- IP maintains its bullish pattern above the EMA, indicating robust continuation potential going ahead.

- Spot and derivatives flows point out market resets and scale back the chance of liquidations and pullbacks.

- Institutional allocation and provide constraints speed up demand and worth discovery.

Story (IP) prolonged its current rally after a decisive breakout reshaped the short-term market construction. The token has soared past its long-term worth vary, attracting renewed curiosity from each speculative merchants and long-term members.

Importantly, this transfer unfolded in parallel with bettering market sentiment, tightening alternate charge circumstances, and renewed institutional visibility. These components mixed to shift the narrative from restoration to continuity and place IP among the many strongest performers in its section.

Bullish construction is above key ranges

IP continues to commerce above all main exponential shifting averages on the 4-hour chart. This association not solely signifies the power of the pattern, but in addition usually attracts systematic pattern followers.

An upward slope throughout the short-term and long-term averages suggests continuation quite than depletion. Furthermore, the supertrend indicator remains to be beneath the worth, rising the directional bias.

Speedy resistance lies between $2.65 and $2.70, which might result in short-term extensional strain. Acceptance above this band might result in a follow-through in the direction of the $2.90 to $3.00 space. This zone has psychological significance and is according to the anticipated extension from the current breakout.

On the draw back, $2.38 to $2.40 serves as the primary line of protection. This degree coincides with a deep Fibonacci retracement and former response level.

Associated: Monero Value Prediction: Privateness Coin Soars to $573 as Peter Brandt’s Chart Comparability Indicators a Massive Breakout

Nevertheless, the broader bullish construction stays in place so long as costs maintain above $2.18 to $2.20. An extra decline in the direction of $2.03 will check the resilience of the pattern, however it won’t instantly invalidate the bigger setup.

Resetting the show of derivatives and spot flows

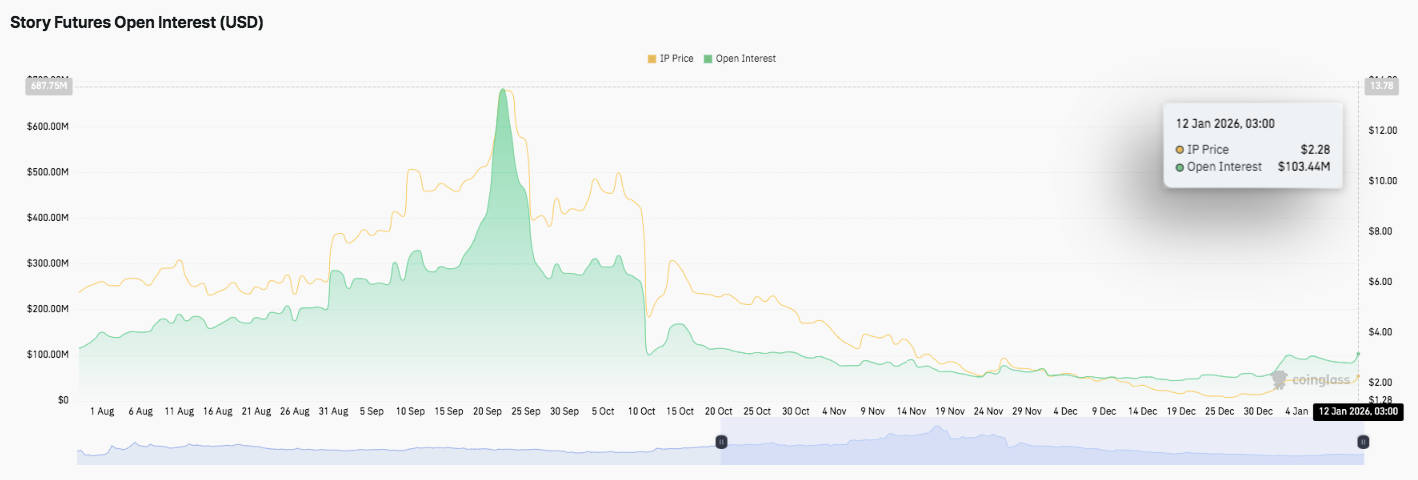

Derivatives information displays accomplished leverage cycles quite than continued overruns. Open curiosity rose quickly to document highs, however was subsequently eradicated by pressured liquidations and danger mitigation.

In consequence, present positioning seems cleaner and liquidation danger throughout pullbacks is diminished. Knowledge from early January confirmed solely modest re-engagement, suggesting merchants stay selective.

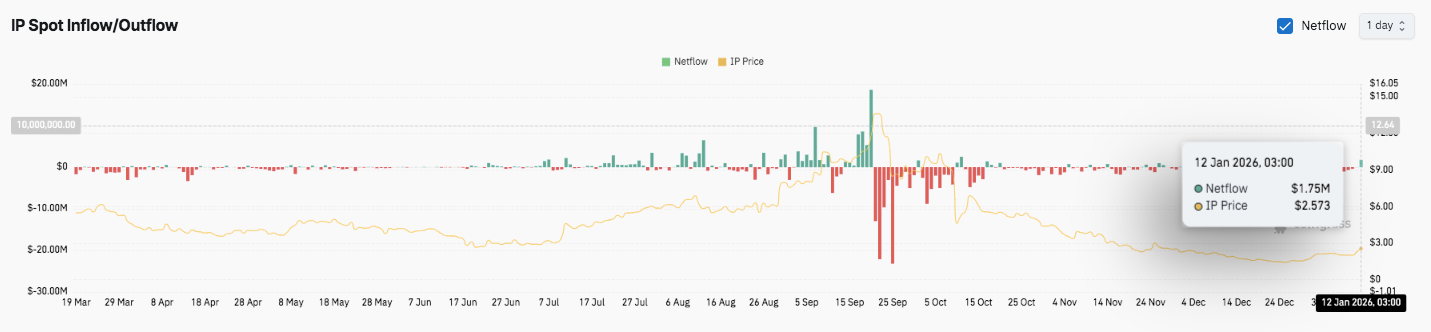

Spot circulate reinforces this narrative. The preliminary accumulation section transitioned to revenue taking after the height of capital inflows. Since then, inflows and outflows have been in equilibrium, indicating hesitation quite than distribution. Due to this fact, it seems that the market is ready for affirmation earlier than injecting new funds.

Institutional consideration and provide components

The newest set off arose from adjustments in institutional allocation. On January 8, Grayscale added Story to its decentralized AI fund and assigned it a weight of 8.73%.

Moreover, short-term deposit suspensions at main South Korean exchanges constrained short-term provide. These developments mixed to amplify demand throughout an already bullish technical section and speed up worth discovery.

Story (IP) Value Technical Outlook

Story (IP) enters the near-term outlook with a well-defined bullish construction after decisively breaking out of the $2.20-$2.25 vary. The worth growth has been sharp and key technical ranges are actually shaping the subsequent step within the path as momentum cools barely after an impulsive transfer.

Prime degree: $2.65-$2.70 stays the fast resistance zone. A clear break and sustained maintain above this space will verify your endurance. Past that, the $2.90 to $3.00 space would be the subsequent anticipated growth zone, combining psychological resistance and a measured shifting goal from the earlier vary.

Cheaper price degree: $2.38-$2.40 serves as the primary assist space and coincides with a key Fibonacci retracement. Under that, $2.18-$2.20 marks the previous breakout zone and represents a key degree to maintain the bullish construction. A deeper decline to $2.03-$2.05 would check the 0.5 Fibonacci degree and the essential EMA cluster, which, if misplaced, would sign potential momentum depletion.

Value is firmly above all main EMAs, with the 200 EMA presently effectively beneath spot ranges. This positioning removes the overhead shifting common resistance and shifts the main target utterly to the horizontal provide round $2.70. This construction is extra like an growth section after a breakout than a prime sample.

Will the story evolve additional?

Storey’s worth outlook relies on whether or not consumers can proceed to defend the $2.20 space throughout a consolidation. So long as worth stays above this degree, a pullback favors a continuation over a reversal. Acceptance above $2.70 will possible open the door to $3.00 territory.

Nevertheless, if the worth can’t maintain $2.18, there’s a danger of a deeper retracement to $2.05. For now, IP is buying and selling in a constructive zone, with momentum, construction, and outlined ranges suggesting that elevated volatility stays biased to the upside.

Associated: 2026 Canton Value Prediction: DTCC Treasury Tokenization and $6 Trillion Asset Processing Goal at $0.25-0.50

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply