- XRP continues its sturdy downtrend, dealing with repeated help exams round $1.55-$1.58.

- Momentum and channel indicators verify that sellers have the higher hand and restrict any upside restoration makes an attempt.

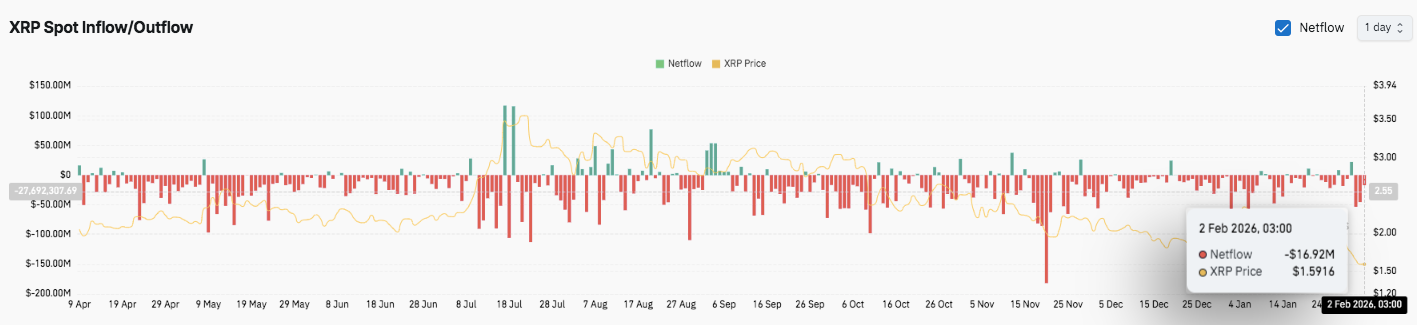

- Derivatives and spot flows present cautious positioning, with web outflows persevering with to be noticed.

XRP continues to face continued draw back strain because the short-term chart displays sustained bearish management. On the 4-hour timeframe, XRP/USD trades inside a well-defined downtrend characterised by falling highs and repeated help failures.

The bearish construction stays intact on the 4-hour chart

Worth motion reveals that XRP is buying and selling under a number of key Fibonacci retracement ranges, reinforcing the overall bearish construction. Moreover, XRP stays under the Donchian and Keltner channel bands, highlighting sustained promoting strain.

Momentum indicators help this view. ADX numbers close to 60 usually point out a robust tendency to favor continuation over consolidation.

Current candlesticks have shallow makes an attempt at restoration, however sellers shortly take in every pullback. Because of this, upward momentum is troublesome to generate.

Presently, the $1.58 to $1.55 space is performing as rapid help, and the value has repeatedly examined this space. A crucial failure right here would expose the $1.50 stage, which merchants view as a psychological and structural threshold.

On the draw back, a break under $1.50 might speed up losses in direction of the $1.42-$1.45 area. This zone represents the subsequent notable help cluster on the 4-hour chart. Nevertheless, sustaining above $1.50 might gradual the decline, though it will not reverse the development.

Associated: Bitcoin worth prediction: Bitcoin plummets to $74,000 as $266 million outflow anticipated as a consequence of Warsh Fed nomination and Iran tensions

On the upside, resistance begins round $1.60 and widens to $1.66, marking the earlier breakdown space. Moreover, the $1.71 to $1.72 zone coincides with the 0.236 Fibonacci stage and stays an essential defensive space for sellers. A stronger change in construction would require a payback of greater than $1.85. Past that, the $1.95 to $2.06 vary stays the higher certain for broad bearish dominance.

Derivatives and spot flows elevate considerations

Open curiosity knowledge reveals a transparent transition from extra to a managed place within the second half of 2024. The height of greater than $10 billion in the course of the earlier rally mirrored aggressive leverage. Since then, open curiosity has plummeted to about $2.8 billion.

Associated: Cardano Worth Prediction: ADA weakens as outflows and deleveraging proceed

Due to this fact, merchants proceed to cut back threat as the value development declines. Nevertheless, open curiosity stays elevated in comparison with pre-breakout ranges, indicating continued participation in derivatives.

Spot move knowledge additional helps this cautious development. Foreign money outflows have continued in current transactions, with web outflows of almost $17 million. Inflow stays short-lived and reactive, failing to ascertain accumulation. General, XRP displays a market targeted on protection reasonably than conviction shopping for.

XRP Worth Technical Outlook: Key Ranges Outline Subsequent Transfer

XRP worth continues to commerce at a key inflection level because the short-term construction stays bearish, however the draw back stage is now clearly outlined. On the 4-hour chart, worth compression close to main helps means that volatility might enhance because the market approaches the choice zone.

High stage: Instant resistance lies between $1.60 and $1.66, with earlier help turning into provide. A break above this vary might begin a transfer in direction of $1.71-$1.72, adopted by $1.85 as the primary trend-breaking stage. A sustained restoration above $1.95-$2.06 might sign a broad-based momentum restoration and weaken bearish management.

Cheaper price stage: XRP is presently defending the $1.58 to $1.55 help band. Failure to maintain this space will increase the chance of a breakdown in direction of $1.50. Beneath $1.50, draw back threat extends to the subsequent structural demand zone, the $1.42 to $1.45 space.

Higher restrict of resistance: The $1.72 Fibonacci stage stays a key barrier for bulls. So long as the value stays under this zone, sellers preserve short-term management.

From a structural perspective, XRP trades inside a well-defined bearish development characterised by falling highs and falling lows. A rising ADX studying means that the energy of the development is undamaged, and continuation is taken into account advantageous except a definitive restoration happens. Then again, the shrinking open curiosity and sustained spot outflows replicate cautious positioning reasonably than aggressive market shopping for.

Will XRP go up?

The path of XRP worth will depend upon whether or not consumers can defend the $1.55 to $1.50 zone lengthy sufficient to problem the overhead resistance. If demand stabilizes and momentum rises above $1.66, XRP might try a restoration in direction of $1.85.

Nevertheless, if we fail to stay to $1.50, we threat accelerating our losses to the mid-$1.40s. For now, XRP stays locked in a crucial vary, the place technical construction and confidence move will decide the subsequent leg.

Associated: Solana Worth Prediction: SOL recovers from $95 lows as Jupiter polymarket commerce lifts ecosystem sentiment

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply