- ETH stays under Ichimoku resistance as robust ADX confirms sellers are controlling momentum

- Derivatives and spot flows present disciplined leverage for sellers to diversify into rallies

- Vitalik’s ETH allocation helps long-term improvement regardless of short-term worth weak point

Ethereum continues to commerce underneath seen short-term stress, with technical indicators, derivatives information, and spot flows indicating a cautious posture out there. On the 4-hour chart, ETH/USD stays structurally weak after shedding a significant Fibonacci assist stage. Along with chart indicators, latest disclosures from Ethereum management have added one other layer of market focus.

Bearish construction defines short-term worth motion

Ethereum is buying and selling firmly under the Ichimoku cloud, confirming that the bearish momentum continues. The Tenka Line and the Reference Line are trending downward and proceed to suppress any upward motion makes an attempt. Due to this fact, any pullback faces fast promoting stress quite than sustained follow-through.

Speedy assist is positioned close to $2,682, in step with a significant Fibonacci base. A break under this stage may expose the $2,600 to $2,550 demand zone. On the upside, ETH must recuperate $2,852 to stabilize the value motion.

Furthermore, a break above $2,957 would assist neutralize promoting stress. Nonetheless, the $3,042 to $3,128 zone stays a key reversal space for a broader bullish shift.

Directional indicators additionally affirm the bearish bias. ADX continues to rise above 30, indicating the energy of the pattern. As well as, the unfavorable directional index exceeds the constructive index, confirming the vendor’s benefit.

Derivatives and spot information reflecting threat administration

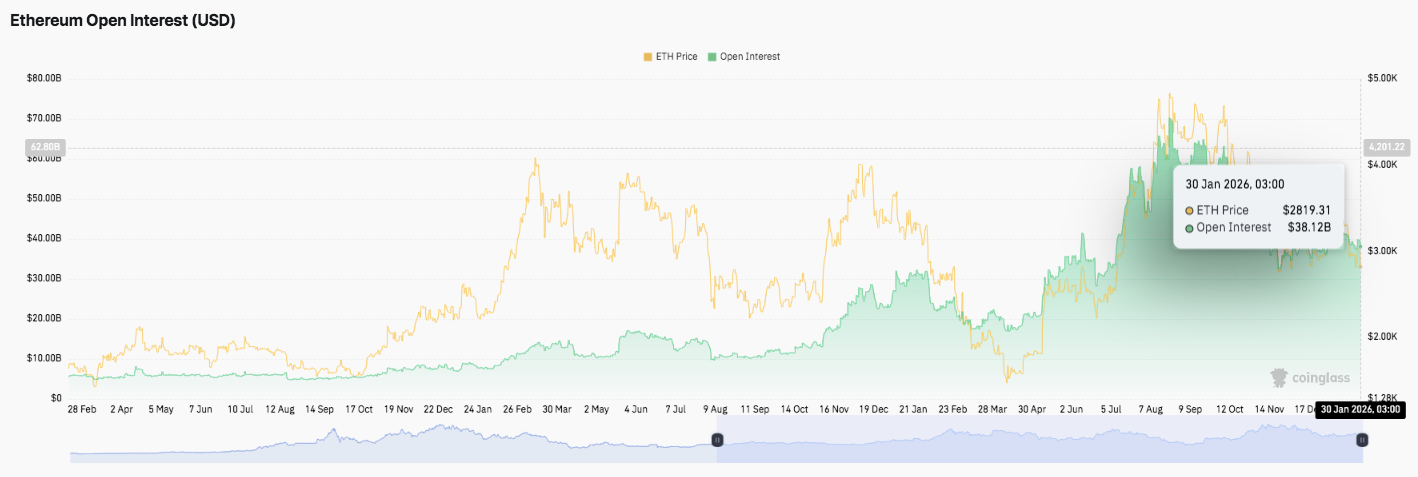

Ethereum open curiosity reveals an growth and reset sample that highlights adjustments in leverage demand. Open curiosity rose amid a robust rebound, reflecting aggressive lengthy positions.

Nonetheless, a interval of instability was adopted by a pointy decline, indicating a liquidation quite than a secure distribution. Notably, open curiosity is at the moment secure at practically $38 billion, suggesting that merchants stay lively however extra disciplined.

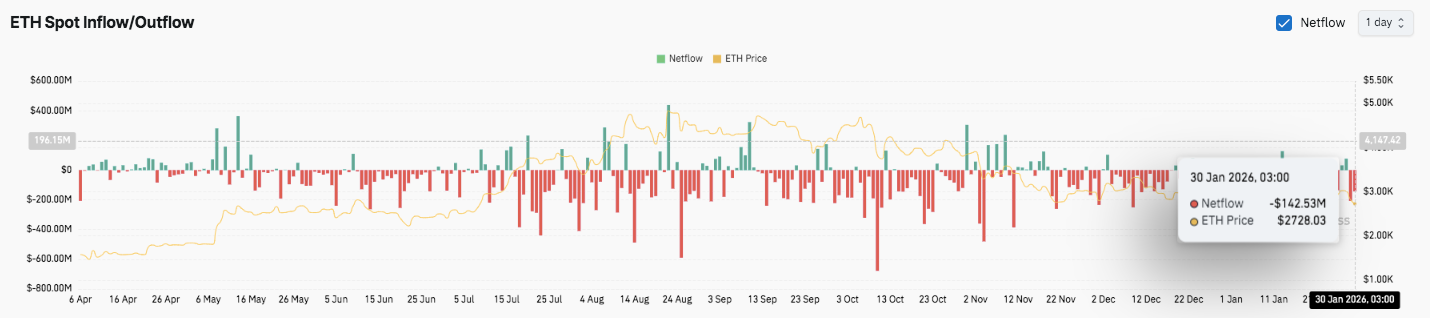

Spot stream information reinforces this cautious stance. In latest months, internet outflows have dominated, with spikes exceeding $400 million in a number of instances. Inflows seem throughout short-term rebounds however can’t be sustained. Consequently, massive holders look like promoting on energy quite than actively accumulating belongings.

Improvement spending provides long-term context

Over the subsequent 5 years, the Ethereum Basis will enter a interval of delicate fiscal austerity that can permit it to realize two targets concurrently:

1. Delivering an aggressive roadmap that secures Ethereum’s place because the world’s pc with uncompromising efficiency and scalability…

— vitalik.eth (@VitalikButerin) January 30, 2026

Amid market uncertainty, Ethereum co-founder Vitalik Buterin revealed plans to allocate 16,384 ETH, value practically $43 million, to ecosystem improvement. He outlined a technique targeted on full-stack openness, safety, and verifiability. Moreover, the Ethereum Basis has entered a section of tightening spending to maintain long-term scaling efforts.

Ethereum (ETH) technical outlook: Proceed to deal with key ranges heading into February

Ethereum’s worth construction stays underneath short-term stress, with key ranges clearly outlined as elevated volatility.

On the upside, $2,850 and $2,957 stand out as fast hurdles. A sustained break above this zone may open the door to $3,040 and the broader $3,120 resistance band that marks pattern reversal territory. Nonetheless, sellers proceed to aggressively defend these requirements.

On the draw back, $2,682 stays an essential assist to observe. If it falls under this stage, ETH could possibly be uncovered to the $2,600-$2,550 demand zone. The broader construction nonetheless displays falling highs and weak momentum, persevering with to right the bull marketplace for now.

Will Ethereum go up?

Ethereum’s near-term course will rely upon whether or not consumers can confidently defend $2,682 and recuperate $2,957. Compression under resistance indicators extra volatility forward.

If inflows strengthen and leverage stays subdued, ETH may try a restoration in direction of $3,040. Nonetheless, if the value is unable to carry $2,682, there’s a threat of additional draw back. For now, Ethereum stays at a important inflection level.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply