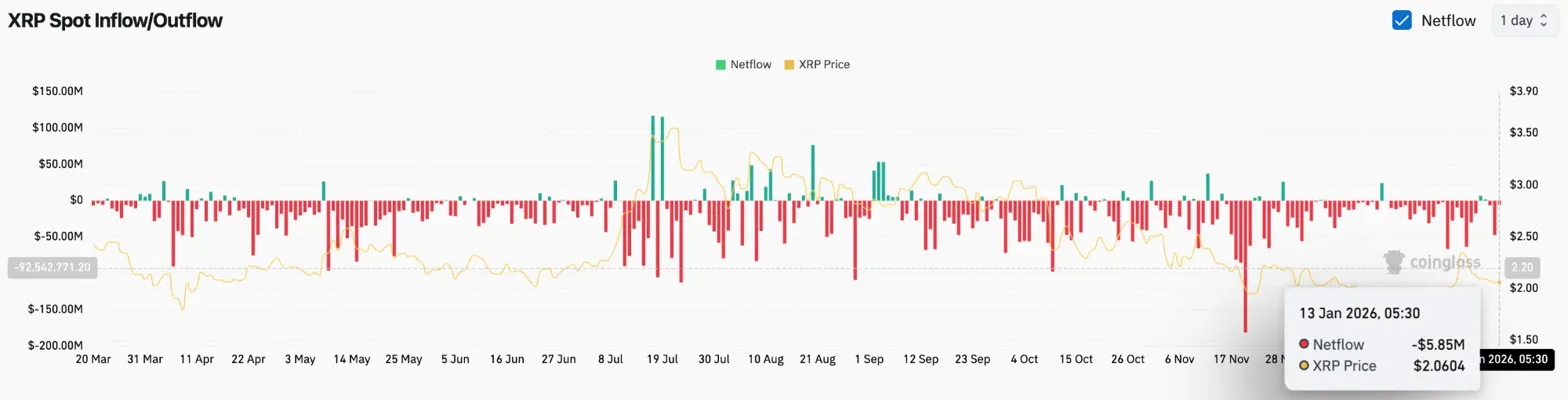

- A spot outflow of $5.85 million on January thirteenth reveals holders exiting their positions amid a broader market downturn, with XRP buying and selling at $2.0517.

- Value is caught in a descending channel under the 50-day, 100-day, and 200-day EMAs, with the supertrend at $1.9555 serving as a key assist flooring.

- With a “promote the rally” tone dominating the crypto market, no new catalysts emerge and XRP loses course, correlating with Bitcoin’s weak spot.

XRP worth is buying and selling round $2.0517 immediately, consolidating inside a descending channel that has guided the worth decline because the July excessive when the token exceeded $3.60. Whereas the $5.85 million spot outflow on January thirteenth suggests distribution relatively than accumulation, the dearth of recent catalysts has stored XRP range-bound, intently correlating with broader market weak spot.

It seems that holders will exit their positions because of outflow of $5.85 million

Internet outflows on January 13 have been $5.85 million, based on alternate circulate information, representing one other session through which holders moved their tokens to exchanges relatively than withdrawing them to chilly storage. If outflows proceed through the consolidation part, it often signifies {that a} distribution will happen as contributors take quick positions relatively than accumulating at present ranges.

The sample of flows all through 2025 was combined, with sporadic inflows through the upswing, shortly adopted by sustained outflows through the downswing. The present outflow of $5.85 million comes after XRP failed to interrupt out of the $2.17 resistance zone, suggesting that merchants are profiting from the pullback to exit relatively than improve their positions.

Associated: Bitcoin Value Prediction: BTC trades sideways because of futures confidence…

The sustained promoting strain is according to the technical construction exhibiting that XRP is under all main EMAs besides the 20-day. With out new catalysts to vary sentiment, the outflows will create additional headwinds for any try at a rebound.

Downward channel has prevailed since July highs

The every day chart reveals that XRP is buying and selling inside a descending channel that has contained worth actions because the surge above $3.60 in July. The channel is compressed in volatility as decrease highs and decrease lows kind a transparent bearish construction.

The principle technical ranges are:

- 20-day EMA: $2.0479

- 50-day EMA: $2.0702

- 100-day EMA: $2.2083

- 200-day EMA: $2.3295

- Supertrend: $1.9555

Value is barely above the 20-day EMA at $2.0479, however nonetheless under the 50-day, 100-day, and 200-day averages. This EMA configuration reveals bearish momentum on the upper timeframe regardless of current stabilization round present ranges.

The $1.9555 supertrend indicator gives an essential decrease certain. So long as XRP stays above this stage, the construction stays bearishly impartial relatively than breaking utterly. Shedding supertrend assist may trigger the indicator to reverse and set off a transfer into the $1.80 to $1.70 demand zone.

Channel resistance is close to the higher restrict at $2.15. Breaking via this stage on quantity could be the primary signal that patrons are in management, however the present worth development doesn’t give us confidence in both course.

Hourly worth motion reveals impartial momentum

On the timeframe, we see that XRP stays in a slim vary between $2.05 and $2.07. The RSI is 48.46, utterly impartial between bulls and bears. The MACD reveals a barely optimistic studying of 0.0011, however the sign line stays flat, indicating that neither aspect is in management.

Value is buying and selling inside a descending channel that displays the every day construction. The hourly chart reveals a number of assessments of each channel boundaries and not using a definitive break, usually making a compression sample forward of a directional transfer.

Associated: Ethereum worth prediction: Bitmine bets $4 billion as Tom Lee predicts restoration

Quantity through the consolidation interval was modest, with no aggressive shopping for or panic promoting. The insecurity displays the tone of the broader crypto market, with Bitcoin and Ethereum struggling to take care of their beneficial properties and altcoins remaining directionless.

There aren’t any contemporary catalysts throughout the vary of XRP

Cryptocurrency markets remained vary certain as Bitcoin and Ether struggled to take care of momentum after current beneficial properties slowed. A “sell-the-rally” development throughout main cryptocurrencies dampened threat urge for food, and regardless of some intraday energy, altcoins confirmed little course.

Relating to XRP specifically, there have been no new headlines that induced worth motion. ETF flows, institutional positioning, and community exercise proceed to assist within the background, however none have been sturdy sufficient to decisively carry the token out of its multi-week vary.

Merchants centered on short-term ranges as liquidity thinned and worth actions remained intently correlated to the broader market. Except Bitcoin breaks out of its personal consolidation vary, XRP lacks the mandatory momentum catalyst to problem channel resistance.

Outlook: Will XRP rise?

This setup requires a catalyst to interrupt the combination. If XRP regains $2.07 and breaks above the $2.15 channel resistance with quantity, the construction will shift bullishly. In that case, the preliminary 50-day EMA goal is $2.17, with an extra transfer in direction of $2.20 if momentum beneficial properties.

If the worth declines by $2.04 and falls under the 20-day EMA, the consolidation will resolve to the draw back. This places supertrend assist at $1.9555, which may result in a deeper correction in direction of $1.80-$1.70 if the promoting accelerates and the channel breaks down.

A break above $2.15 will change momentum. A lack of $2.04 confirms that the distribution continues.

Associated: Shiba Inu Value Prediction: SHIB is in a cooling part after a rally at first of the month

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply