- XRP is buying and selling at $2.1394 as Ripple receives Luxembourg Digital Cash Establishment license approval following the current UK FCA approval.

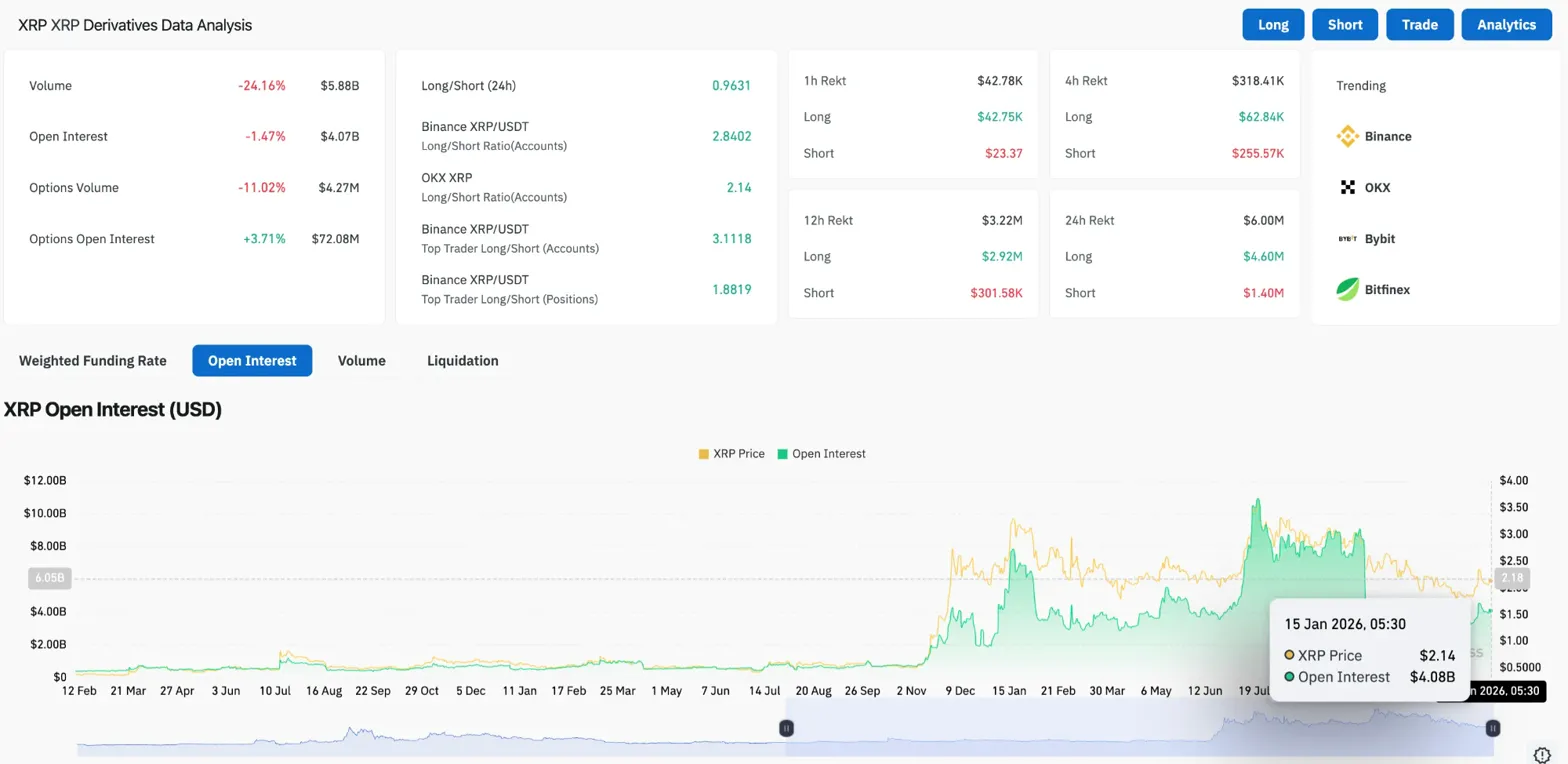

- The XRP ETF attracted web inflows of $10.6 million, however open curiosity was combined, with open curiosity down 1.47% to $4.07 billion.

- Worth has stabilized under all main EMAs within the descending channel, with supertrend help at an vital decrease sure at $1.9555.

XRP worth is buying and selling round $2.1394 at present after Ripple introduced that it has acquired preliminary approval for an digital cash establishment license from the Luxembourg Monetary Regulatory Authority. This regulatory milestone got here because the Spot XRP ETF attracted web inflows of $10.6 million, however the decline in open curiosity and quantity means that merchants stay cautious regardless of constructive elementary developments.

Ripple introduced on Wednesday that it has acquired preliminary approval for an EMI license from Luxembourg’s monetary regulator. This is a vital step in direction of full regulatory approval within the European Union. This approval follows Ripple’s current success in acquiring EMI clearance from the UK Monetary Conduct Authority.

“The EU is without doubt one of the first main jurisdictions to introduce complete digital asset regulation, giving monetary establishments the understanding they should transfer blockchain from pilot to industrial scale,” Ripple President Monica Lengthy mentioned in a press release. He added that the corporate is “managing the end-to-end movement of worth” with the intention of modernizing cross-border funds.

Luxembourg’s approval represents its strategic place throughout the EU regulatory framework. Having secured each UK and Luxembourg licenses, Ripple will have the ability to function fee companies throughout main European markets below the excellent license that institutional prospects require to deploy blockchain.

ETF inflows present demand regardless of low costs

The Spot XRP ETF added about $10.6 million in web inflows, becoming a member of different tokens that recorded beneficial properties regardless of uneven worth efficiency. The Solana ETF noticed bigger inflows of about $23.6 million, whereas the Bitcoin Spot ETF noticed $843.6 million in inflows on January 14, its largest single-day influx in current months.

XRP ETF inflows are offering elementary help and point out continued institutional demand at the same time as XRP trades under all main transferring averages. Nevertheless, the comparatively modest quantity of $10.6 million in comparison with Bitcoin’s $843.6 million highlights that XRP stays a secondary consideration in institutional buyers’ capital allocation.

Open curiosity decreases as buying and selling quantity collapses

Regardless of the regulatory information, futures information reveals a decline in convictions. Open curiosity decreased by 1.47% to $4.07 billion, and buying and selling quantity decreased by 24.16% to $5.88 billion. The mixture of lowering open curiosity and lowering quantity normally signifies that merchants are closing positions somewhat than establishing new directional bets.

Associated: Bitcoin Worth Prediction: BTC eyes 6 digits on leverage reset throughout pullback

Choices quantity decreased by 11.02% to $4.27 million, whereas choice open curiosity elevated by 3.71% to $72.08 million. This divergence means that some merchants are utilizing choices for hedging somewhat than directional hypothesis.

Lengthy/quick ratio signifies combined positioning. The 24-hour complete is 0.9631, giving shorts a slight benefit. Nevertheless, Binance’s account ratio stands at 2.8402 in favor of longs, with prime merchants’ positions at 1.8819. The discrepancy between combination positioning and account-level ratios means that retail is bullish whereas skilled flows are extra balanced.

Descending channels dominate the technical construction

The each day chart reveals that XRP is trapped inside a descending channel, inducing a worth decline since July highs above $3.60. Worth is buying and selling under all main exponential transferring averages, making a bearish technical construction regardless of evolving fundamentals.

The key ranges are:

- 20-day EMA: $2.0699

- 50-day EMA: $2.0781

- 100-day EMA: $2.2070

- 200-day EMA: $2.3265

- Supertrend: $1.9555

XRP is barely above the 20-day and 50-day EMAs of $2.0699 to $2.0781, offering help for current worth motion. Nevertheless, the 100-day EMA and 200-day EMA of $2.2070 and $2.3265 are making a thick resistance zone overhead.

Associated: Cardano Worth Prediction: ADA Stays Bullish Construction Regardless of Decrease Leverage…

$1.9555 of the Supertrend indicator marks an vital decrease sure. So long as XRP stays above this stage, the construction stays impartial somewhat than utterly bearish. Shedding supertrend help may trigger the indicator to reverse and set off a transfer into the $1.80 to $1.70 demand zone.

Quick-term worth consolidation under parabolic SAR

The 30-minute timeframe reveals XRP consolidating simply above the parabolic SAR of $2.0966 after pulling again from its current try at $2.18 to $2.20. The RSI is 47.55, which is impartial to barely bearish after cooling down from rising ranges.

Worth is testing help at SAR, which has offered the underside in the course of the current decline. Holding this stage would maintain the consolidation, however a break from this stage would push the 20-day EMA to $2.0699, confirming a bearish shift in short-term momentum.

Quantity in the course of the consolidation has decreased, with neither aggressive shopping for nor panic promoting. Regulatory information and ETF inflows haven’t led to any motion in confidence, suggesting merchants are ready for stronger catalysts or clearer technical alerts earlier than committing capital.

Outlook: Will XRP rise?

The elemental backdrop is enhancing with the Luxembourg license and ETF inflows, however technical weak spot and decrease derivatives exercise dampen bullish beliefs. If XRP regains $2.15 and breaks above the 100-day EMA of $2.2070, the construction will shift to a bullish course. In that case, the 200-day EMA has a goal of $2.3265, which may result in an extra transfer in direction of $2.50 if momentum beneficial properties.

The consolidation will likely be resolved bearishly if the worth loses $2.0699 and falls under the 20-day EMA. This reveals supertrend help at $1.9555, which may result in a deeper correction in direction of $1.80-$1.70 if the promoting accelerates and the breakdown of the descending channel is confirmed.

The $2.15 restoration proves regulatory momentum. A lack of $2.0699 confirms that the distribution continues.

Associated: Horizen Worth Prediction: ZEN Worth Agency After Breakout as Momentum Stays Bullish

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply