- The IMF says Bitcoin needs to be thought-about when measuring financial development.

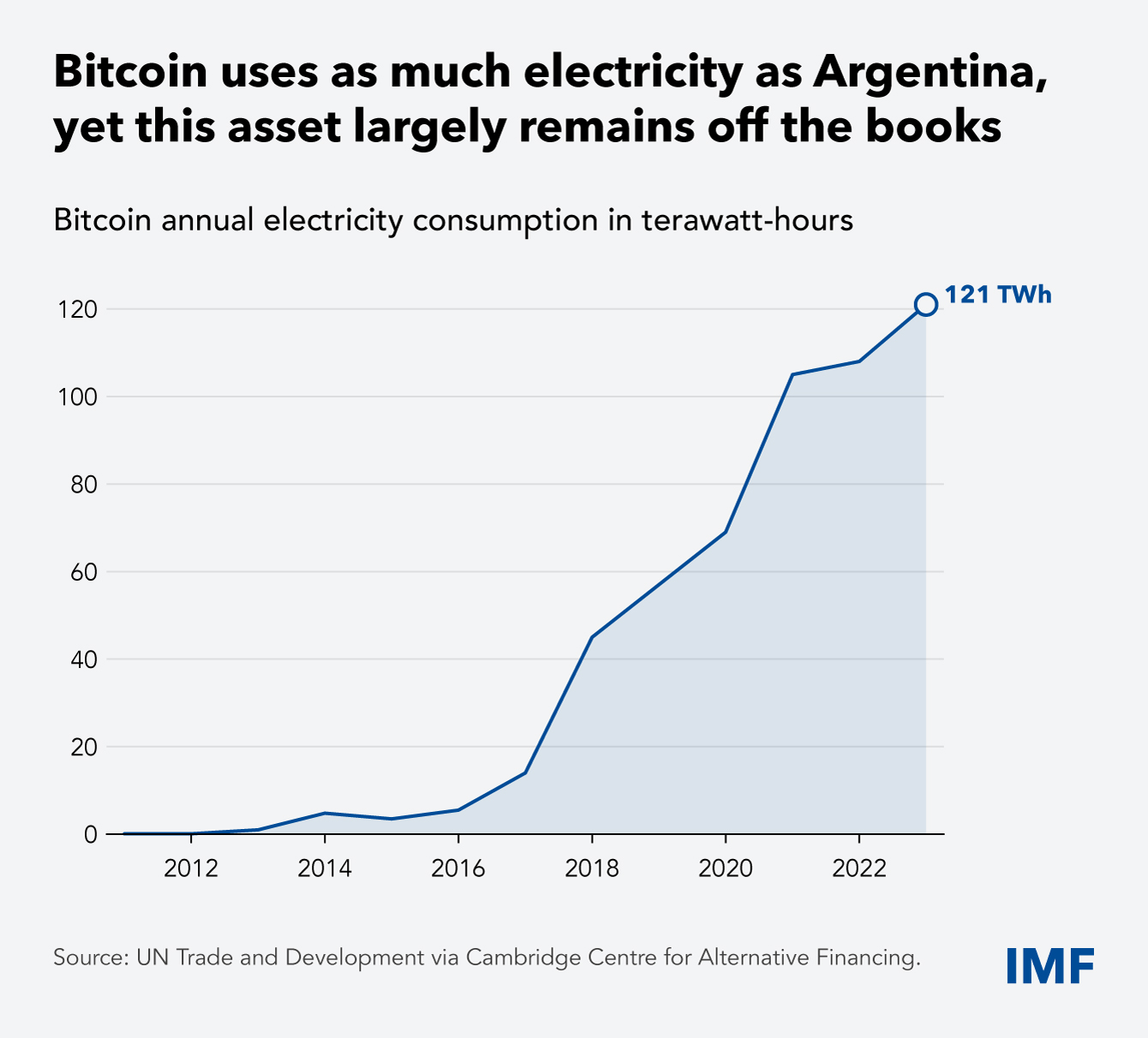

- International Bitcoin mining consumes as a lot electrical energy as Argentina.

- Updates SNA incorporates new applied sciences, together with cryptocurrencies.

The Worldwide Financial Fund (IMF) acknowledges the necessity to take into account Bitcoin and cryptocurrencies when measuring financial development. In its newest publication, the group revealed the significance of cryptocurrencies and rising applied sciences in international finance.

Measuring crypto from a public coverage perspective

Based on the IMF, it has turn out to be important to judge cryptocurrencies from a public coverage perspective, which may have important implications for future monetary stability, tax coverage, and regulatory oversight. The IMF used comparative evaluation to reveal the significance of this expertise, noting that Bitcoin mining alone consumes as a lot electrical energy as Argentina.

Citing the brand new System of Nationwide Accounts (SNA), the worldwide normal for creating indicators of financial exercise, the IMF emphasised the necessity for international locations to undertake methods to report on cryptocurrency exercise and its impression. The brand new SNA will absolutely incorporate rising applied sciences, digital companies and intangible belongings, based on the IMF report.

Excited about broader digital transformation

Along with reporting on cryptocurrencies, the IMF can be increasing its consideration to broader areas, together with digital transformation throughout a wide range of industries and merchandise. Based mostly on the brand new SNA suggestions, international locations should develop a set of indicators protecting a number of areas corresponding to AI, cloud computing, digital intermediation platforms, and e-commerce.

In the meantime, the up to date SNA addresses essential points affecting international finance and recommends improved methods to know monetary dangers and vulnerabilities. Recognizing the rising dangers related to non-bank monetary establishments, non-bank monetary establishments are actually enjoying a higher position within the international monetary ecosystem.

Bitcoin leads a brand new period of digitalization

It’s price noting that Bitcoin, regardless of its excessive volatility and unpredictability as an asset, has led the way in which in a brand new period of digitalization. Cryptocurrencies, together with their underlying expertise, have sparked a wave of digital invention over the previous 15 years, resulting in the reshaping of world finance in a brand new monetary period.

Bitcoin’s newest transfer highlights the digital asset’s attribute volatility, with it plummeting greater than 16% over the previous 5 days and buying and selling beneath $76,500 for the primary time since April 2025, based on TradingView information.

Associated:IMF confirms fiscal targets on observe as El Salvador strikes ahead with reforms

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply