- After a powerful rally above $2 in early January, XRP has returned to round $1.95.

- On-chain information reveals short-term holders are accumulating whereas high-cost patrons are underneath stress.

- The liquidation heatmap reveals latest lengthy positions being flushed out, lowering short-term draw back threat.

XRP displays the weak spot and is buying and selling underneath stress beneath $2. The decline isn’t restricted to XRP, as most main digital property have fallen into damaging territory in latest buying and selling.

Earlier this month, XRP soared greater than 25% at one level, topping $2, and peaked at almost $2.14 in early January. That rise shortly disappeared. By January nineteenth, the token had fallen to round $1.92, which coincided with round $40 million in liquidations as leveraged positions had been compelled out.

Acquainted market patterns return

Blockchain evaluation agency Glassnode says the present market construction for XRP intently resembles the scenario seen in February 2022. In keeping with the corporate, short-term holders working on a one-week to one-month time-frame accumulate XRP beneath the fee foundation of long-term holders in teams of six to 12 months.

If this sample continues, stress will improve on traders who purchased close to increased ranges. Glassnode beforehand said that the $2 degree carries robust psychological weight for XRP holders. Since early 2025, every retest of $2 has resulted in weekly realized losses of between $500 million and $1.2 billion, demonstrating how delicate merchants are relating to this worth vary.

Why is clearing vital?

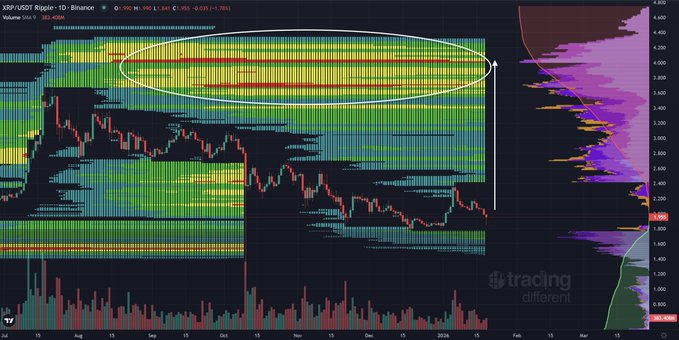

Analysts level to the liquidation heatmap to elucidate latest worth actions. These charts present the place leveraged lengthy and brief positions are concentrated, revealing zones the place compelled buys or sells are more likely to happen if worth strikes into these areas.

Costs typically shortly transfer away from low liquidity zones and towards dense clusters of stops and liquidations. In latest buying and selling, lengthy positions had been unwound as costs fell, relieving short-term downward stress.

Analysts be aware a focus of brief positions at increased costs above present ranges. If the worth rises, these brief positions might face liquidation, doubtlessly spurring extra violent strikes.

ETF flows add one other layer

The newest liquidation occasion comes at the same time as exchange-traded merchandise linked to XRP proceed to draw capital. Since its launch in November 2025, the XRP ETF has recorded internet inflows of over $1.28 billion, with consecutive optimistic inflows and no reported outflows.

Whereas costs stay underneath stress for now, analysts say the mixture of robust demand for ETFs, altering holder conduct and visual liquidity ranges suggests the market continues to be actively repositioning itself moderately than retreating fully.

Associated: XRP defends key assist as merchants look ahead to a $2.06 restoration

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply