- BTC trades under key EMA as weak rebound strengthens bearish short-term market dominance

- After the breakdown between $86,000 and $89,000, the highs and lows proceed to fall, confirming the bearish construction.

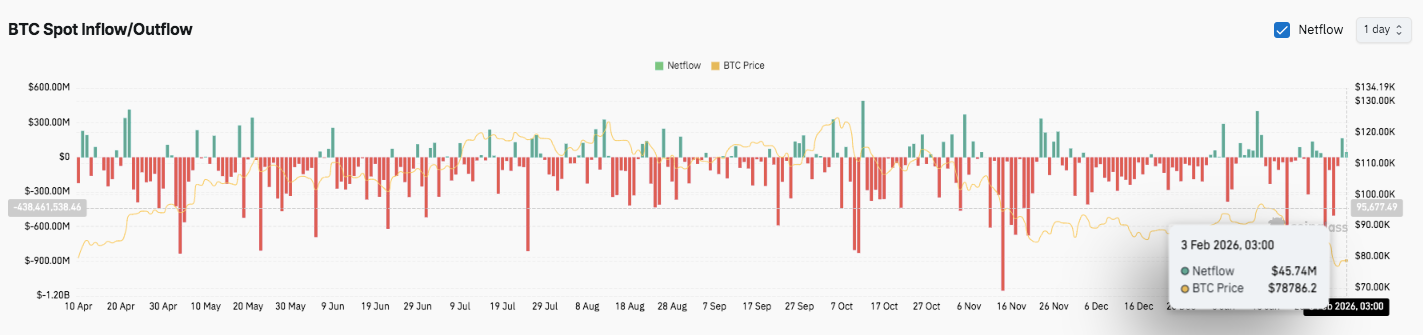

- Decrease open curiosity and adverse spot flows point out deleveraging and never robust dip demand

Bitcoin continues to commerce below seen stress as short-term market construction displays sustained bearish dominance. On the 4-hour chart, BTC stays under the most important exponential shifting averages and draw back momentum is gaining power.

Because of this, the latest rally lacked power and failed to draw follow-through shopping for. Market individuals are at present assessing whether or not the present stabilization indicators a lull or one other decline.

Bearish construction defines short-term development

Worth tendencies in latest periods verify a collection of decrease highs and decrease lows. This construction adopted a decisive breakdown from the $86,000 to $89,000 consolidation vary.

Importantly, this zone supported costs for a number of weeks earlier than sellers regained management. A pointy decline then pulled BTC to round $74,500, marking a brand new native low.

Nevertheless, patrons tried a slight rebound after that decline. The restoration has stalled quickly, suggesting restricted confidence. Furthermore, technical indicators proceed to favor sellers.

The parabolic SAR sign is above the value, indicating sustained downward stress. Subsequently, merchants proceed to deal with the upward motion as a correction reasonably than a change in development.

Bitcoin at present faces a number of overhead obstacles that complicate a sustained rebound. The $80,100 to $80,300 zone represents the primary technical hurdle. The recall might assist stabilize sentiment within the quick time period. Nevertheless, stronger resistance has emerged close to the earlier breakdown stage of $83,500.

Associated: Zilliqa Worth Prediction: ZIL faces check of religion as roadmap progress meets weak spot demand

Moreover, the $86,280 space is extra important. This midpoint retracement coincides with earlier structural assist. If it fails there, it’s possible that the bearish development will proceed to strengthen.

The $89,000 to $89,100 space above it combines a serious retracement stage and a clustered shifting common. Because of this, sellers could aggressively defend their zones. Solely a transfer above $92,900 would materially change the broader bias.

Notes on derivatives and spot information indicators

Bitcoin’s open curiosity has shrunk considerably following the latest value decline. The information exhibits a decline from a late 2025 excessive of greater than $70 billion in direction of a spread of $52 billion to $55 billion. Importantly, this decline displays unwinding leverage reasonably than an energetic quick place. Because of this, the market construction seems to be cleaner and fewer crowded.

Spot circulation information additional reinforces cautious sentiment. Persistent adverse internet flows point out continued distribution throughout volatility. Moreover, buy intent seems to be sporadic and reactive. Because of this, the rally stays below promoting stress reasonably than a sustained buildup.

Associated: Shiba Inu value prediction: SHIB rebounds 10% from low as open curiosity rises

Bitcoin (BTC) technical outlook

After the latest decline, Bitcoin value ranges stay well-defined as volatility diminishes.

Upside ranges embrace the primary hurdle at $80,300, adopted by $83,500 and the all-important $86,280 zone. A clear break above $86,000 might open room for a broader restoration towards $89,000 and even $92,900.

On the draw back, $78,000 acts as quick assist. Beneath that, the $75,400 to $74,600 demand zone stays necessary. A break under $74,500 would expose Bitcoin to much more extreme draw back danger.

The technical construction exhibits that BTC is buying and selling under the most important shifting averages, indicating a correction section. Worth actions mirror consolidation after deleveraging, which might set the stage for extra volatility.

Will Bitcoin go up?

Bitcoin’s short-term route relies on whether or not patrons can defend $78,000 and get better $83,500. Robust capital inflows and elevated open curiosity will assist the bailout rebound.

Nevertheless, if assist can’t be maintained, draw back danger will stay elevated. For now, Bitcoin is at a pivotal inflection level.

Associated: Canton value forecast: CC rises 75% as system burns towards deflation

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply