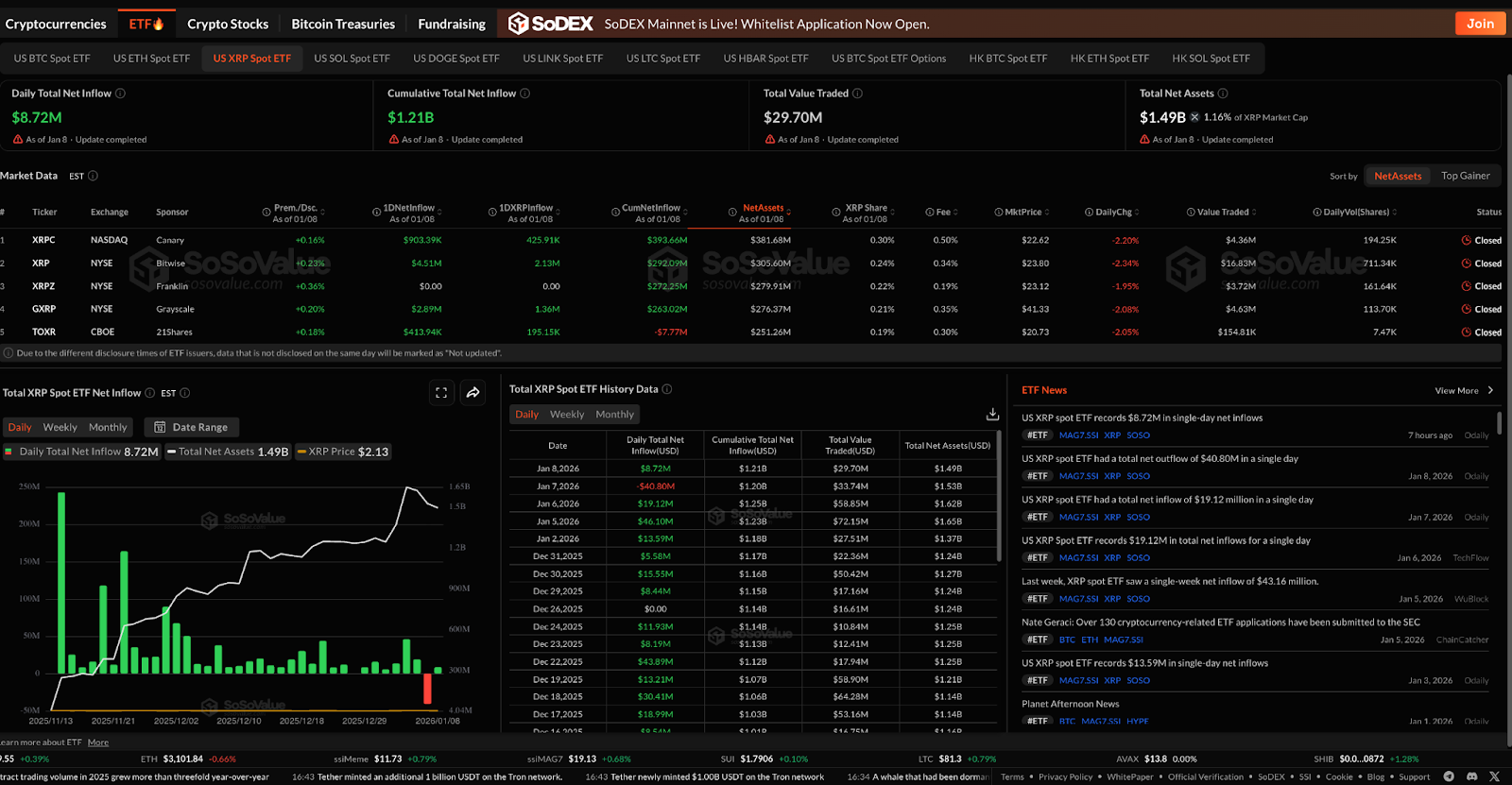

ETF circulation knowledge reveals a transparent change in positioning this week.

On January 7, 2026, the US Spot XRP ETF recorded internet outflows of $40.8 million, marking its first significant decline after 54 consecutive days of constant inflows. This reversal signifies that some institutional traders have chosen to lock in earnings moderately than proceed so as to add publicity at greater ranges.

A lot of the promoting strain got here from the 21Shares XRP ETF (TOXR), which noticed about $47 million in redemptions through the session. Small outflows had been additionally reported throughout Bitwise, Canary Capital, and Grayscale merchandise, whereas Franklin Templeton’s XRP fund noticed little change, suggesting the sell-off was concentrated moderately than widespread.

The following session noticed a special tone. On January 8, 2026, the XRP Spot ETF recorded internet inflows of $8.72 million, indicating that bullish shopping for appeared shortly after the preliminary wave of liquidations. Though modest in measurement, this rebound means that institutional investor curiosity has not utterly receded, despite the fact that costs stay beneath technical strain.

This order is vital. The outflow on January seventh displays profit-taking after a protracted interval of inflows, moderately than a large-scale outflow. The January 8 inflows present that patrons, whereas nonetheless lively, have gotten extra selective. ETF participation has shifted from aggressive accumulation to cautious positioning, which is in keeping with XRP’s present consolidation under key resistance ranges.

outlook. Will XRP go up?

XRP is at a technological crossroads.

- Bullish Case: Consumers want a every day shut above $2.22 adopted by a definitive breakout to $2.40 to invalidate the downtrend line. A sustained rise above this zone will change momentum and open the door to $2.75.

- Bearish case: Failure to carry $2.00 may weaken the construction and expose $1.78. A every day shut under that stage would verify a continuation of the broader correction development.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply