- As highs proceed to fall, XRP stays beneath key bands, sustaining near-term management by sellers

- Failure to recuperate the $1.62-1.67 body will transfer up as a correction inside a broader downtrend.

- Reducing open curiosity and spot outflows recommend easing of leverage quite than new demand

XRP stays underneath strain as merchants assess whether or not current value actions recommend stability or additional draw back threat. On the 4-hour chart, XRP/USD continues to commerce inside an outlined short-term downtrend. Value motion stays beneath main volatility bands and short-term averages.

Consequently, the market construction doesn’t point out a change in development and stays in favor of sellers. Patrons tried to rebound from the current lows, however the transfer lacked follow-through and didn’t considerably change the sequence of decrease highs.

Management the bears with short-term construction

Technically, XRP nonetheless respects a descending value construction. The asset is buying and selling beneath the midpoint of the Keltner Channel, indicating growing bearish momentum.

Furthermore, every restoration try stalled close to the earlier failure zone. Subsequently, merchants are viewing the current rally as a corrective rebound quite than a reversal.

Instant help is at $1.5750-$1.5600. A decisive break beneath this vary might open the door to demand territory at $1.5260. Importantly, $1.5010 is a key draw back threshold. If the worth falls beneath this degree, promoting strain could speed up.

On the optimistic aspect, the resistance stays layered and well-defended. The $1.6217 to $1.6660 zone coincides with volatility resistance and former consolidation. Moreover, sellers have thus far rejected costs round $1.6758, making it an necessary degree to look at.

The bulls might want to regain $1.7170 to point out near-term power. Above that, $1.8500 turns into an inflection level for the broader development.

Associated: Cardano Value Prediction: ADA faces promoting strain forward of CME futures launch

Momentum indicators proceed to replicate robust draw back management. The Directional Motion Index exhibits a rise in ADX, indicating a longtime development. Nevertheless, the damaging path line remains to be dominant.

Subsequently, bearish momentum nonetheless outweighs bullish makes an attempt. Volatility additionally expands downward, which regularly accompanies a continuation part. Consequently, merchants stay cautious about chasing short-term rebounds.

Derivatives and spot flows replicate cooling

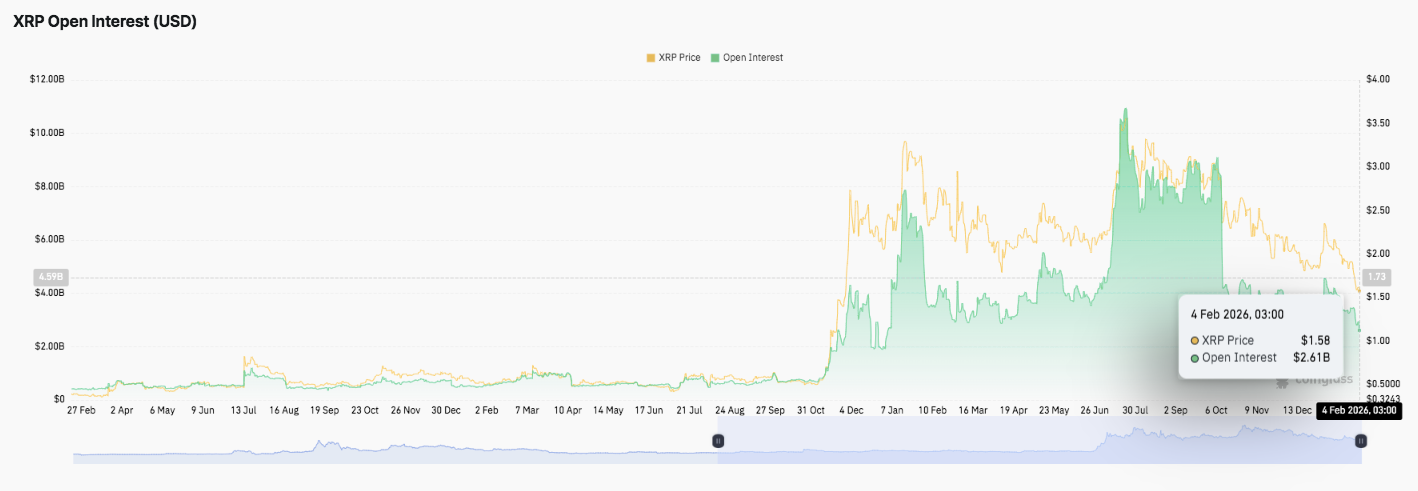

Derivatives knowledge provides context to the technical image. XRP open curiosity expanded quickly within the second half of 2025 as leveraged positions elevated quickly. Nevertheless, that improve steadily reversed as value momentum weakened.

Associated: Bitcoin value prediction: Berry warns of company dying spiral, BTC checks $75,000

By early February 2026, open curiosity had fallen to just about $2.6 billion. This decline means that merchants have decreased leverage quite than constructing new publicity. Consequently, the market seems to be resetting after extreme hypothesis.

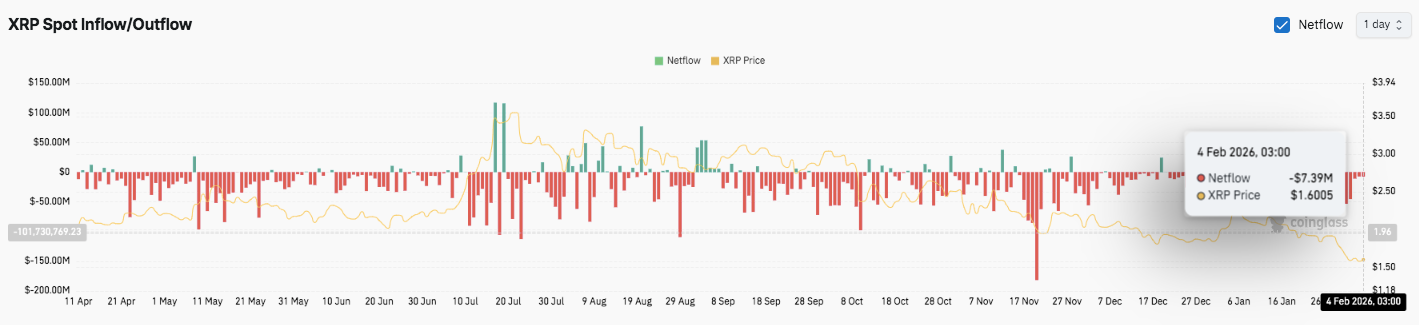

Spot stream knowledge additional helps the cautious outlook. Persistent internet runoff has dominated current exercise, exhibiting a steady distribution. Quick-term influx spikes seem, however shortly disappear. Moreover, bigger outflows usually coincide with sharper declines in costs. Subsequently, sellers nonetheless management the market stream.

Technical outlook for XRP value

Key ranges stay properly outlined as XRP trades inside a fragile short-term construction.

On the upside, promoting strain has repeatedly appeared with $1.6220, $1.6660, and $1.6760 appearing as quick hurdles. A sustained breakout of this cluster might open the door to $1.7170 after which into the $1.8500 space, which may very well be an inflection level within the broader development.

On the draw back, $1.5750-$1.5600 stays the primary help space to look at. Failure right here may very well be at $1.5260, with $1.5010 remaining as a key draw back degree.

Technical settings recommend that XRP is consolidating inside a bearish construction, characterised by decrease highs and a restricted rebound. Volatility compression inside this vary will increase the chance of enlargement.

Will XRP go up?

The near-term path of XRP will rely on whether or not patrons can defend $1.5600 and recuperate above $1.7170. Elevated capital inflows and improved momentum might help a aid rally in the direction of the excessive resistance zone.

Nevertheless, draw back dangers stay excessive as the worth continues to fall beneath $1.6750. For now, XRP stays in a pivotal zone, the place confidence and follow-through will decide the following leg.

Associated: PI Value Prediction: PI trades in downtrend as provide unlocks close to February peak

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply