- HYPE’s high-to-high construction and rising volatility counsel patrons are controlling momentum

- Derivatives leverage is slowly recovering, indicating it’s potential to take part with out taking up undue danger

- On-chain choices and monetary yield methods add omnidirectional help to HYPE demand

Hyperliquid’s HYPE token is again available in the market’s highlight after a powerful rally, however merchants are weighing technical momentum in opposition to adjustments in derivatives and authorities bond traits. Current value traits, on-chain knowledge, and new institutional methods have mixed to create a market that appears constructive however cautious.

HYPE’s value construction reveals power

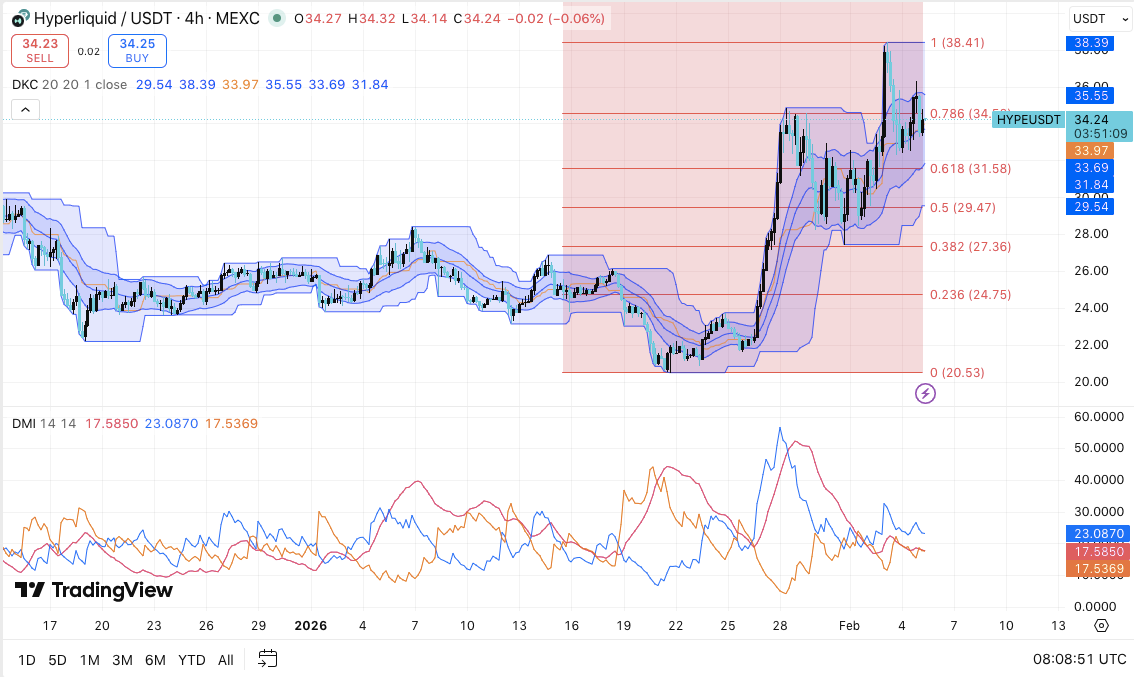

On the 4-hour chart, Hyper Liquid continues to commerce inside a transparent short-term uptrend. The value expanded quickly from the $20.50 base and consolidated across the 0.786 Fibonacci retracement. Due to this fact, this pause displays power quite than fatigue.

Volatility indicators verify that change. Bands within the model of Donchian and Keltner expanded after their breakout, exhibiting growth after a compressed state. Along with that, this construction nonetheless reveals highs and lows. Due to this fact, regardless of slowing momentum, patrons stay accountable for the route.

Resistance is at the moment concentrated between $34.40 and $35.55, with the worth going through near-term provide. A decisive breakout of this space may allow a transfer in direction of $38.40. Nevertheless, the extent of help continues to be necessary.

The $33.70 to $33.90 zone acts as quick safety. Moreover, a deeper decline may take a look at $31.60 consistent with the 0.618 Fibonacci stage.

Derivatives knowledge factors to cautious re-engagement

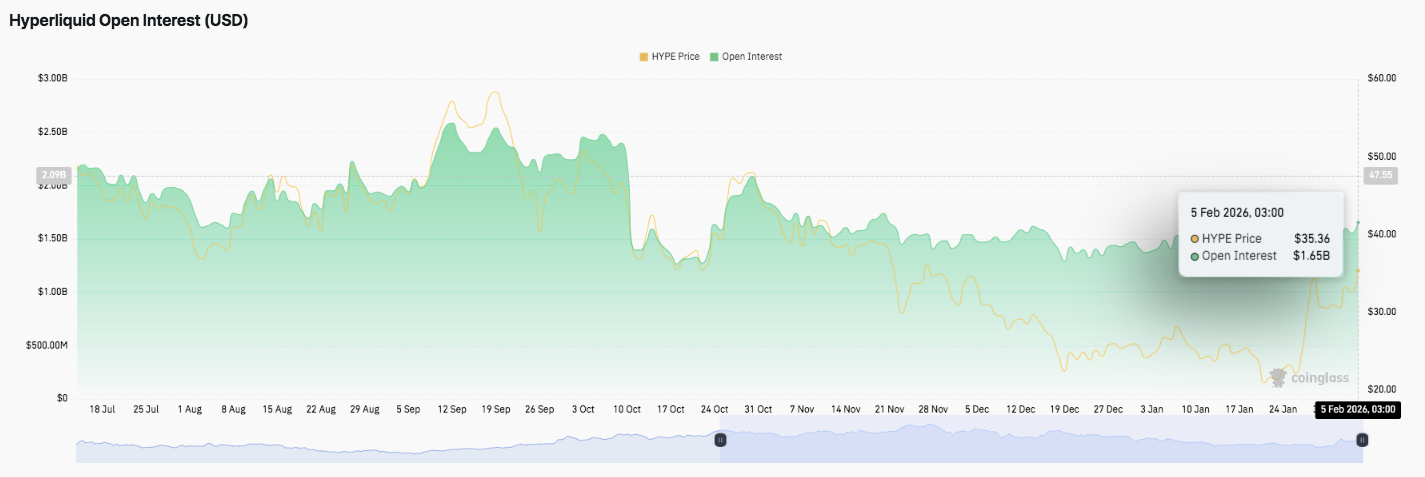

Open curiosity traits add necessary context. HyperLiquid open curiosity reached almost $2.6 billion in September after which entered a protracted contraction. Importantly, leverage reset sharply in early October as merchants diminished their publicity.

Associated: Solana Value Prediction: $71M Liquidation Causes Weekly Breakdown, SOL Loses $100

From November to December, open curiosity stabilized between $1.4 billion and $1.6 billion. This vary instructed prudence quite than aggressive positioning. Moreover, knowledge from late January reveals that the restructuring is progressing in phases in direction of $1.65 billion. Though this improve displays new participation, leverage stays beneath earlier highs.

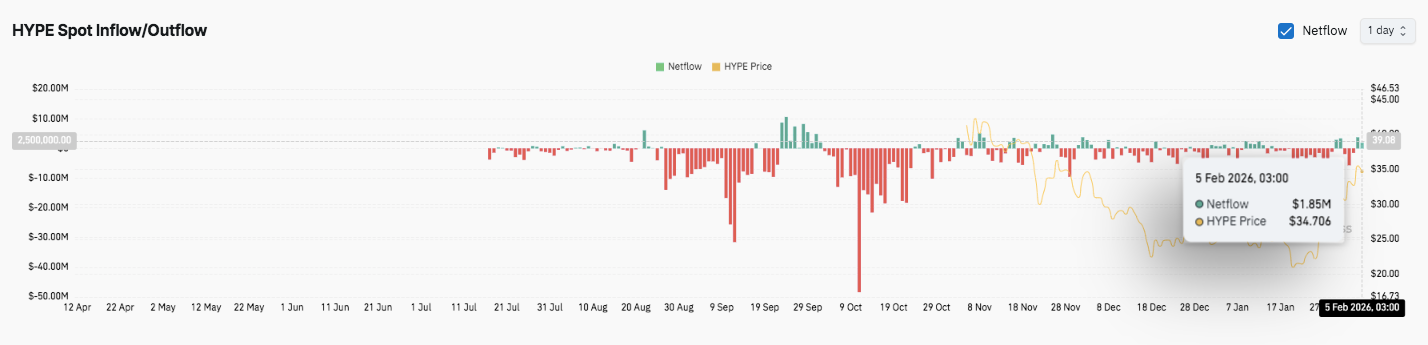

The identical factor might be seen from the spot move knowledge. Internet outflows accounted for a big portion of the earlier interval, indicating distributional stress. We noticed a major sell-side spike in September and October. Nevertheless, the outflow slowed in December, indicating that sellers have been changing into exhausted. A gradual influx has been noticed lately, suggesting early accumulation.

Monetary technique provides a elementary angle

Past the charts, institutional exercise provides a brand new layer. Hyperion DeFi Inc. has introduced plans to deploy its HYPE holdings as collateral for on-chain choices methods. Consequently, the corporate goals to earn premium and charge earnings with out taking up directional danger.

This technique makes use of the infrastructure of the Rysk protocol, which helps structured choices methods which are executed utterly on-chain. Moreover, Hyperion plans to mix this income with staking income. The corporate plans to open these vaults to different institutional holders over time.

Hyper Liquid (HYPE) value technical outlook

The important thing stage stays clearly outlined because the HYPE commerce throughout the bullish consolidation part.

Upside resistance lies between $34.40 and $35.55, which poses a right away hurdle to continuation. If a breakout above this zone is confirmed, the worth motion may lengthen to $38.40-$38.50, consistent with earlier predictions.

On the draw back, $33.70-33.90 serves as the primary help, and the $31.60-31.80 space marks the 0.618 Fibonacci demand zone. Structural help is situated close to $29.40-$29.50 and development rejection is situated close to $27.30. The technical picture suggests a pause after a powerful impulsive leg quite than fatigue.

Will Hyper Liquid go up?

The short-term bias stays bullish so long as the worth stays above $31.60. If the worth breaks cleanly above $35.55, the upward momentum might be regained.

Nevertheless, failure to defend $33.70 dangers a deeper retracement in direction of decrease Fibonacci help. For now, HYPE stays within the important zone and volatility is prone to improve going ahead.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply