- Ethereum fell beneath $3,000 for the primary time in six weeks, breaking beneath the help of the descending channel that had been in place since December.

- Bitmine Immersion purchased 35,268 ETH value $106.2 million final week, bringing its complete holdings to greater than $12.5 billion as establishments collected the drop.

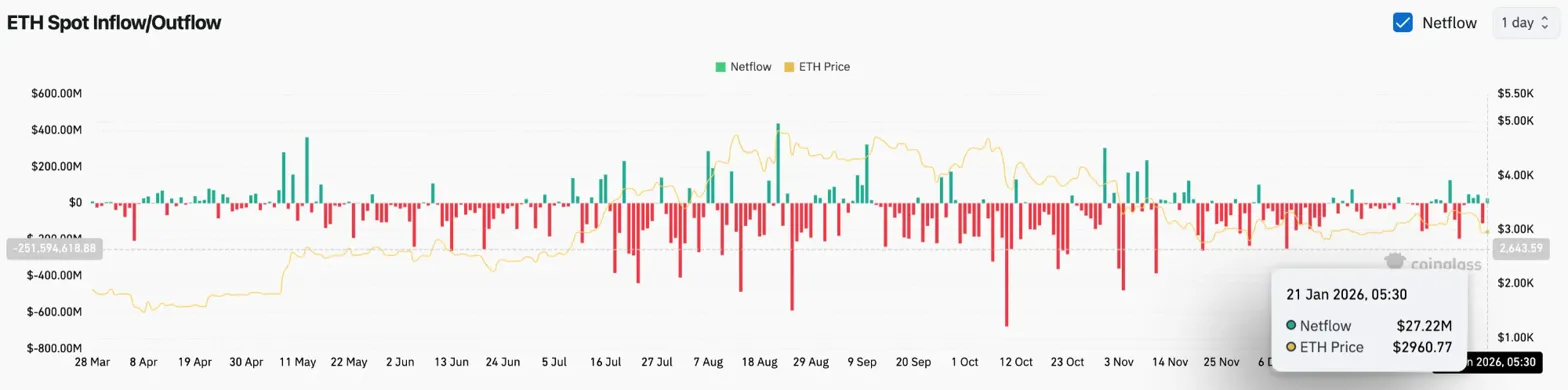

- Inflows into spot buying and selling reached $27.22 million, displaying that patrons are coming in regardless of the 8% decline in two weeks.

Ethereum worth at present broke out of a descending channel that features worth actions since December lows and is buying and selling round $2,957.50. The transfer marked the primary shut beneath $3,000 since early December, and the technical construction turned bearish whilst institutional patrons intervened.

Bitmine buys $106 million throughout crash

Not everybody sells. Bitmine Immersion revealed on Tuesday that it bought 35,268 ETH final week, value $106.2 million at present costs. With this acquisition, the corporate’s complete Ethereum holdings will exceed 4.2 million tokens (value $12.5 billion).

Chairman Tom Lee cited the development within the ETHBTC ratio as a motivation for buying. This indicator has been steadily rising since mid-October, suggesting that Ethereum is gaining relative energy in opposition to Bitcoin regardless of general market weak spot.

Institutional accumulation throughout a crash typically suggests long-term legal convictions. The added publicity of presidency bonds as retail exits creates a possible decrease certain that may help future restoration makes an attempt.

Affirmation of accumulation resulting from spot influx

Change circulation knowledge helps the buying concept. Coinglass recorded web inflows of $27.22 million on January twenty first. Which means that the cash are being moved from an trade to a private pockets slightly than being ready on the market.

Associated: Axie Infinity 2026 Value Prediction: GameFi’s $380M Quantity Surge Indicators Turnaround

The influx follows a sample established earlier this week, when the buildup occurred throughout a broader cryptocurrency selloff linked to tariff issues and geopolitical tensions over Greenland. Costs have fallen 8% prior to now 14 days, however patrons proceed to soak up provide.

This divergence between worth motion knowledge and circulation knowledge creates a possible setup for restoration. Accumulation at decrease costs reduces the availability obtainable on exchanges and might speed up the rally when sentiment adjustments.

Channel breakdown turns construction bearish

On the day by day chart, Ethereum has damaged beneath the decrease certain of the descending channel that was maintained from December to early January. This sample had help close to $3,100, however Monday’s decline didn’t hesitate to interrupt beneath that stage.

Value is presently buying and selling beneath all 4 EMAs, and the hole is widening because the correction drags on. EMA stack displays technical injury.

- Instant resistance: $3,142 to $3,147 (20/50 EMA cluster)

- Key resistance: $3,273 (100 EMA)

- Supertrend resistance: $3,321

- Pattern resistance: $3,328 (200 EMA)

- Present help: $2,900 to $2,920

- Breakdown aim: $2,800

The Supertrend indicator turned bearish at $3,321 and is now almost 12% above the present worth. Recovering to this stage would require a big reversal of momentum.

Intraday momentum reaches oversold excessive

A shorter timeframe signifies the severity of the decline. On the hourly chart, ETH fell from $3,370 to a low of $2,920 in simply three periods. Parabolic SAR is presently buying and selling slightly below its worth at $2,937.73, suggesting that the downtrend could also be pausing in the meanwhile.

Associated: Bitcoin Value Prediction: BTC faces short-term stress after failed breakout

The RSI crashed to 30.39 and entered oversold territory. Readings at this stage typically precede a short-term pullback as promoting stress dries up. Nevertheless, throughout sturdy tendencies, oversold situations can persist earlier than a significant reversal happens.

The $2,900 to $2,920 zone has obtained shopping for curiosity in a number of intraday exams. If this stage might be maintained, it can affirm that accumulation is laying the foundations. Shedding it opens the door to $2,800.

Outlook: Will institutional purchases help costs?

This setup creates a battle between technical weaknesses and elementary strengths. Charts are displaying promote and monetary establishments are displaying purchase. Options come when one overpowers the opposite.

- Bullish case: Value holds the $2,900 help and collects $3,000. Sustained institutional accumulation will gasoline a restoration in direction of the 20EMA of $3,142.

- Bearish case: If the closing worth for the day is beneath $2,900, the breakdown can be confirmed and the goal can be $2,800. A lack of $2,800 reveals the November low close to $2,600.

Ethereum is out of help and going through a legal trial. Institutional shopping for suggests there may be worth within the push, however bulls want to shut above $3,000 for the construction to stabilize.

Associated: Cardano Value Prediction: ADA faces new pressures as outflows decline however construction stays weak

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply