- River stays bullish general as worth maintains upward channel regardless of provide denial

- Failure to get better $39.98 dangers additional decline into the $32 FIB help zone space

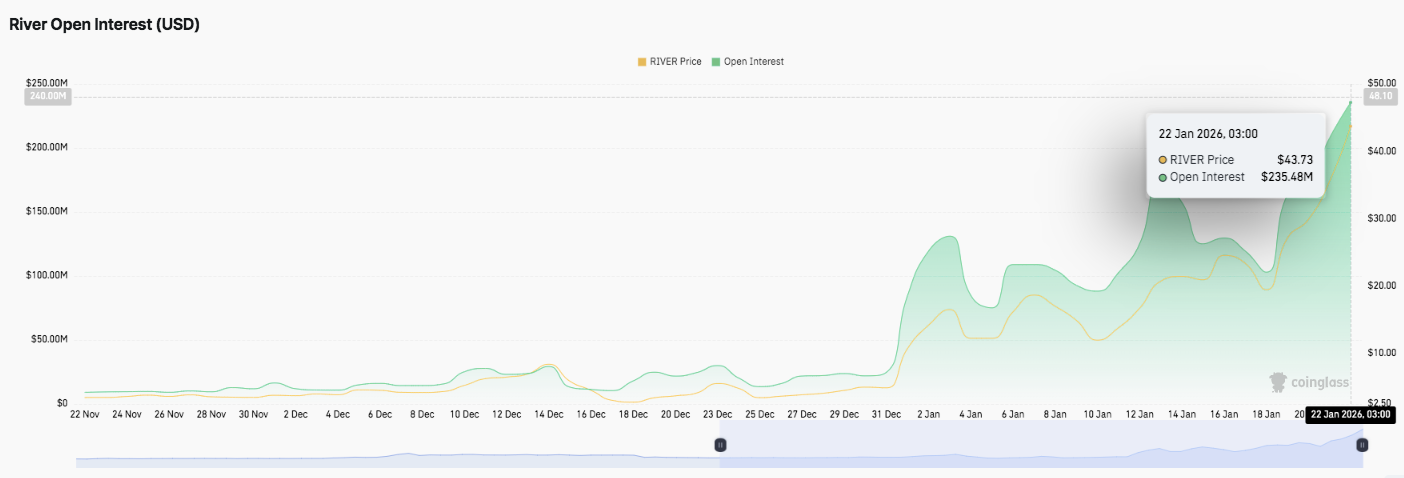

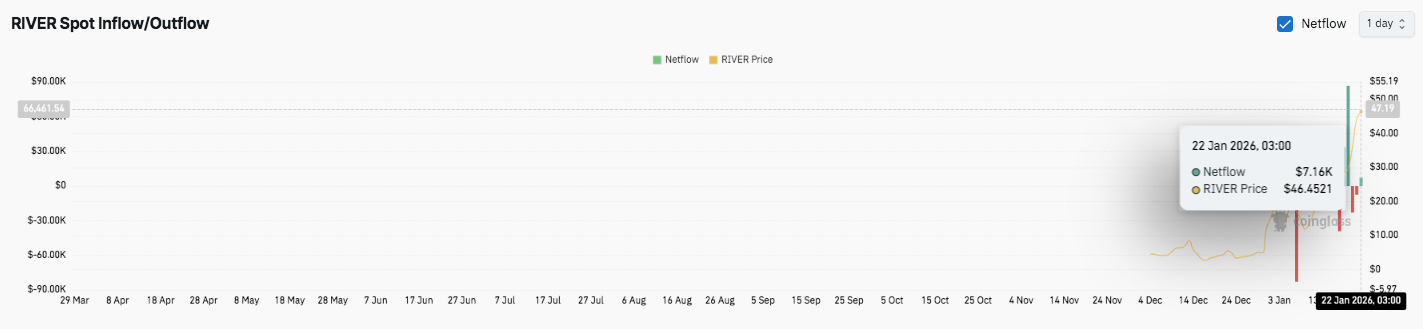

- Open curiosity and spot circulation affirm lively buying and selling and fast place rotation

RIVER stays one of many best-performing shares on the 4-hour chart, even after a pointy pullback from latest highs. The token remained inside the worth ascending channel, indicating that consumers have been nonetheless in charge of the broader motion.

Nevertheless, the value pattern was centered on promoting across the provide zone between $46 and $50, and the newest candlestick confirmed fast revenue taking on the high. Merchants are actually centered on whether or not the river can maintain key helps and reset additional upwards.

RIVER withdraws after provide check

The river not too long ago rose to the $46.70-$50.10 resistance zone, which was additionally the newest peak space. The transfer confirmed sturdy momentum, however the rejection highlighted provide pressures. Moreover, to get better the bullish continuation, the value must cleanly regain the $39.98 degree close to the Fib 0.786 zone.

So long as the value stays above the short-term shifting common, the uptrend might be maintained. Subsequently, the subsequent session may decide whether or not this pullback stays wholesome or turns right into a deeper correction.

Rapid help is situated close to $37.83, in line with the 20 EMA and the short-term pattern line. If the promoting continues, the subsequent buffer might be across the 50 EMA at $36.29. Moreover, the Fib 0.618 degree at $32.03 represents main structural help. A break under $32 may trigger a lack of momentum.

Associated: Seeker (SKR) Value Prediction 2026: Can Solana’s Cellular Token Problem Apple and Google?

Under that, the Fib 0.5 degree at $26.45 and the EMA 100 at $24.78 kind a average demand zone. Subsequently, if strain builds, these ranges may entice bullish shopping for. Deeper help contains the Fib 0.382 at $20.87 and the EMA 200 at $18.49. A drop into that vary would point out a a lot weaker pattern.

Open Curiosity and Spot Move Present Excessive Exercise

RIVER’s open curiosity has expanded quickly since late December, demonstrating the energy of speculative participation. In early January, the numbers rose however have been risky, suggesting lively place rotation. Moreover, open curiosity not too long ago reached a brand new peak of almost $235 million, coinciding with a big acceleration in worth.

After a number of months of quiet buying and selling, spot circulation exercise has additionally turn out to be extra lively. Late December and early January noticed giant outflows, typically indicating the motion of tokens from exchanges. Nevertheless, through the rally, inflows immediately returned, suggesting a resurgence in deposits. On January 22, 2026, netflow turned constructive round $7.16,000 as RIVER traded round $46.45.

Technical outlook for RIVER worth

Even after RIVER’s sturdy 4-hour uptrend and up to date pullback from the $46-$50 provide zone, key ranges stay clear.

- Prime degree: $39.98 (Fib 0.786) is the primary degree that the bulls should get better, adopted by $46.70 and $50.10 as main resistance ceilings. A break above $46.70 may resume momentum towards $50.

- Cheaper price degree: $37.83 (EMA 20) and $36.29 (EMA 50) are the primary pattern helps to defend. If the value falls by $32.03 (Fib 0.618), the construction weakens after which exposes $26.45 and $24.78.

Will the river rise?

RIVER’s course is dependent upon holding between $37 and $36 and rapidly regaining $39.98. A big improve in open curiosity helps bullish conviction, however leverage additionally will increase the danger of a pullback. If consumers fail to defend $32, momentum may rapidly flip bearish.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply