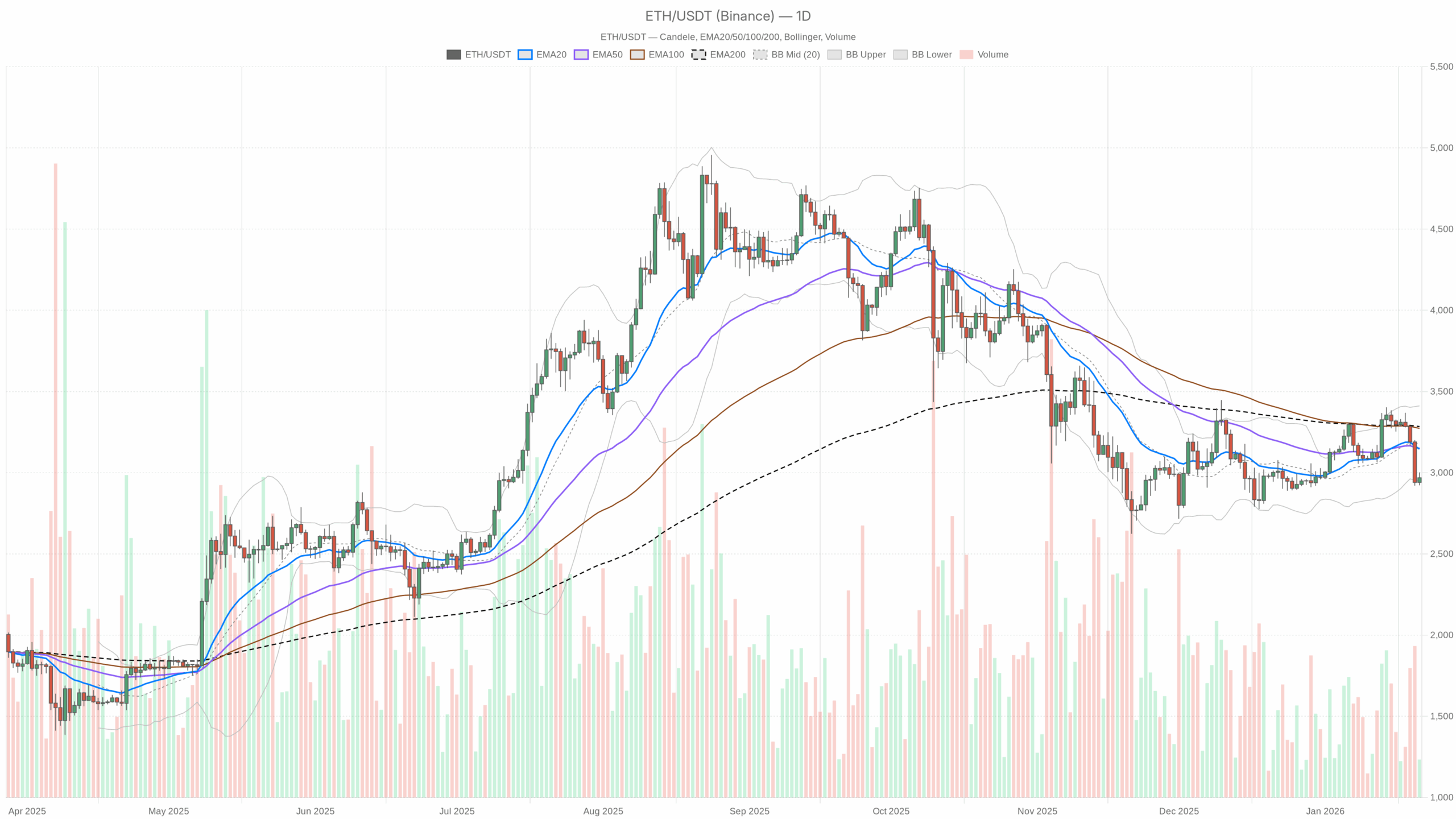

ETH continues to be buying and selling defensively and Ethereum worth is steady. $2,970anchored close to the underside of the Bollinger Bands on the every day chart, and under all main transferring averages.

Predominant situation on every day chart: Nonetheless bearish however approaching choice level

of every day timeframe clearly bearish for ETHUSDT Then outline the principle situation. This isn’t a balanced market. Sellers have the higher hand, and push shopping for is simply starting to seem throughout the day.

Day by day development and EMA

worth: $2,968.65

EMA20: $3,145.61 | EMA50: $3,149.67 | EMA200: $3,284.50

Worth is decisively under the 20-day, 50-day, and 200-day EMAs, and these brief EMAs have rolled over under the 200-day. This can be a typical downtrend construction. That’s, the rally shouldn’t be continued and is offered.

Human learn: So long as ETH is roughly under $3,150 to $3,200the market is treating the pullback as a chance to scale back threat reasonably than the beginning of a brand new bullish transfer.

every day RSI

Day by day RSI(14): 39.87

Though the RSI is under 50, it’s not oversold but. Though the momentum is damaging, it’s not a give up.

Human learn: The bears are in management, however that is extra of a low grind than a flush. There may be nonetheless room for an additional drop earlier than the everyday oversold depletion units in.

Day by day MACD

MACD line: 13.37 |Sign: 42.70 |Histogram: -29.33

The MACD line is under the sign and reveals a damaging histogram. The unfold is noticeable, however not but improved.

Human learn: The downward momentum stays lively. There may be nonetheless no clear signal that the promoting wave has come full circle, however it has gotten in far sufficient that we begin to look ahead to momentum to decelerate within the subsequent session.

every day bollinger bands

Center band: $3,178.86

Higher band: $3,411.44 |Backside band: $2,946.28

shut: $2,968.65 (simply above the underside band)

ETH is hugging the decrease band after transferring down from the midline.

Human learn: Worth is inside a decrease volatility envelope, which regularly means two issues directly. The downtrend is legitimate and we’re coming into a zone the place a mean-reverting bounce is extra prone to happen in a short while body. The larger query is whether or not these bounces can get the midband again. $3,180;till that occurs, it is only a reduction rally in a downtrend.

Day by day ATR (volatility)

ATR(14) Day by day: $115.21

Day-to-day real-world volatility has elevated, however has not reached panic ranges.

Human learn: typical every day swing $100-120 This implies a 3-4% shift in both route is totally regular. Place sizing should take that into consideration or tight cease placements close to apparent ranges may be shaken out.

every day pivot stage

Pivot level (PP): $2,964.18

R1: $3,006.47 | S1: $2,926.36

After exploring close to the decrease sure of the Bollinger Band, the value is buying and selling nearly precisely on the every day pivot.

Human learn: The market is at an intraday choice stage. Holding above the pivot favors a short-term rebound. $3,000 to $3,010throughout a steady break under $2,930 A continuation to new lows begins inside the every day downtrend.

Market Situations: Danger-off, BTC-favorable setting

The market capitalization of digital currencies is roughly 3.10 trillion {dollars}roughly under 2.1% Inside 24 hours, 24 hour quantity ends 32%. That is the kind of mixture seen throughout the threat aversion section, the place exercise spikes whereas costs fall.

Bitcoin The benefit is close by 57.5%ETH’s market capitalization share is roughly 11.5%. Merely put, capital takes precedence. Bitcoin Relating to Ethereum and altcoins. When mixed with excessive concern Studying (24), the general image is defensive as merchants cut back beta and search perceived security.

On-chain DeFi Actions (Uniswap, Curve, and so forth.) have excessive charges. Nonetheless, on this macrotape, the rise in DEX exercise is extra prone to be pushed by hedging, stablecoin rotation, and volatility buying and selling than by a clear risk-on rotation into ETH.

Decrease timeframe: Intraday bounce inside a bigger downtrend

First half chart: weak however steady development

worth: $2,968.64

EMA20: $2,993.12 | EMA50: $3,070.71 | EMA200: $3,183.79

RSI(14): 35.25

MACD line: -35.13 |Sign: -41.94 |Histogram: +6.81

Bollinger Mid: $2,976.64 |Higher: $3,014.69 |Decrease: $2,938.60

ATR(14): $25.12

Pivot PP: $2,965.92 | R1: $2,971.79 | S1: $2,962.76

Within the first half, ETH continues to be in a downtrend, with the value under all EMAs, however the very short-term momentum is altering. RSI is within the 30s, weak however not light. However, the MACD histogram has flipped to optimistic although each traces stay under zero.

Human learn: The vendor is dropping some momentum throughout the day, however nonetheless owns the construction. There’s a risk of a rebound in direction of the EMA for the primary half of 2020 $2,990 – $3,000 For now, that is only a take a look at of resistance except ETH can truly sit on prime of it.

Worth is transferring across the time pivot $2,965 – $2,972 and round ATR $25short-term scalp may be simply seen. $25-$50 Swing with out altering the massive image. On prime of that $3,015 (higher 1H band) signifies a extra significant intraday squeeze, whereas under $2,940 Reconfirming bearish management.

15m Chart: Microbalance in a bearish regime

worth: $2,968.64

EMA20: $2,968.94 | EMA50: $2,978.27 | EMA200: $3,075.03

RSI(14): 48.63

MACD line: -2.94 |Sign: -3.17 |Histogram: +0.23

Bollinger Mid: $2,968.86 |Higher: $2,982.84 |Decrease: $2,954.89

ATR(14): $8.48

Pivot PP: $2,968.33 | R1: $2,969.38 | S1: $2,967.60

The 15-minute chart is sort of flat across the 20 EMA and the center of the Bollinger Bands, the RSI is near 50, and the MACD histogram is barely optimistic.

Human learn: Within the very brief time period, the market is catching its breath. Though the microstructure is impartial, it’s bearish on the hourly and every day timeframes. This usually favors fading out reasonably than chasing sharp spikes except a transparent breakout emerges by way of a better timeframe stage.

Click on right here for Ethereum worth situation

Bullish situation: imply reversion and brief protecting

To realize a reputable bullish development, ETH wants to show this short-term stabilization right into a sustained restoration in direction of the every day midrange.

The bullish continuation appears like this:

- in 15m / 1 hourthe value stays above the time pivot neighborhood. $2,965 and begins to shut above the 1H 2020 EMA $2,990 – $3,000.

- The RSI for the primary half of the yr is again above 50 and the MACD crosses that sign and shows an growing optimistic histogram.

- This offers us extra room for the 1H Bollinger Bands and 1H EMA50. $3,050 to $3,100 space.

- in dailyAfter that, ETH must assault close to the Bollinger midline. $3,180. A restoration of this stage and a every day shut above it will be the primary actual argument that the downtrend is transferring right into a broader vary.

Main bullish set off zones: Continued break and every day closing costs are above approx. $3,150 to $3,200 (20/50 day EMA). That might point out that sellers are dropping grip on the medium-term development and that this transfer is a correctional pullback reasonably than the beginning of a deeper bearish section.

What invalidates the bullish case: If ETH can’t be maintained past the higher restrict, $2,930 area and begin closing every day candles at or under the Bollinger Bands (Lower than $2,950) Because the RSI slides in direction of the low 30s, the story shifts from imply reversion to continuation of momentum, pushing the bullish situation additional out over time.

Bearish situation: development continuation and attainable acceleration

The bears are already accountable for the upper time frames. The query is whether or not they can flip this into one other impulsive bearish transfer as an alternative of basing the market on it.

The bearish continuation appears like this:

- in 15m / 1 hourattempt to get it again $3,000 has been repeatedly rejected and costs are caught under the 2020 H1 EMA.

- The hourly RSI stays under 45 and after this brief pause, the MACD histogram returns to damaging.

- Decisive transfer under $2,930 (close to S1, simply contained in the every day decrease band) triggers a cease and brings in a brand new development follower.

- The every day RSI is climbing towards the low 30s, whereas the MACD is transferring additional into damaging territory, indicating that momentum is reaccelerating reasonably than slowing down.

From there, draw back targets will come from volatility reasonably than from clear horizontal ranges. Round every day ATR $115a continuation leg can simply discover one other leg 100-150 {dollars} Important financial savings may be achieved in a single session with none structural modifications.

Predominant bearish confirmations: A number of every day closing costs exist under the pivot space $2,960 Persistent buying and selling close to or under the decrease sure of the Bollinger Bands. In that setting, any small intraday bounce is suspect and prone to lead to a sell-off.

What invalidates the bearish case: If consumers can push the every day closing worth again up $3,150 to $3,200 (20/50 day EMA) and if it holds, the present bearish regime on the every day chart might be in severe doubt. If the every day RSI returns above 50 in parallel with this transfer, it can affirm that the downtrend has at the very least moved right into a broader vary, if not the start levels of a brand new uptrend.

How ought to we take into consideration positioning primarily based on this Ethereum worth vary?

All three time frames agree on one factor. weak authorities. The disagreement is about pacing. The every day and hourly charts present a transparent downtrend, however the 15m solely marks a time close to the native pivot. This can be a frequent phenomenon close to inflection factors, when the market is deciding whether or not to show a pause right into a reversal or only a decline.

towards the background excessive concern BTC’s robust dominance and ETH’s aggressive lengthy publicity is a wager on the present macro temper. It might work, however it depends on imply reversion and brief protecting reasonably than a clear risk-on rotation into ETH. Conversely, shorts are buying and selling in step with the development, however with elevated volatility late within the transfer, growing the chance of a powerful squeeze day.

Regardless of the bias, the chance ought to at the very least be adjusted to account for every day variation. 3-4%. Merchants must be clear on which period body they’re buying and selling. A 15 meter bounce can appear spectacular although it has nothing to do with the every day downtrend. The principle battlefield ranges in the meanwhile are roughly as follows: $2,930 The draw back and $3,150 to $3,200 upwards. Motion round these zones can inform us whether or not ETH is establishing for an additional low or a broader consolidation.

If you wish to monitor the market utilizing skilled charting instruments and real-time information, you possibly can open an account at: make investments Utilizing companion hyperlinks:

Open an Investing.com account

This part comprises sponsored affiliate hyperlinks. We might earn commissions at no extra value to you.

This text is market commentary and is for informational functions solely. This isn’t funding, buying and selling or monetary recommendation and shouldn’t be handled as a suggestion to purchase or promote any property. Cryptoassets are extremely unstable and may end up in full lack of principal. All the time do your individual analysis and consider your threat tolerance earlier than making any buying and selling choices.

Leave a Reply