- DASH holds $83.8 Fibonacci pivot, maintains bullish construction and momentum

- Provide between $88 and $90 would be the first check earlier than DASH targets an extension to $97

- If bulls stay in management, elevated open curiosity and PERP listings may speed up volatility

DASH (DASH) is gaining momentum once more after a pointy breakout from its $35 base and regular rise on the 4-hour chart. Market watchers stated the transfer displays sturdy continued demand, with the worth not too long ago buying and selling round $83.7.

Importantly, DASH stays above the important thing Fibonacci restoration zone and stays in its bullish construction. The newest market knowledge means that merchants are actually centered on whether or not DASH can defend its present pivot stage. Analysts imagine the subsequent leg may develop shortly if the bulls preserve management.

DASH holds key place as bulls defend pattern

Technical merchants pointed to $83.8, which coincides with the Fibonacci 0.786 stage, as a key pivot. A clear maintain above that space will assist additional climb makes an attempt.

Along with that, the primary main provide zone is between $88 and $90. This vary represents current rejection territory and will set off short-term profit-taking.

Due to this fact, the $97 stage is a much bigger upside goal. Analysts identified that this coincides with the Fibonacci 1.0 extension. Above $97, DASH might transfer right into a stronger pattern part. This state of affairs may draw extra breakout merchants into the market.

On the draw back, chart observers highlighted $73.4 as a very powerful assist. This stage coincides with the 0.618 Fibonacci mark.

Shedding it may weaken momentum and result in a deeper retrace. Moreover, $66.1 stays a robust construction zone, however $58.8 may act as a pullback if volatility picks up.

Momentum indicators proceed to assist the upside. DASH is above the 20, 50, 100, and 200 EMAs on the 4-hour timeframe. Merchants stated this correction usually displays sturdy pattern management. EMA assist zones close to $79.9, $70.5, $60.6, and $54.0 present a number of layers of safety.

Moreover, the supertrend assist is round $65.9, which many merchants will deal with as invalid. Analysts stated the bullish bias stays in impact above the $73 to $70 space. Due to this fact, sentiment can change shortly beneath this band.

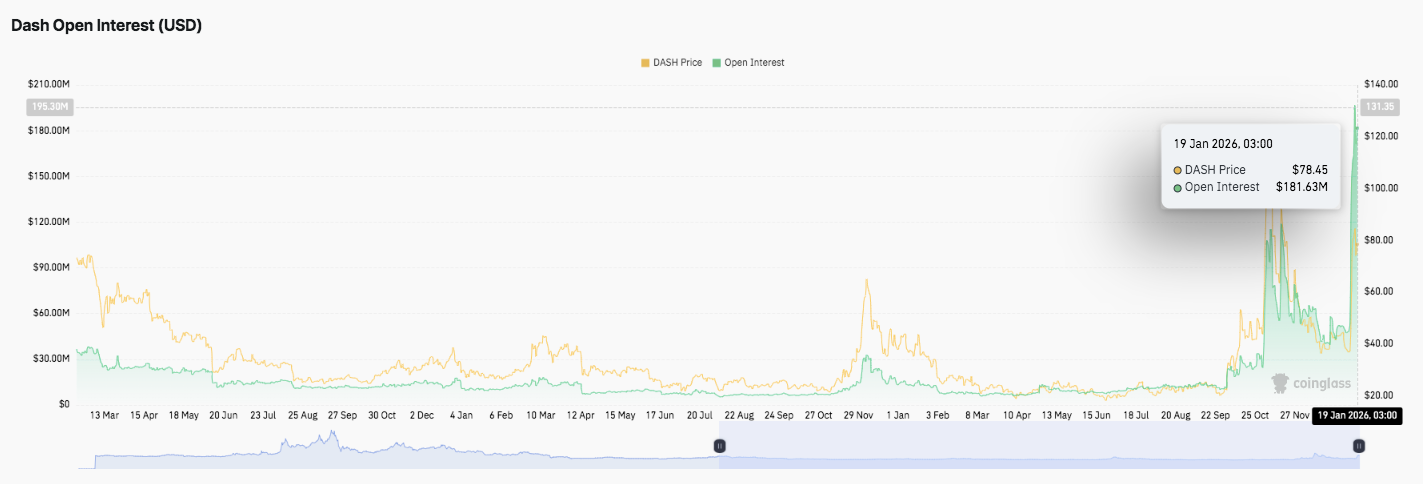

Open curiosity will increase once more as a result of elevated entry by means of Perp listings

Derivatives knowledge additionally factors to new positions. DASH open curiosity remained quiet for a number of months, however then expanded quickly in the course of the breakout part. After a cooldown related to the pullback, open curiosity started to rise once more. By mid-January, it had reached round $181.6 million, however the worth was hovering round $78.

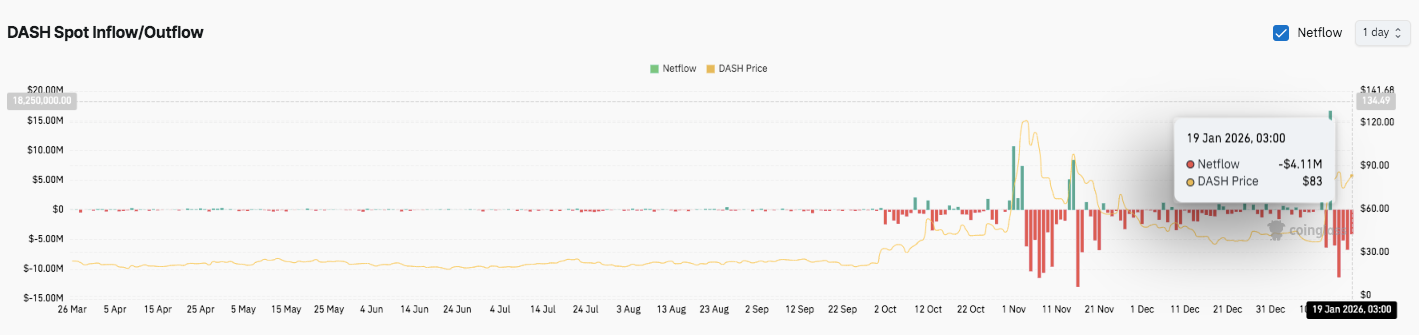

Nonetheless, spot move knowledge has remained principally adverse since early October. Analysts hyperlink this to currency-driven steady provide. Via mid-January, web flows remained adverse, of which $4.11 million was recorded.

Moreover, DASH gained new publicity with Hyperliquid being listed for everlasting buying and selling. Together with Aster DEX, DASH at present trades on two main Perp DEX venues. Merchants can use as much as 5x leverage, doubtlessly amplifying their subsequent transfer.

Technical outlook for DASH worth: Key ranges stay clear even in February

Even after the sharp breakout of the sprint and continued bullish construction on the 4H chart, the important thing ranges are nonetheless clear.

- Prime stage: The present pivot zone is $83.8. Holding tight on it’ll preserve momentum. The following massive hurdle is $88-$90, which would be the first provide space. If consumers can break by means of that ceiling, Sprint may prolong in direction of $97, which is in step with the Fib 1.0 goal and can be a major upside magnet.

- Lower cost stage: Assist stays strongest at $73.4 and the 0.618 Fib zone that consolidates the pattern. A break beneath this might weaken the bullish setup and drive a deeper pullback. The following assist ranges are $66.1 and $58.8, and a rise in volatility may entice buy-side shopping for.

- Development assist: Sprint is buying and selling above the 20, 50, 100, and 200 EMAs, indicating a robust pattern match. The supertrend assist close to $65.9 stays an invalidity line for the bulls.

Will the sprint go up?

Sprint worth predictions depend upon whether or not consumers can persist with the $73-$70 zone lengthy sufficient to problem $88 once more. If DASH converts into assist between $88 and $90, the $97 goal turns into lifelike.

Nonetheless, failure to maintain $73.4 may end in a deeper retracement in direction of $66.1. For now, Sprint stays within the bullish zone, however the subsequent breakout will depend upon follow-through quantity and sustained demand.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply