- ETH stays secure round $3,100, above main averages, indicating a balanced commerce.

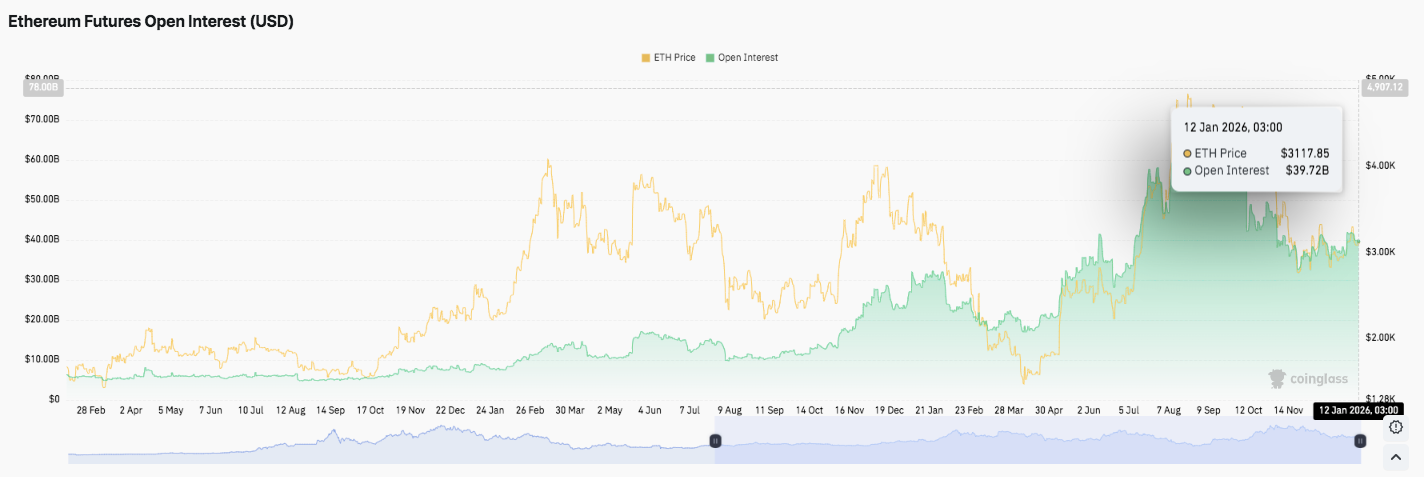

- Futures open curiosity close to $40 billion signifies elevated leverage, suggesting the opportunity of a pointy transfer.

- Elevated staking reduces provide and quietly will increase structural strain for future volatility

Ethereum continues to commerce inside a slender vary after rebounding strongly from its late December lows. Value motion across the $3,100 degree displays consolidation slightly than depletion. Market knowledge exhibits that ETH is buying and selling above main transferring averages, suggesting a stability between patrons and sellers.

Quick-term construction is above key assist

On the 4-hour chart, ETH remains to be restricted to swing highs under $3,300. Nonetheless, the lows from round $2,700 proceed to assist the broader restoration construction. In consequence, the market remains to be honoring its earlier upward impulse.

Speedy resistance lies between $3,130 and $3,150, the place short-term averages are concentrated. A sustained transfer above this band might expose the $3,290 to $3,300 zone. This space coincides with an essential Fibonacci retracement and former provide. Past that, $3,450 is the higher finish of the earlier vary.

Help stays nicely outlined. The $3,080 to $3,100 zone serves as the present worth space. Moreover, there may be robust structural assist within the $3,000 to $2,995 area.

Associated: Story Value Prediction: IP Extends Rise After Main Breakout Sign…

If it fails there, the main target will shift to $2,890. A break under $2,716 will invalidate the restoration narrative. The transferring common between the 100 and 200 intervals is now clustered across the worth. Subsequently, ETH trades in equilibrium slightly than pattern extension.

Sign rigidity for derivatives and spot flows

Futures knowledge provides one other layer to your setup. Ethereum’s open curiosity continues to develop regardless of the flat worth. Open curiosity stays close to cycle highs of round $40 billion. This habits means that the dealer rotates the leverage slightly than closing out the place.

Traditionally, such conditions enhance the chance of sharp directional actions. Moreover, elevated leverage usually amplifies volatility from liquidations when costs transfer out of that vary.

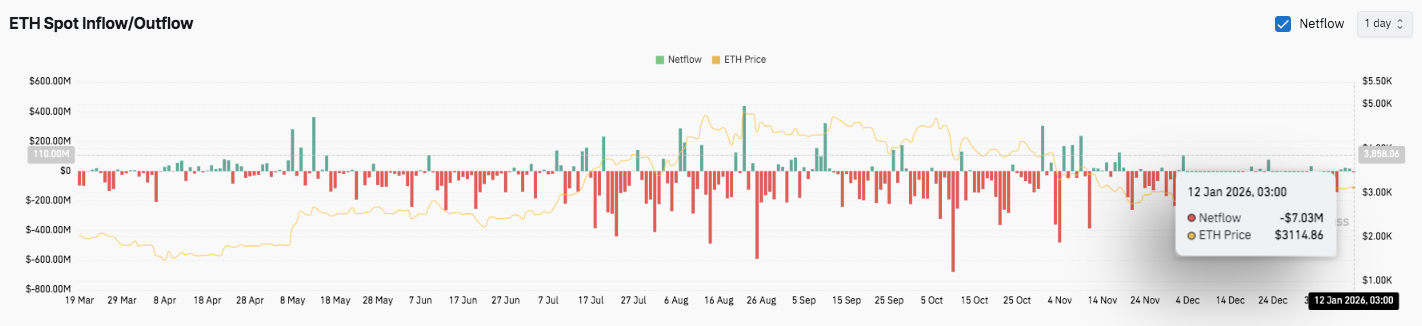

Spot move knowledge exhibits a cautious image. Web outflows accounted for a lot of the offers, indicating continued sell-side strain. Nonetheless, latest flows have been smaller and appear extra balanced round $3,100. This stabilization suggests a brief equilibrium. In consequence, upward momentum will stay subdued till sustained inflows return.

Staking exercise quietly reduces circulating provide

Lengthy-term positioning provides a structural dimension. Tom Lee’s Bitmine lately elevated its Ethereum staking by over 86,000 ETH. At the moment, complete stake holdings exceed 1 million ETH. Every deposit takes provide away from the energetic circulation.

Moreover, staking rewards encourage long-term holding slightly than short-term buying and selling. In consequence, ETH quietly absorbs provide with out instantly reacting to the value. When demand will increase, this imbalance usually precedes volatility.

Associated: Monero Value Prediction: Privateness Coin Soars to $573 on Peter Brandt’s Chart…

Technical outlook for Ethereum worth

Ethereum is buying and selling inside a tightening vary round $3,100, with key ranges nonetheless clearly outlined.

Upside ranges embody the primary resistance zone at $3,130-3,150, adopted by $3,290-3,300 across the 0.786 Fibonacci retracement. If a breakout of this space is confirmed, the rally might prolong in direction of the earlier vary excessive of $3,450.

On the draw back, instant assist is between $3,080 and $3,100. Under that, $3,000 to $2,995 stays a key demand zone alongside the 0.382 retracement, with $2,890 performing as deeper structural assist. If the value returns to $2,716, the broader restoration can be nullified.

The technical construction means that Ethereum is compressing above its medium- to long-term transferring averages, indicating stability slightly than weak spot. This correction section usually precedes a rise in volatility.

Will Ethereum rise additional?

Ethereum’s near-term route will rely upon whether or not patrons can confidently defend the $3,000 area and recuperate $3,150. A profitable rally might pave the best way for costs above $3,300.

Nonetheless, if $3,000 just isn’t sustained, the main target will shift to $2,890 and the restoration construction will weaken. For now, Ethereum stays in a crucial zone, with vary decision more likely to decide the following large transfer.

Associated: 2026 Canton Value Prediction: DTCC Treasury Tokenization and $6 Trillion Asset Processing Goal at $0.25-0.50

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply