- After sellers regain management of the development, ETH’s short-term momentum shifts to a correction.

- With a number of resistance zones capping ETH, a restoration is required to shift momentum again to patrons.

- Bitmine stakes 86.8K ETH, displaying new on-chain power amid weak spot flows.

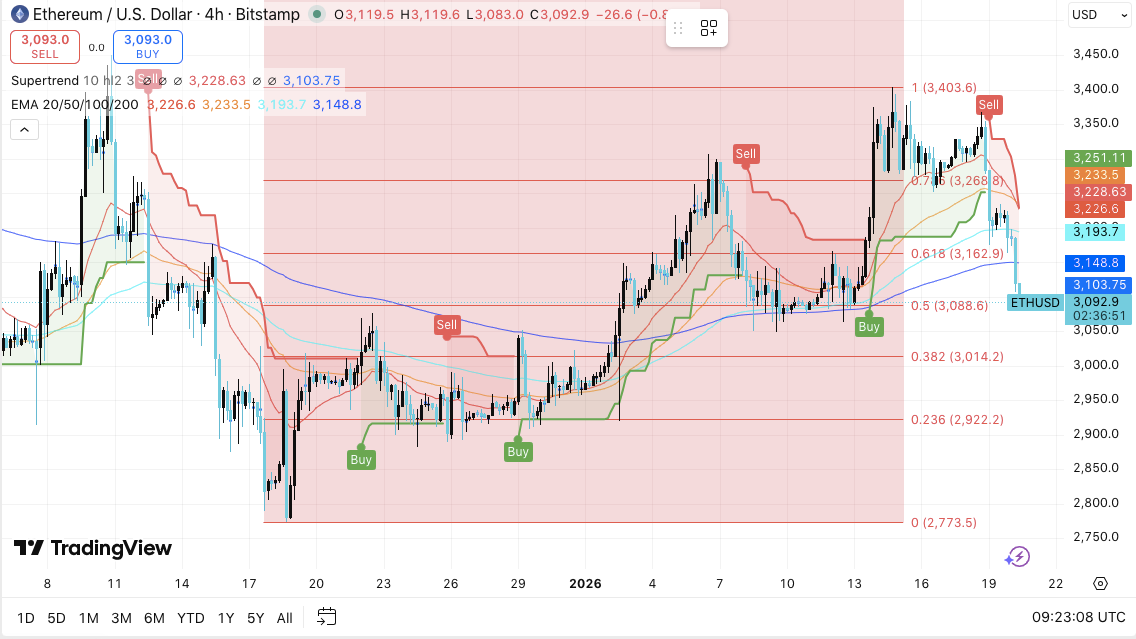

Ethereum traded round $3,093 on the 4-hour chart after a pointy decline from a peak of $3,403 as sellers regained management and pushed the worth beneath key development alerts. Though it retreated after a powerful rally, current strikes counsel short-term momentum has shifted into correction mode.

Along with weakening worth construction, merchants are additionally maintaining a tally of leverage and spot movement tendencies, suggesting market positioning stays cautious. Consequently, ETH is presently at a key determination level the place the bulls must defend the close by assist ranges and regain the overhead resistance to renew the upward continuation.

ETH faces a zone of intense resistance

ETH stays capped beneath $3,163, which coincides with the 0.618 Fibonacci degree and represents the primary upside hurdle. Moreover, a tighter resistance zone exists between $3,227 and $3,233, the place the transferring averages and the supertrend promote sign converge. This cluster is performing as a ceiling and can should be recovered cleanly inside 4 hours for ETH to shift momentum again in favor of patrons.

Moreover, the $3,268 degree marked by the 0.786 Fibonacci zone provides one other barrier after the earlier rejection. An excellent stronger breakout of all three resistance zones could also be wanted to rally in direction of $3,403.

With ETH hovering round the important thing Fibonacci midpoint at $3,088, the significance of draw back ranges has elevated. Due to this fact, this degree serves as an instantaneous line that will decide the subsequent swing. If ETH falls beneath $3,088, the subsequent draw back goal might be round $3,014, adopted by deeper assist at $2,922.

Associated: Shiba Inu Value Prediction: SHIB Merchants Be Cautious as Outflows Proceed to Rise Under Zero

It’s important that $2,922 stands out as a bounce zone based mostly on previous reactions. If promoting strain will increase, the general construction might be fastened on the decrease finish of the vary at $2,773.

Make the most of cool whereas spot movement stays weak

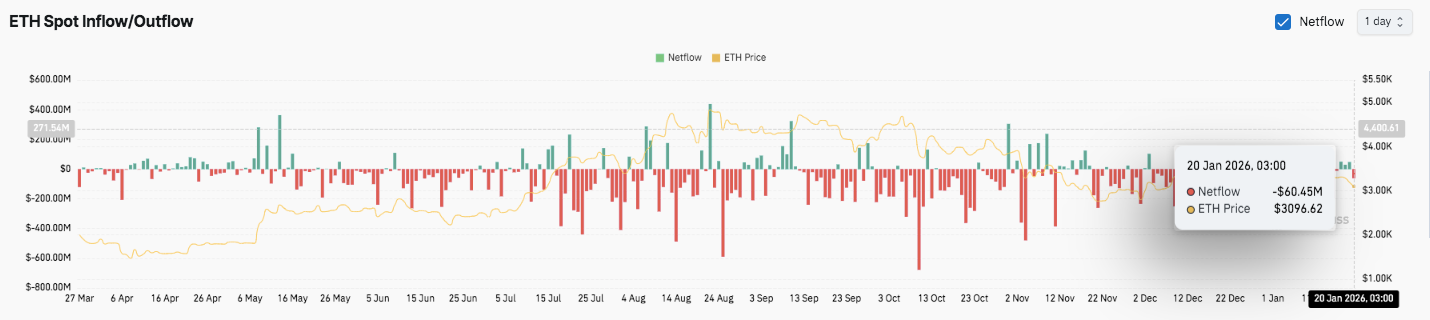

Ethereum futures open curiosity has been on a transparent build-and-reset cycle over the previous yr, rising sharply through the rally after which unwinding. Nevertheless, it’s nonetheless up at roughly $40.31 billion as of January 20, 2026, indicating that merchants nonetheless have important publicity.

Spot movement knowledge has been bearish in current months as a consequence of repeated web outflows and restricted follow-through on inflows. Moreover, current web outflows of practically $60 million counsel that patrons stay unconvinced through the pullback.

Bitmine staking provides new on-chain alerts

Lookonchain reported that Bitmine linked to Tom Lee’s Fundstrat staked a further 86,848 ETH value roughly $277.5 million. Moreover, the whole staking steadiness on Bitmine reached 1,771,936 ETH, with a worth of roughly $5.66 billion. This exercise provides a brand new headline on the chain as ETH checks main assist and merchants are awaiting the subsequent directional break.

Associated: Bitcoin Value Prediction: $108M Lengthy Liquidation Breaks EMA Cluster…

Technical outlook for Ethereum worth

Ethereum trades in a correction part after a powerful rally, so the important thing ranges are nonetheless clearly outlined.

Upside ranges embrace the primary hurdle at $3,163, adopted by a resistance cluster between $3,227 and $3,233. A break above this zone might pave the way in which to $3,268, with $3,403 being the first swing excessive goal.

On the draw back, $3,088 acts as speedy assist. This degree of loss might end result within the subsequent main demand zone being $3,014 after which $2,922. The broader construction stays supported close to $2,773.

Technical situations counsel that ETH is consolidating after dropping momentum, with the worth compressed between Fibonacci assist and transferring common resistance. This setting is usually performed previous to volatility enlargement.

Will Ethereum go up?

Ethereum’s near-term path is dependent upon whether or not patrons can recuperate $3,163 and maintain above the $3,233 cluster. A powerful follow-through might revive the bullish momentum in direction of $3,403.

Nevertheless, if the worth fails to guard at $3,088, there’s a threat of additional draw back strikes in direction of $3,014 and $2,922. For now, ETH stays at a key inflection level, the place affirmation fairly than anticipation will drive the subsequent transfer.

Associated: Oasis 2026 Value Prediction: ROFL “Trustless AWS” and Franklin Templeton Pilot Targets $0.04-$0.06

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply