- Bitcoin fell 1.62% to $91,064, falling beneath the 20-day and 50-day EMA clusters on issues that danger property will probably be rattled amid skinny vacation liquidity as a result of tariff battle.

- Outflows from spot exchanges reached $145.89 million, with $108 million of lengthy positions being liquidated in 24 hours.

- Supertrend assist at $88,496 turns into a key stage of safety as value checks the decrease finish of the ascending channel.

Bitcoin value is buying and selling round $91,064 at this time after falling beneath the 20-day and 50-day EMA clusters resulting from renewed tariff issues. The transfer got here amid skinny vacation liquidity with U.S. markets closed, amplifying the draw back as leveraged longs had been flushed.

Tariff headlines drive risk-off motion

The impetus got here from geopolitical headlines relatively than crypto-specific information. The contemporary menace of tariffs in opposition to the European Union has spooked world markets and despatched traders to protected havens. Gold soared to an all-time excessive of practically $4,700 an oz as danger property retreated.

Kraken Vice President Matt Howells Barbee famous that cryptocurrencies have proven uneven draw back danger since October, with the market punishing unfavorable information extra harshly than rewarding constructive catalysts. This sample repeated on Monday, with BTC down 3.5% from its weekend excessive.

Some merchants are predicting a “TACO” state of affairs by which President Trump ultimately withdraws his tariff menace, just like the sample with China final 12 months. However volatility is more likely to proceed because the World Financial Discussion board in Davos generates headlines on commerce coverage.

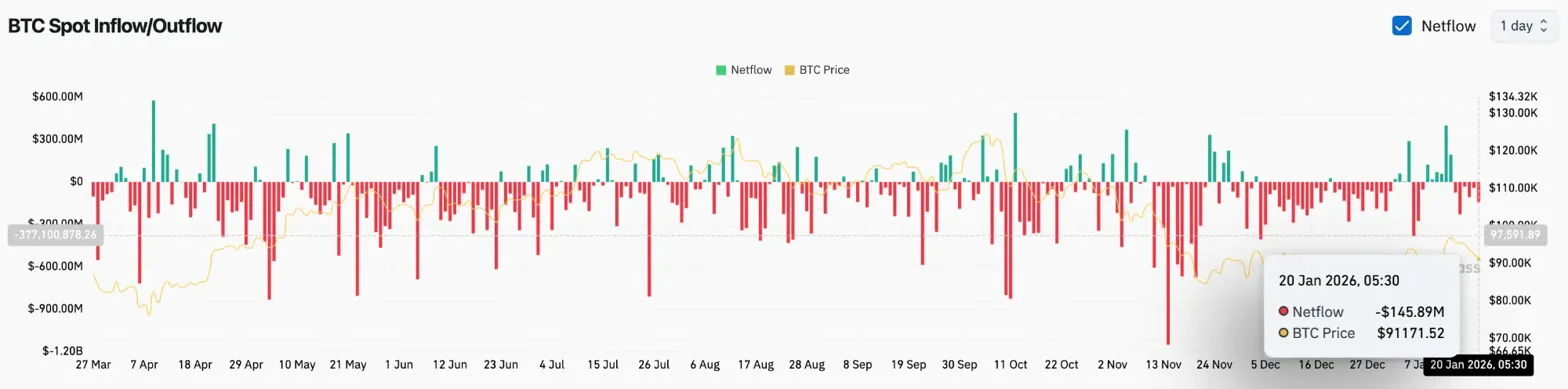

Spot outflow sign distribution

Alternate stream information confirms that holders are transferring cash to exchanges. Coinglass recorded web outflows of $145.89 million on January twentieth, one of many largest single-day distributions in current weeks.

If spot flows flip unfavorable throughout a decline, it is a sign that holders are getting ready to promote relatively than hoard their positions. This dynamic will increase provide to the order e book and will lengthen the correction if patrons fail to soak up the strain.

Associated: Oasis 2026 Worth Prediction: ROFL “Trustless AWS” and Franklin Templeton Pilot Targets $0.04-$0.06

This outflow is in distinction to the buildup sample seen earlier this month, when ETF inflows supported the value above $95,000. This bid has weakened as macro issues outweigh institutional demand.

Longs flush on EMA assist

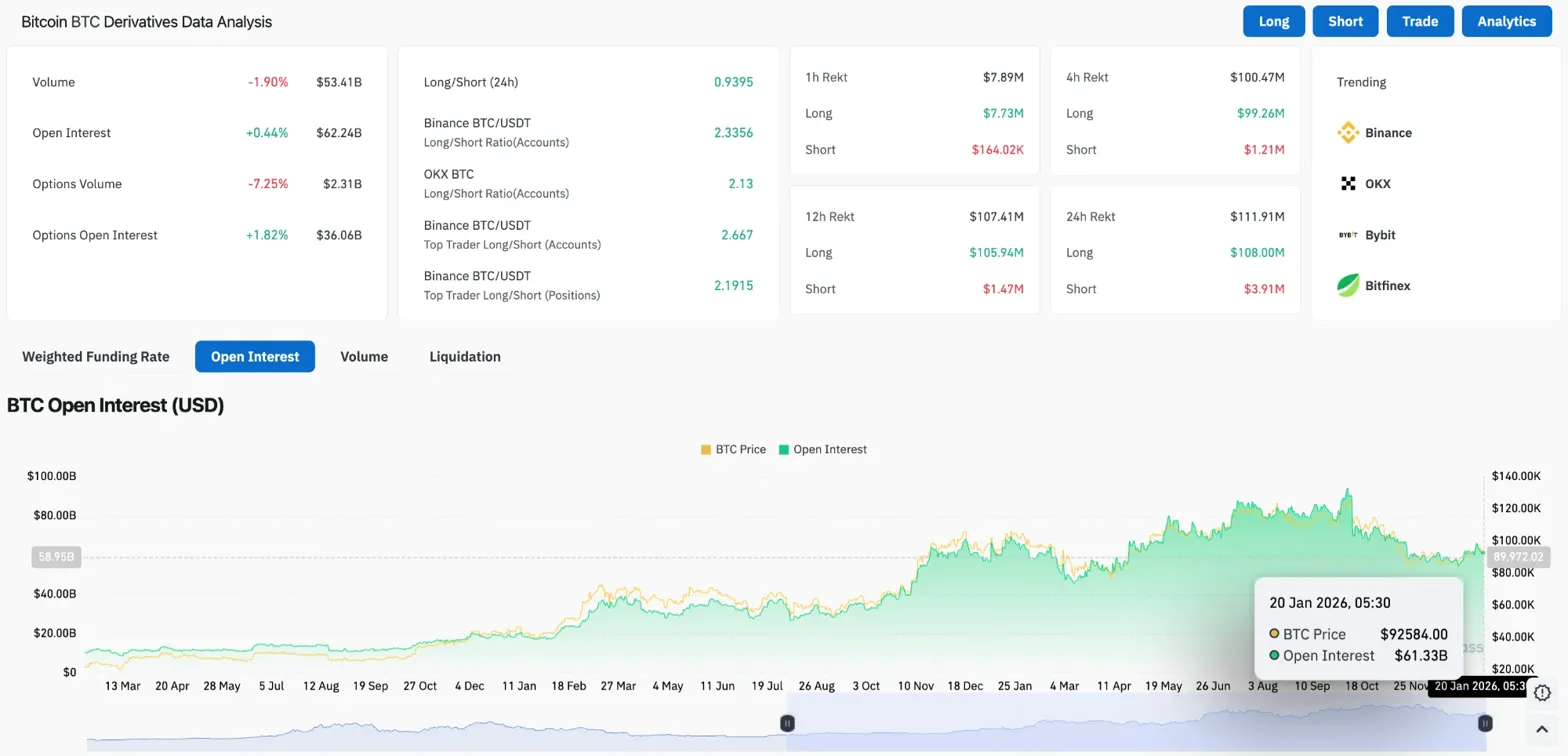

Derivatives markets absorbed important injury. In 24 hours, lengthy positions of $108 million had been liquidated, whereas quick positions had been solely $3.91 million. This 27:1 ratio exhibits how the unilateral positioning was over $92,000.

Open curiosity remained steady at $62.24 billion, up 0.44% regardless of liquidations. The lengthy/quick ratio fell to 0.93, tilting barely in the direction of shorts for the primary time in current weeks. Binance’s prime merchants preserve web lengthy at 2.33, however retail sentiment has turned defensive.

Bitfinex analysts word that promoting strain from long-term holders has eased to round 12,800 BTC per week, down from a cycle peak of over 100,000 BTC. Nonetheless, a dense provide zone between $93,000 and $110,000 continues to restrict the upside from which earlier patrons might search to exit.

Worth falls beneath the 20/50 EMA cluster

On the day by day chart, Bitcoin broke the 20-day EMA at $92,388 and the 50-day EMA at $92,293 in a single session. This cluster has supported costs because the restoration in early January, however its losses shift the short-term construction to a bearish one.

The uptrend channel from December lows round $80,000 stays intact for now. The decrease certain converges with the supertrend assist close to $88,496, forming a confluence zone that the bulls should shield.

Present main stage:

- Rapid resistance: $92,293 to $92,388 (20/50 EMA cluster)

- Key resistance: $95,754 (100 EMA)

- Pattern resistance: $99,258 (200 EMA)

- Channel assist: $88,500 – $89,000

- Supertrend assist: $88,496

- Breakdown objective: $85,000

A detailed beneath $88,496 would bearishly reverse the supertrend, breaking the ascending channel and opening the door for a retest of the December low close to $80,000.

Outlook: Will Bitcoin preserve channel assist?

This setting helps vigilance within the quick time period. Macro headwinds, skinny liquidity, and damaged EMA assist create a tricky setting for bulls. The following take a look at will probably be on Supertrend assist close to $88,500.

- Bullish case: Worth rebounds from $88,500 and retakes the EMA cluster above $92,300. A detailed above $95,000 would point out an finish to the correction and the 200 EMA goal could be $99,258.

- Bearish case: A day by day shut beneath $88,496 would break each the supertrend and channel assist, with a goal of $85,000. A lack of $85,000 reveals a December low of $80,000.

Bitcoin faces important challenges in channel assist. Till tariff headlines stabilize and patrons reclaim the EMA cluster, the rally will probably face resistance from trapped longs on the lookout for an exit.

Associated: Dogecoin Worth Prediction: Doge weakens if assist fails and outflows proceed

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply