In a fear-filled, risk-off crypto market, Dogecoin’s value has been hovering round key technical ranges, suggesting decreased volatility and the potential for sharp strikes forward.

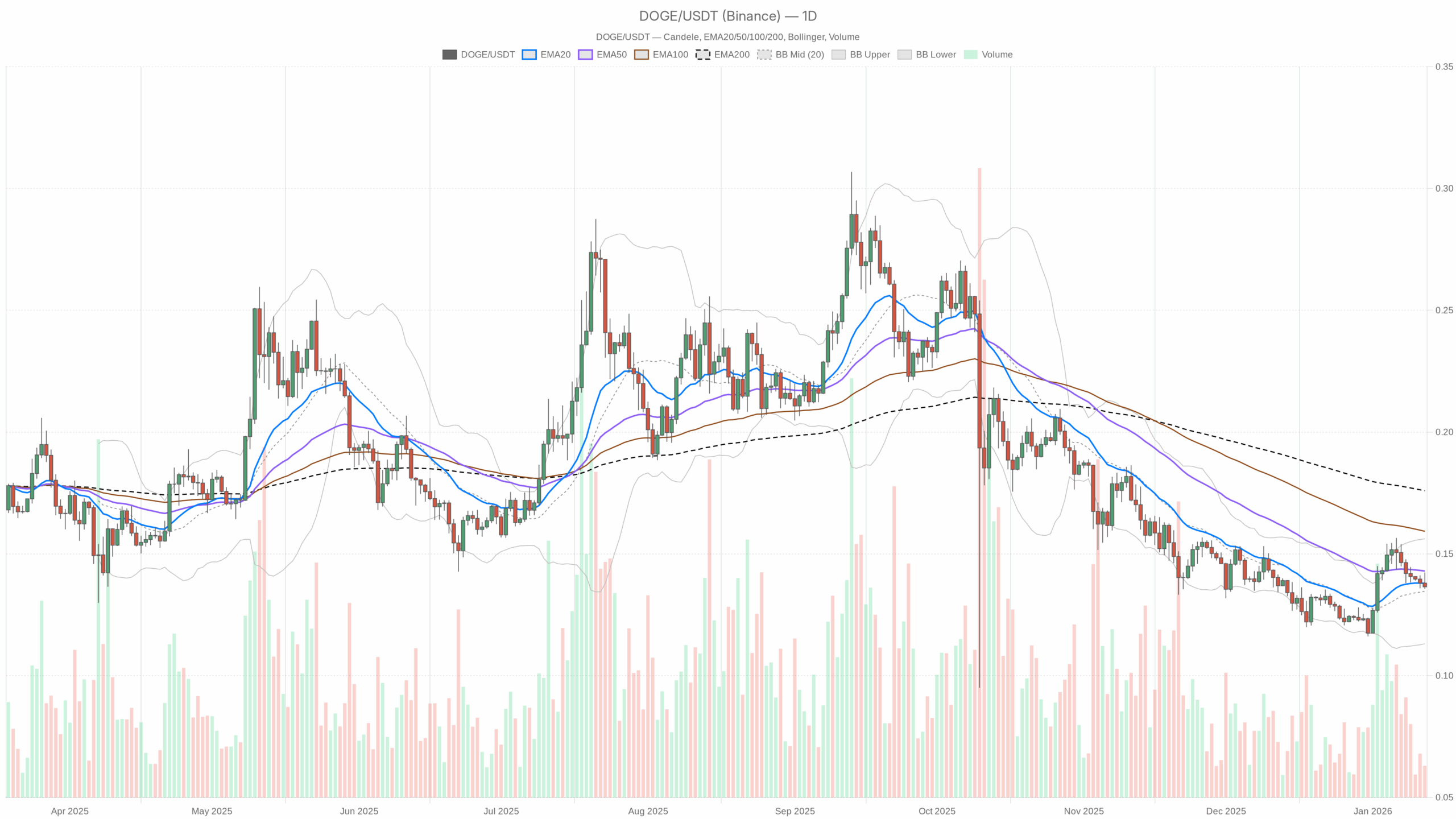

Predominant situation (D1) on every day chart: structurally bearish, tactically impartial

The bias nonetheless stays on the every day time-frame. bearishhowever in a really particular sense, the construction is bearish and momentum is impartial. This mixture typically precedes both the typical rebounding to resistance or a pointy flush after liquidity returns.

Development construction – EMA

– Value (D1 closing value): $0.14

– EMA 20: $0.14

– EMA 50: $0.14

– EMA200: $0.18

– Regime flag: bearish

The 20-day and 50-day EMAs are principally flat and overlap proper now. dogecoin value It’s round $0.14, however the 200-day EMA is even greater. $0.18. This reveals two issues:

- of The long-term pattern continues to be downward. (Value for lower than 200 days).

- of Quick-term to medium-term traits are stagnant (Quick EMA is flat and bunched up).

Merely put, the downtrend has misplaced momentum however has not reversed. Reasonably than beginning a brand new uptrend, Dogecoin is extra like resting underneath a ceiling.

Momentum – RSI and MACD

– RSI 14 (D1): 48.45

– MACD line/sign/histogram (D1): Just about all 0

Day by day RSI is slightly below 50 pure indecision. There isn’t a actual shopping for stress, however there may be additionally no lively capitulation. Dogecoin is neither overbought nor oversold and is just about ignored.

The truth that the MACD is caught close to zero additionally confirms the identical. No sturdy bullish or bearish momentum Each day. Earlier traits have run their course, however new instructions haven’t but begun. That is the sort of background the place costs can rapidly escape of equilibrium as a consequence of information, liquidity shocks, or broader market actions.

Volatility and Vary – Bollinger Bands and ATR

– Bollinger Bands (D1): Mid $0.13, late $0.16, low $0.11

– ATR 14 (D1): $0.01

On the every day chart, the value is center of bollinger bands. The band unfold ($0.11 to $0.16) offers an summary of the present medium-term worth space. We’re removed from excessive circumstances, so we do not see any quick squeeze breakout or band stroll traits but.

per ATR $0.01 Fairness at $0.14 is low, however commonplace for a cooling section. The details listed below are: Volatility has been compressed in comparison with the earlier swing. Traditionally for DOGE, low volatility has not often been sustained and tends to resolve with sharp strikes as soon as merchants get up once more.

every day pivot stage

– Pivot level (PP, D1): $0.14

– R1 (D1): $0.14

– S1 (D1): $0.13

The every day pivot clustering very near the present value signifies that we’re at the moment hanging on to the value Quick-term steadiness level. The $0.13 drop in S1 is the primary line the place bullish patrons might react. On the upside, there isn’t a quick pivot resistance clearly outlined above, so the market is more likely to $0.16 band high and, $0.18 200 days EMA As the following actual take a look at.

Macro context and benefit background

The present highly effective forces are Macro risk-off and neglect of altcoins. Bitcoin is holding up 56% market energythe market capitalization of cryptocurrencies is flat to barely unfavourable, and the Worry & Greed Index is among the many highest on this planet. worry In that context, Dogecoin, at $0.14 and beneath its 200-day common, is a basic laggard. Though we aren’t actively promoting it, there have been no bids on it, so it has been left within the ready room.

Intraday scenario: Tape freezes throughout intraday promoting stress

1 hourly (H1): weak intraday bidding, frozen volatility

– Value (finish of first half): $0.14

– EMA 20/50/200 (H1): Complete about $0.14

– RSI 14 (H1): 37.95

– MACD (H1): Round 0

– Bollinger Bands (H1): Tightly narrowed all the way down to round $0.14

– ATR 14 (H1): 0

– Pivot (H1): PP/R1/S1 are all clustered at $0.14

The hourly chart seems nearly synthetic, with the value caught at $0.14 and ATR successfully caught at $0.14. zeroBollinger Bands collapse above the value and all EMAs overlap. it is a basic microfluidic freezing. There are few two-way trades, the unfold is probably going tight however depth is low, and nobody is pushing the tape.

When the RSI drops to about 38, underneath nonetheless water; Strain is barely on the promote facet On this time-frame. It wasn’t a crash, only a quiet grind to inactivity. When the MACD is flat, there isn’t a actual momentum construction to depend on through the day, solely the data that when volatility returns, the preliminary directional push might lengthen earlier than reverting to the imply.

quarter-hour (M15): Very short-term downtrend

– Value (near M15): $0.14

– EMA 20/50/200 (M15): Throughout $0.14

– RSI 14 (M15): 28.9

– MACD (M15): Round 0

– Bollinger Bands and ATR (M15): Very tight, ATR is 0

– Regime (M15): bearish

If the 15-minute RSI is lower than 30, Oversold domestically The state, even when the value itself moved little in absolute phrases. What this implies in follow is that whereas the small strikes that did happen had been dominated by promoting, volatility has been so compressed that the market has not but been in a position to react appropriately.

As you achieve this, keep in mind the next: Shorting domestically oversold intraday tapes with low volatility has poor reward and danger. Except a brand new catalyst hits. Even when the broader every day pattern stays fragile, a small optimistic shock may set off a fast snapback on this timeframe.

Dogecoin value situation

Bullish situation: imply returns to resistance

The constructive path from right here isn’t quick; imply reversion bounce from a recessionary and illiquid atmosphere.

The bullish path seems like this:

- Owned by Dogecoin $0.13 or extra Maintains the present vary based mostly on every day closing costs.

- D1 RSI decisively pushes again upwards 50–55indicating a transition from indifference to lively buy.

- Costs start to rise in direction of $0.16 Bollinger Bands HigherIdeally, the ATR would broaden, which means volatility would return to an uptrend quite than a downtrend.

- On the way in which up, a brief EMA (20/50) begins. tilt up Then they separate from one another and the flat cluster turns right into a short-term uptrend construction.

In that case, the vital upside checkpoints are:

- $0.16: The primary main resistance alongside the every day band high.

- $0.18: 200 days EMA and vital pattern inflection level zone. Retrieving and sustaining this stage could be the primary vital sign that the bigger downtrend is over and a brand new medium-term uptrend is starting.

What invalidates the bullish situation?

a Clear every day closing value beneath $0.13particularly if RSI drops beneath the low 40s and ATR expands to the draw back, indicating that patrons aren’t in a position to defend the present vary. The main focus will then shift from imply reversion to the continuation of the broader bearish construction.

Bearish situation: vary break and pattern resumption

Bears respect the present macro atmosphere: worry, Bitcoin’s excessive dominance, and the retreat of most altcoins. On this atmosphere, Dogecoin will probably be susceptible if liquidity leaves alts once more or BTC rolls over.

The bearish path seems like this:

- dogecoin $0.13 loss Help with quantity and switch the present ground into resistance.

- The every day RSI has fallen into the low 40s or low 30s, confirming a transition from impartial to sustained promoting.

- When the vary is lastly damaged, ATR will broaden, however this enlargement is transfer down.

- The D1 EMA begins to slope downward once more, with the twentieth falling beneath the 50-day in a extra pronounced method.

In that situation, the market would search for decrease worth areas, maybe nearer to that value. Bollinger bands decrease by $0.11 As an preliminary magnet. If market-wide nervousness deepens, it will not be stunning to see a fast break by way of the lows of those bands earlier than a extra significant rebound happens.

What would invalidate the bearish situation?

being pushed again up $0.16 If quantity rises and the every day RSI rebounds above 55, you’ll argue that the draw back break was a bear lure. From there, continued buying and selling above the 200-day EMA will $0.18 Successfully destroy the dominant bearish construction And forces the bear to reevaluate.

Find out how to take into account positioning based mostly on the present Dogecoin value

Presently, Dogecoin is within the following scenario. Low volatility, low confidence pockets. The every day pattern continues to be technically bearish, with value beneath the 200-day mark, however the lack of momentum and compressed vary means there will probably be little reward for aggressive directional bets till volatility returns.

For bulls, this tape nonetheless does not justify intense publicity. Greater likelihood performs are normally look ahead to affirmationcorresponding to a break in direction of $0.16 as a consequence of elevated quantity and rising every day RSI and ATR. Going deep right into a frozen worry market earlier than that occurs means you are betting on timing, not construction.

For bears, the chance is nearly a mirror picture. Shorting a coin that’s already beneath 200 days with the intraday RSI oversold and volatility lifeless will typically lag behind the transfer. Whereas warning in opposition to memetic property is sweet in a macro context, the quick reward/danger isn’t compelling except Dogecoin has vitality behind the break and is clearly shedding $0.13.

By definition, volatility returns. The vital factor is to not confuse a quiet market with a protected market. When the vary is compressed this tough, the following leg tends to be sharp, and a misdirection can rapidly develop into a ache. In such a regime, scale, stops, and length are extra vital than normal.

If you wish to monitor the market utilizing skilled charting instruments and real-time information, you’ll be able to open an account with Investing utilizing our companion hyperlink.

Open an Investing.com account

This part incorporates sponsored affiliate hyperlinks. We might earn commissions at no further price to you.

This text is market commentary and displays technical views on Dogecoin costs based mostly on information accessible on the time of writing. This isn’t funding recommendation and doesn’t keep in mind your private circumstances, danger tolerance, or monetary targets. Cryptoassets are extremely unstable and may fluctuate quickly in both route. By no means danger capital you can’t afford to lose.

Leave a Reply