- AI and cryptocurrency analysts say Bitcoin has extra upside potential than gold in 2026.

- Current information exhibits that gold and shares have outperformed Bitcoin over the previous few months.

- The worldwide liquidity cycle stays the principle driver for each cryptocurrencies and commodities.

A brand new debate over whether or not Bitcoin or gold will carry out higher in 2026 is gaining consideration following a social media trade involving cryptocurrency analyst Lark Davis, synthetic intelligence chatbot Grok, and on-chain information firm Santiment.

The controversy sparked after cryptocurrency analyst Davis requested on social media which main property are more likely to carry out worst subsequent 12 months.

AI factors out that gold might lag behind Bitcoin

In response, AI chatbot Grok stated it will take away gold from its portfolio in 2026. The chatbot stated that primarily based on previous market cycles and accumulation traits, Bitcoin has a lot greater upside potential.

In accordance with Grok, Bitcoin may rise greater than 100% in 2026, reaching round $169,000. By comparability, gold may head towards $5,000 an oz, with a lot smaller features. Grok added that whereas Bitcoin is extra unstable, that volatility additionally creates higher upside alternatives.

Current efficiency favors conventional property

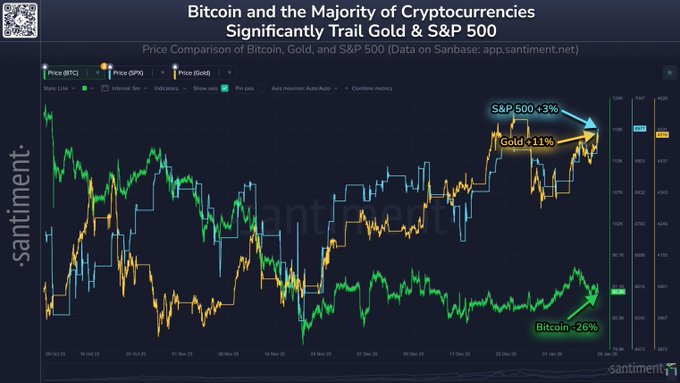

Nevertheless, market information tells a unique story within the quick time period. Santiment famous that digital property have lagged each shares and valuable metals since Bitcoin hit an all-time excessive of almost $126,000 in early October.

Over the previous three months, gold is up about 11%, the S&P 500 is up about 3%, whereas Bitcoin is down about 26%, in keeping with Santiment information. The corporate stated this divergence suggests the cryptocurrency could also be setting itself up for a rebound later, quite than main the market now.

Huge threat in 2026: Liquidity pullback

Many macro analysts anticipate world liquidity to peak by early 2026. The economic system might then proceed to sluggish as governments, companies and buyers refinance massive quantities of debt.

Decreased liquidity may push the US greenback greater and put stress on all threat property, together with shares, cryptocurrencies and commodities. If gold falls sharply at this stage, Bitcoin may additionally endure as an alternative of benefiting from capital turnover.

The analyst stated cryptocurrencies may see a short-term rally in early 2026 resulting from delayed liquidity results and potential regulatory developments. Nevertheless, they warn that any restoration could also be short-lived if monetary situations tighten later this 12 months.

Associated: Brad Garlinghouse says Ripple will give attention to long-term crypto utility, not hype cycles

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply