- After weeks of outflows, Ethereum is holding at $3,093 inside a triangle sample as a spot influx sign of $13.59 million has accrued.

- Open curiosity elevated by 0.83% to $40.37 billion and quantity decreased by 69%, indicating a steady place forward of sample decision.

- The lengthy/brief ratio reached 2.52 on Binance as merchants took positions for the breakout, however the worth stays under the supertrend resistance at $3,296.

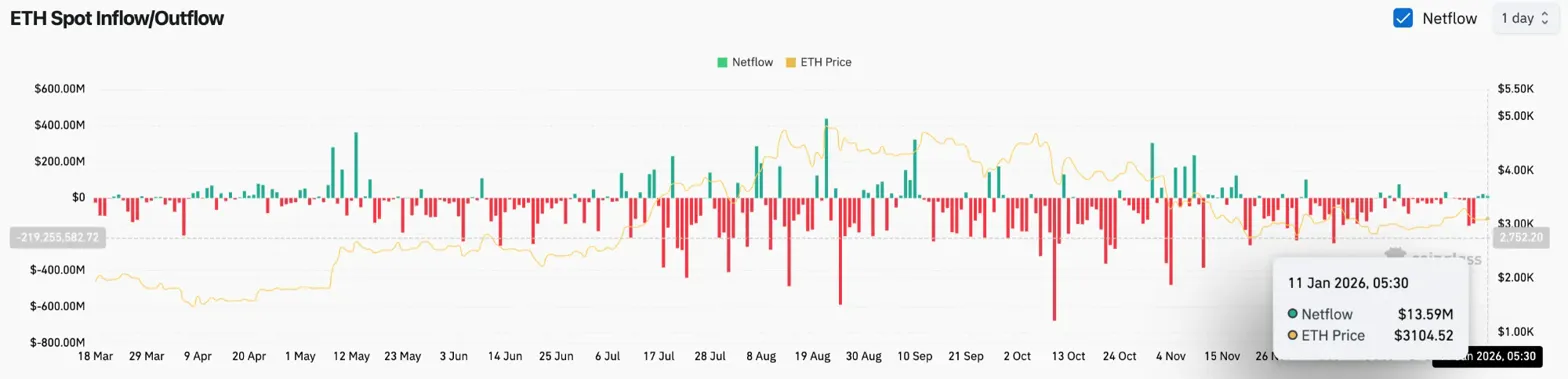

After recording spot inflows of $13.59 million on January 11, Ethereum worth is buying and selling round $3,093 at this time, reversing the distribution sample that had put strain on ETH all through December. The token has been consolidating inside a triangle sample with compressed volatility for weeks, with the catalyst for a community improve on the horizon, as analysts preserve their 2026 targets between $4,000 and $9,000.

Spot influx reverses December distribution development

ETH Netflows (Supply: Coinglass)

Internet inflows on Jan. 11 have been $13.59 million, based on foreign money stream information, marking a change from the sustained outflows that characterised December’s decline. When spot flows flip constructive after an prolonged distribution, it normally signifies that merchants are placing a refund into the trade in preparation for a directional transfer, reasonably than letting it go.

This timing coincides with Ethereum’s triangle compression, the place volatility has declined to ranges that traditionally precede sharp breakouts or breakouts. The inflows recommend that contributors are bracing for a rally reasonably than continued weak point, however that sample has but to be confirmed.

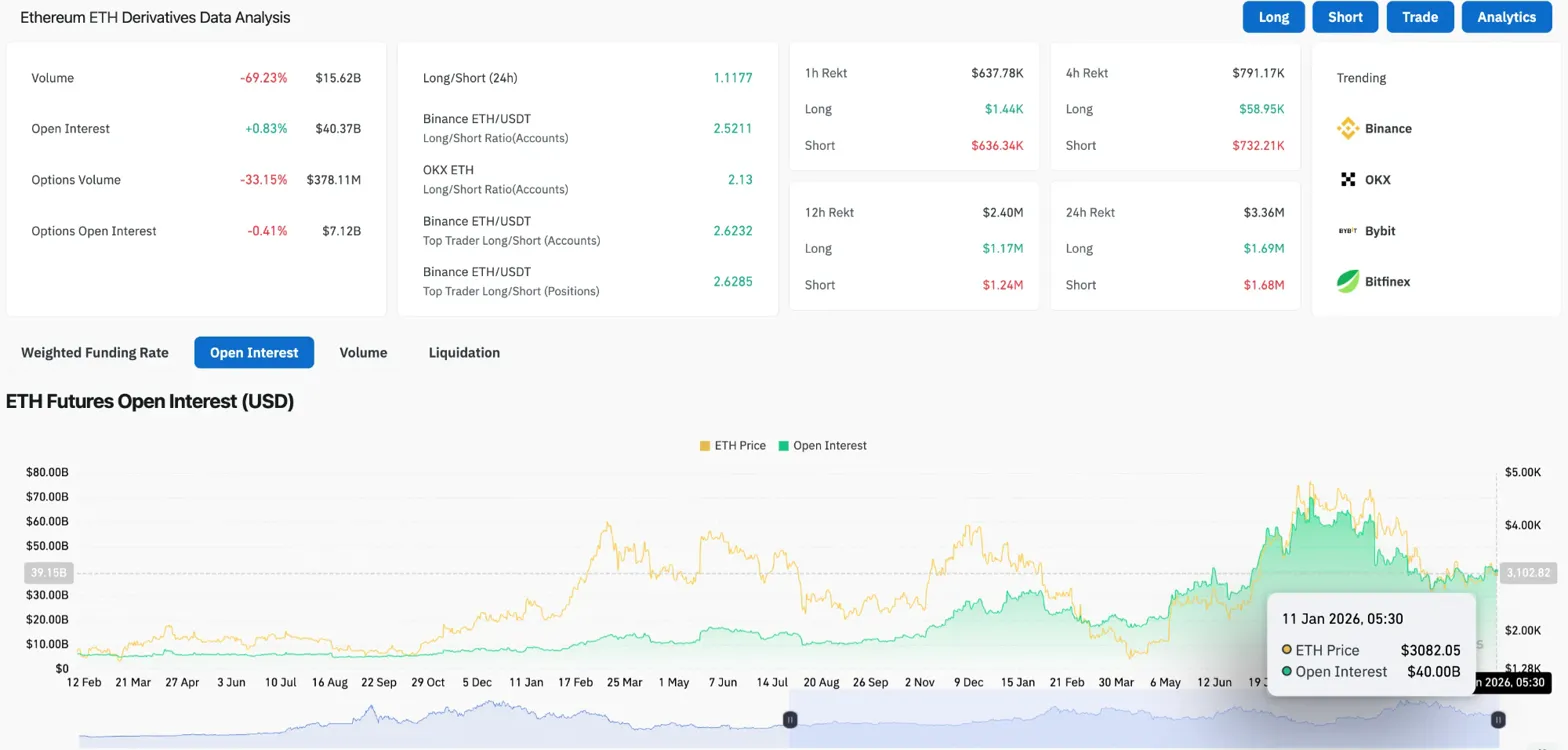

Derivatives present lengthy bias regardless of quantity collapse

ETH derivatives evaluation (Supply: Coinglass)

Futures information reveals contradictory indicators. Open curiosity elevated by 0.83% to $40.37 billion, indicating a steady place with minimal deleveraging. Nevertheless, quantity fell 69.23% to $15.62 billion, one of many quietest trades in latest months.

Choices quantity decreased by 33.15% to $378.11 million, and possibility open curiosity decreased by 0.41% to $7.12 billion. The mix of flat open curiosity and plummeting quantity means that merchants are ready and ready reasonably than actively betting forward of a break within the triangle.

The lengthy/brief ratio exhibits a robust bullish bias. The Binance account ratio is 2.52 in favor of longs, whereas OKX is 2.13. Prime merchants on Binance have indicated a protracted/brief positioning of two.62, indicating that skilled contributors are leaning bullish regardless of the stagnant worth motion.

The 24-hour whole lengthy/brief ratio is 1.11, which is reasonably bullish. Nevertheless, the lengthy bias on the account degree creates squeeze threat if worth breaks down the triangle. If the leverage is stacked to at least one aspect and a key degree fails, the follow-through will normally be stronger.

Take a look at resistance with triangle sample $3,120

ETH worth dynamics (Supply: TradingView)

Ethereum worth at this time is buying and selling inside a symmetrical triangle on the day by day chart, with resistance close to $3,120 and assist at $3,060. This sample has been compressing volatility since early January and is approaching the highest that will usually power a decision.

Parabolic SAR is $3,053, barely under present worth. This means that so long as ETH stays above this degree, short-term momentum will stay impartial to bullish. Nevertheless, the $3,296 supertrend indicator stays bearish and is at the moment properly above the value, marking the primary main resistance zone.

The downtrend line that has been guiding the decline since October is close to $3,140, forming a double wall of resistance. Patrons want to interrupt each the triangle’s higher restrict and the trendline to maneuver the construction from bearish to bullish.

Quick-term chart exhibits bullish momentum constructing

ETH 30 minute chart (Supply: TradingView)

The 30-minute timeframe exhibits Ethereum holding agency on the higher finish of the triangle sample round $3,093. The RSI is impartial at 56.77 with a bullish development after recovering from an oversold state of affairs earlier within the week.

The MACD is displaying constructive momentum at 0.24, with the sign traces at 1.46 and 1.22 forming a bullish crossover. This sometimes precedes an increase on a shorter timeframe, however requires a break above triangular resistance to be confirmed.

The value is testing the $3,100 degree, which has acted as each assist and resistance many occasions up to now classes. If the value can cleanly break by way of $3,120 together with the quantity, a breakout of the triangle can be confirmed and the preliminary goal can be $3,200, and if the momentum continues, we are able to anticipate additional upside towards the supertrend resistance of $3,296.

Community improve delivers 2026 Catalyst framework

Community Improve Catalyst supplies primary assist. The Gramsterdam improve is scheduled for the primary half of 2026, adopted by the Hegota replace within the second half. Each concentrate on bettering scaling means and transaction effectivity, however analysts observe that these enhancements could not instantly impression costs with out corresponding demand.

Conservative estimates recommend that ETH may attain $4,000 based mostly on anticipated community upgrades and institutional adoption tendencies.

Extra optimistic forecasts by distinguished analysts put it within the vary of $7,000 to $9,000 by early 2026, however such a purpose would require distinctive market situations and sustained institutional adoption. The upgrades, scheduled for each halves of 2026, present a primary catalytic framework that may assist phased evaluations if implementation yields measurable enhancements.

Outlook: Will Ethereum Rise?

Fixing the triangle determines short-term course. If ETH regains the downtrend line above $3,120 with quantity, the construction will shift bullishly. In that case, the preliminary goal can be $3,296, with an extra rally in the direction of $3,500 if the supertrend reverses and good points momentum.

If the value loses $3,060 and breaks out of the triangle to the draw back, the sample will exit bearishly. This leaves assist at $3,000 and deeper draw back room in the direction of $2,900-$2,800 if promoting accelerates and over-leveraged longs unwind.

The highest worth can be confirmed if it breaks by way of $3,120. Dropping $3,060 incurs adjustment threat.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply