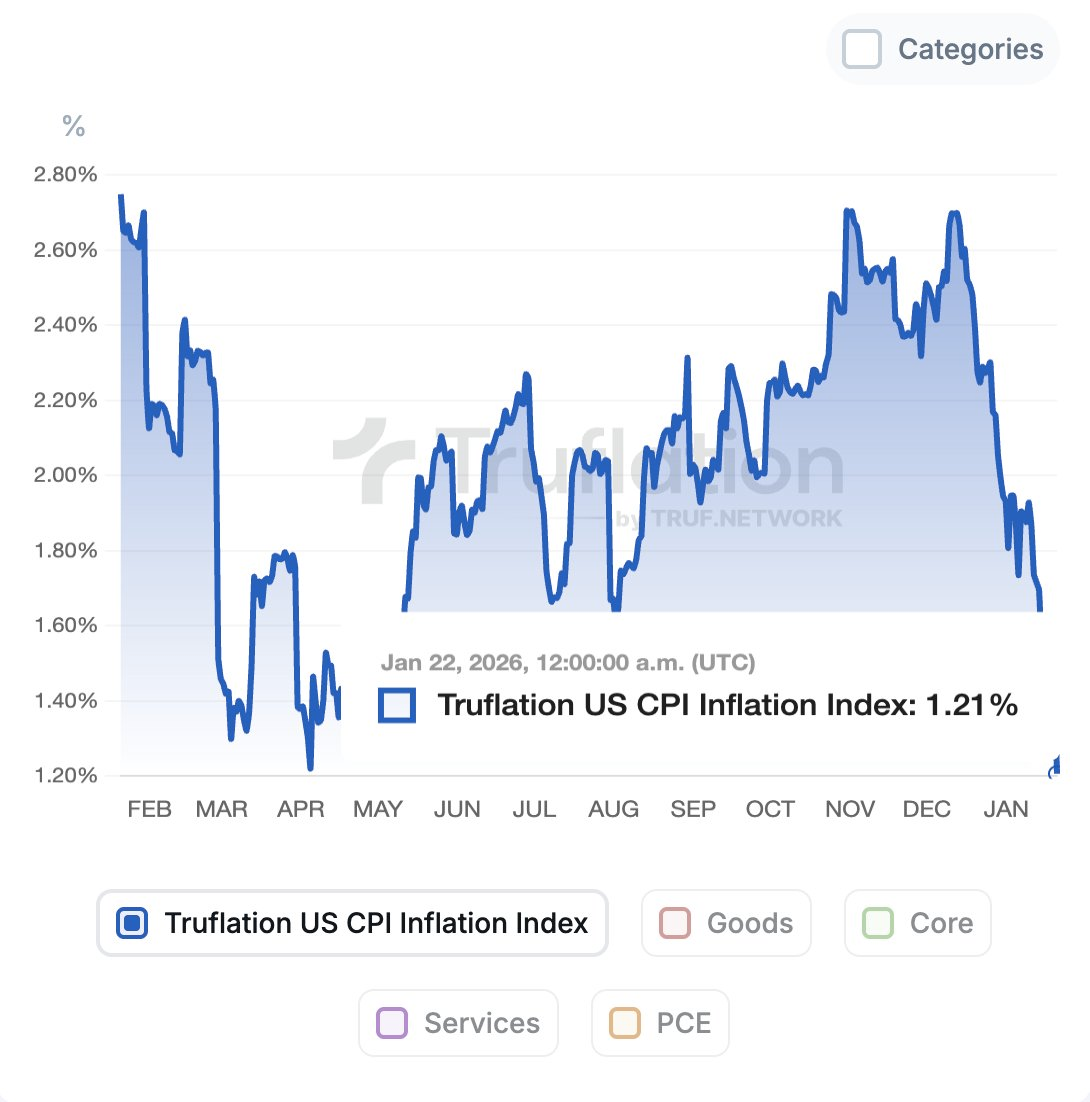

- Inflation fell to 1.21%, indicating cheaper price pressures into 2026.

- Shares rebounded after the US lifted Greenland-related tariffs.

- Supreme Court docket raises issues about Fed independence amid governance debate.

Based on the Truflation U.S. Shopper Value Index (CPI) inflation index, the U.S. inflation charge has fallen to 1.21% as of January 22, 2026, indicating a decline in value progress towards the start of 2026. The actual-time index has tracked unstable inflation tendencies all through 2025, with a number of spikes and pullbacks earlier than the most recent drop.

The figures got here as U.S. shares rallied amid the repeal of tariffs associated to tensions over Greenland, reversing latest market declines and easing stress throughout shares, bonds and currencies.

The torflation index reveals that the inflation charge was above 2.6% firstly of the monitoring interval, however fell under 1.5% round March-April. Mid-year knowledge displays a restoration, with inflation fluctuating between about 1.6% and a pair of.3%.

Inflation pressures elevated in the direction of the top of 2025, reaching practically 2.7% in November and December. The latest decline in January suggests value momentum is cooling heading into 2026, and the index collects real-time value knowledge throughout a number of product and repair classes.

Inventory costs rebound after tariff elimination and Greenland Settlement framework

U.S. shares rose after President Donald Trump mentioned he wouldn’t impose tariffs scheduled for Feb. 1 beneath the framework of a future settlement involving Greenland and the Arctic area.

The Dow Jones Industrial Common rose 588.64 factors, or 1.21%, to 49,007.23, the S&P 500 rose 1.16% to six,875.62, and the Nasdaq Composite Index rose 1.18% to 23,224.82. Regardless of the beneficial properties, all three indexes continued to say no this week, with the Dow down 0.6%, the S&P 500 down 0.9% and the Nasdaq down 1.2%.

Current “Promote America” commerce has been rolled again in response to the repeal of tariffs. US bond costs rose and yields fell. Know-how shares like Nvidia and AMD led the beneficial properties as buyers returned to progress shares.

Coverage and authorized developments

Markets tumbled earlier this week on rising threats of tariffs and uncertainty over attainable navy motion associated to Greenland.

Individually, Supreme Court docket justices questioned whether or not the president had the facility to fireside Federal Reserve President Lisa Prepare dinner, with Justice Brett Kavanaugh saying such energy might weaken the Fed’s independence.

Associated:Subsequent U.S. Shopper Value Index (CPI) report will take a look at expectations for Fed charge cuts following robust jobs report

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply