- Bitcoin must regain $87,000 to return to its earlier vary and pave the best way to $100,000.

- Lengthy-term indicators are extremely oversold, with Z-score measurements under historic bear market bottoms.

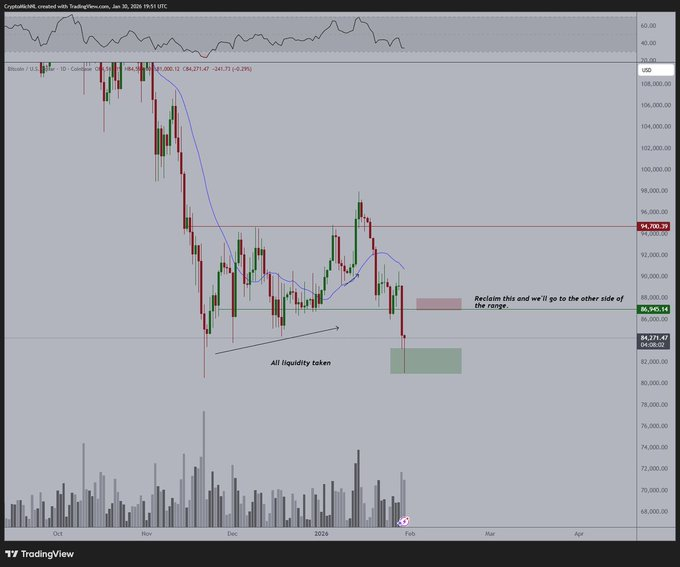

- Bitcoin doesn’t have to fall under $80,000 as the important thing liquidity ranges have already been taken.

After a number of days of heavy promoting and speedy liquidations, the crypto market is beginning to present early indicators of stabilization. The overall market worth rose about 0.8% over the previous 24 hours to $2.83 trillion. That is primarily on account of a technical rebound related to a phenomenon that consultants name a “liquidation flash.”

The main target now could be on Bitcoin and whether or not it may well regain momentum and return to the $100,000 degree.

Why this zone is essential for Bitcoin

In accordance with analyst Michael Van de Poppe, long-term indicators point out that Bitcoin could also be approaching an essential tipping level. One of many indicators is Bitcoin’s relative energy index (RSI) in opposition to gold. In previous cycles, each time this RSI fell under 30, it marked a serious bear market backside for Bitcoin.

Traditionally, main value will increase in gold have coincided with the start of a robust rally in cryptocurrencies. Some analysts imagine the present setup is analogous, elevating expectations that Bitcoin could also be nearing the tip of a correction part.

The subsequent degree to take a look at

In accordance with the analyst, Bitcoin has already misplaced most of its important liquidity ranges within the current selloff. He famous that the value doesn’t have to fall under $80,000 to draw sufficient liquidity for a reversal.

Quite, the following essential step is to interrupt above $87,000. If Bitcoin can regain and preserve this degree, it would return to its earlier buying and selling vary. From there, analysts say it turns into far more practical to push towards $100,000.

One other long-term indicator that has gained consideration is Bitcoin’s MVRV Z-score, a metric used to match costs to long-term averages. The present studying is decrease than the foremost troughs of the 2015, 2018, 2020 coronavirus crashes, and the 2022 bear market.

This implies Bitcoin is traditionally extremely undervalued and could also be nearing the tip of its bear part.

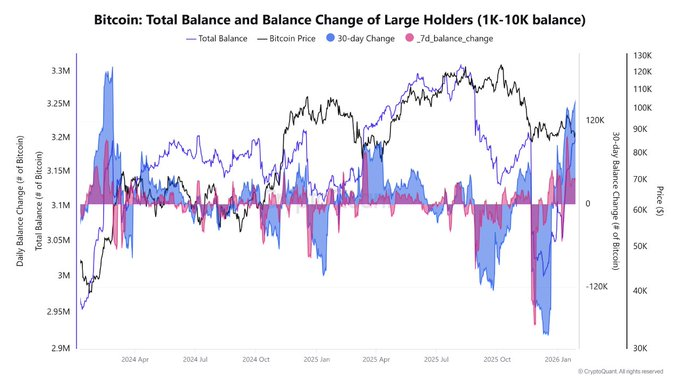

The variety of whales is growing once more.

On-chain information provides one other layer. Bitcoin addresses (also referred to as whales) holding between 1,000 and 10,000 BTC are accumulating on the quickest tempo since 2024.

Whale’s complete holdings have elevated to roughly 3.204 million BTC, confirming the long-term curiosity of huge buyers. Over the previous 30 days, Whale’s stability elevated by roughly 152,000 BTC, however the 7-day change remained optimistic at practically 30,000 BTC.

Binance information additionally exhibits whale exercise rising to round 0.65, the best degree since November. Analysts say this sometimes displays strategic place administration slightly than panic promoting.

Associated: Arthur Hayes explains why greenback illiquidity is dragging Bitcoin down

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply