- Bitwise has partnered with Proficio Capital to launch a brand new ETF known as BPRO.

- BPRO trades on the NYSE and supplies buyers with an environment friendly instrument to guard towards foreign money declines.

- BPRO will maintain at the very least 25% in gold, with the remainder break up between Bitcoin and different metals.

Bitwise Asset Administration, in partnership with Proficio Capital Companions, has launched the Bitwise Proficio Foreign money Improvement ETF (NYSE: BPRO). BPRO is touted because the lacking instrument in fashionable portfolio administration as a result of it helps buyers fight the infinite and quickly rising international cash provide.

Bitwise and Proficio Capital launch BPRO to combat inflation

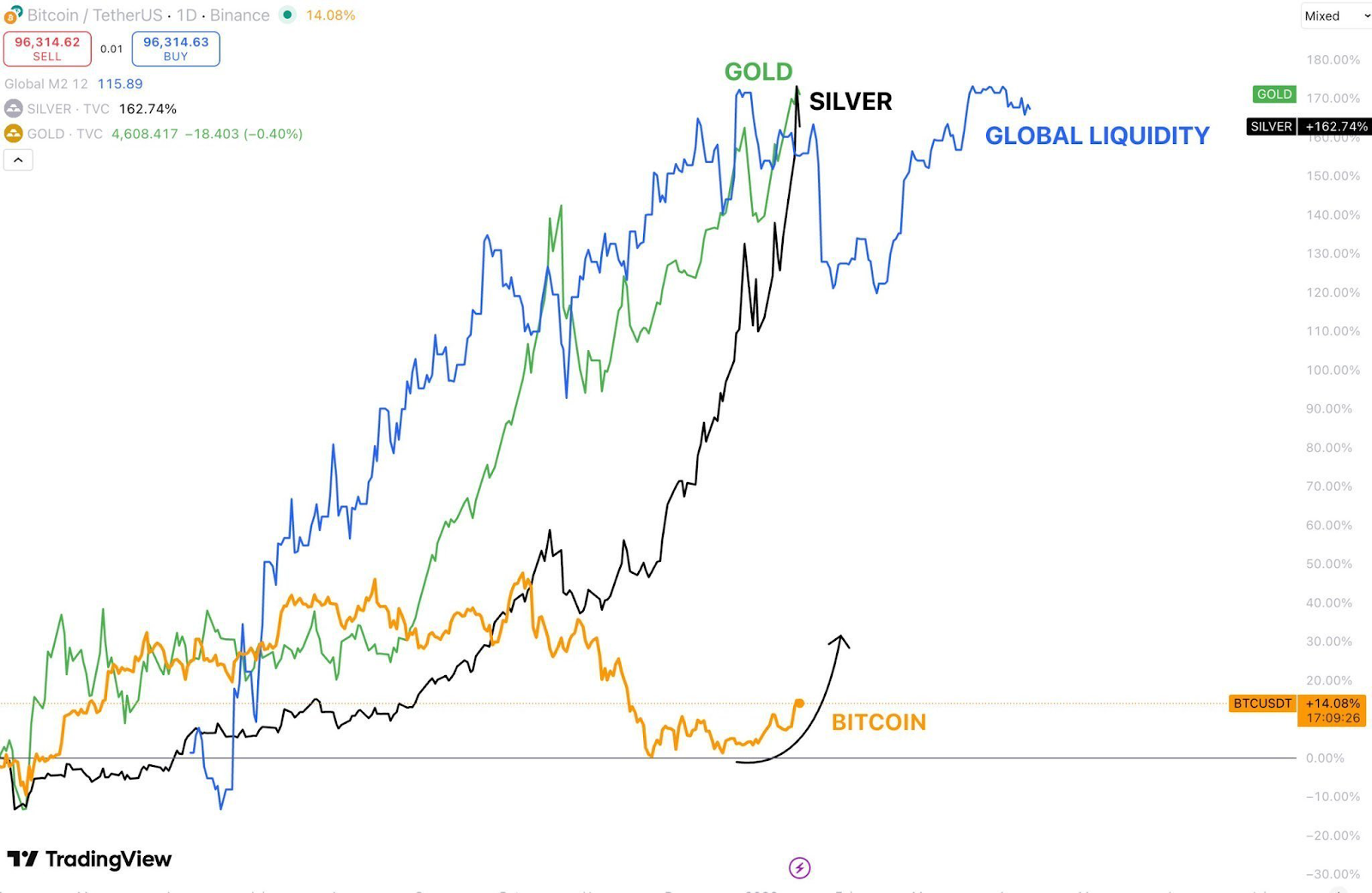

In line with the announcement, the BPRO ETF is a confirmed basket of exhausting belongings. Moreover, the businesses intend to assist buyers counter the decline within the buying energy of fiat currencies with the assistance of Bitcoin (BTC), gold (XAU), silver (XAG), treasured metals, and mining shares.

Bitwise Chief Funding Officer Matt Hogan mentioned BPRO will play an vital function in wealth safety. Moreover, buyers have relied on shares and bonds to counter foreign money depreciation, however this has failed in recent times as a result of speedy enhance within the international cash provide.

“By combining the historic shortage of gold with the fashionable digital shortage of Bitcoin, BPRO supplies a strong new strategy to hedge towards sustained declines in fiat currencies. We consider this ‘exhausting asset’ strategy is the lacking piece in fashionable portfolios,” Hogan mentioned.

To make sure BPRO’s long-term prosperity, Bitwise introduced that it’ll actively handle BPRO to regulate its holdings in keeping with market circumstances. In line with Bob Haber, CIO of Proficio, BPRO will drive mainstream adoption of gold by way of tokenization, as this monetary product stays a ghost in fashionable portfolios.

“BPRO represents an evolution of our wealth preservation mission, shifting between treasured metals and digital storage of worth to offer a versatile protect,” mentioned Haber.

What’s the larger market image?

BPRO strives to take a position a minimal of 25% in gold at any time. Holders of the BPRO ETF can have the remaining 75% publicity to different treasured metals along with Bitcoin.

As international demand for treasured metals and Bitcoin will increase, BPRO is well-positioned to guard buyers’ wealth. Notably, the worth of gold has greater than doubled previously two years, buying and selling at round $4,946 per ounce on the time of writing.

Equally, the worth of silver has greater than doubled previously two years, getting into a parabolic bull part. Prior to now 24 hours, the worth of silver has surged 2.6% and was buying and selling at round $98.66 per ounce at press time.

In the meantime, Bitcoin costs are lagging behind a bull market led by treasured metals as international cash provide continues to develop.

Associated: Gold reaches all-time highs whereas Bitcoin lags behind in safe-haven debate

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply