- Bitcoin rose 8% to $64,670 after hitting $60,001, its lowest since October 2024, as whale holdings fell to 68.04% of provide, a nine-month low.

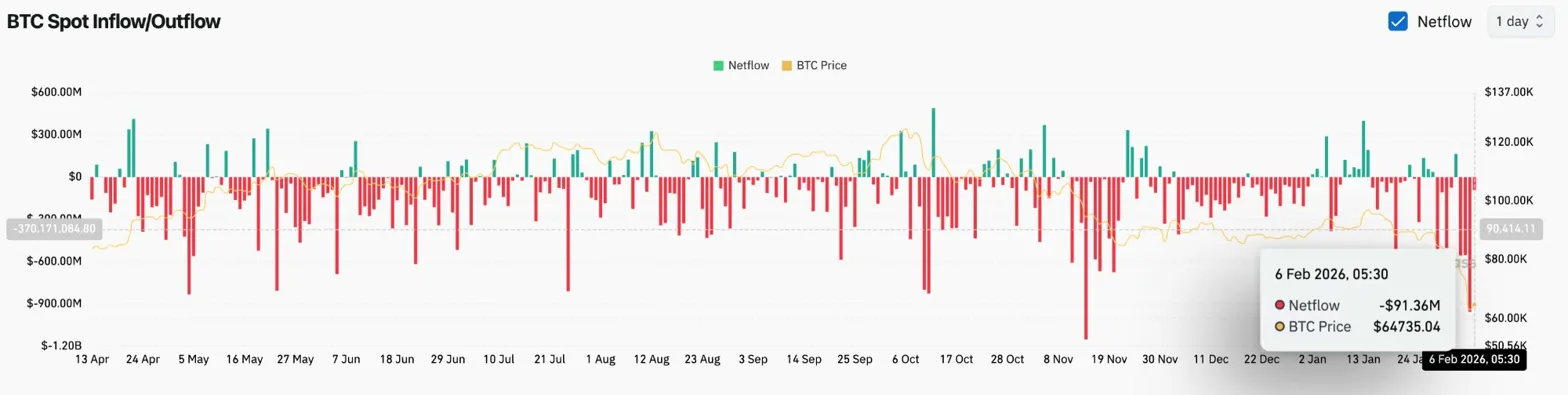

- Spot outflows reached $91.36 million on February 6, a part of a three-day outflow of almost $1 billion as institutional ETF withdrawals accelerated.

- A restoration would require a return to $77,950, however a detailed beneath $60,000 will open the draw back in direction of the $54,469 assist zone.

Bitcoin costs are buying and selling round $64,670 at the moment after rebounding from session lows of $60,001, which fell beneath $65,000 for the primary time in over a 12 months. The rally got here as whale wallets launched 81,068 BTC in simply eight days, pushing provide amongst massive holders to a nine-month low whereas retail buyers have been actively accumulating.

Whales launch 81,000 BTC as provide of huge holders hits 9-month low

Santiment information reveals dramatic adjustments in Bitcoin’s possession construction. Whale and shark wallets holding 10-10,000 BTC have fallen to their lowest provide share since late Might 2025, and collectively they account for simply 68.04% of all Bitcoin.

The 81,068 BTC crash in eight days coincided with Bitcoin falling from $90,000 to $65,000 (a 27% drop). When massive holders cut back their publicity at this tempo, it alerts confidence that the asset has peaked, reasonably than a brief change in positioning.

In the meantime, the retail “Ebi Pockets” with holdings of lower than 0.1 BTC has risen to a 20-month excessive and at the moment accounts for 0.249% of the provision, or roughly 52,290 BTC. Santiment warns that this mix of main gamers promoting and retail shopping for creates traditionally bearish cycles.

Spot outflows strategy $2 billion in 3 days

In line with Coinglass information, spot outflows on February 6 have been $91.36 million, an enlargement of the large outflows that characterised final week. Withdrawals from institutional ETFs are accelerating in tandem with spot promoting, with spot outflows approaching $2 billion in three days.

Analysts at Deutsche Financial institution attributed the decline to heavy withdrawals from institutional ETFs. This outflow sample represents one of many hardest distribution durations for Bitcoin ETFs since their launch, and suggests an institutional capitulation reasonably than a brief repositioning.

Associated: Cardano Worth Prediction: ADA Worth Weak spot Will get Deeper as Hoskinson Urges Focus Past Crimson Days

If outflows of this measurement proceed throughout a crash, it confirms the arrogance of sellers. The dearth of shopping for curiosity on the $60,000 stage means that the market has not but discovered a worth at which demand can take in provide.

Each day chart reveals crucial assist ranges

On the every day chart, Bitcoin broke via a number of assist ranges with devastating velocity. The $77,950 supertrend stage was damaged first, adopted by the $76,000 horizontal assist that had held for a number of months.

Worth is at the moment buying and selling nicely beneath all 4 main EMAs. 20 days is $80,431, 50 days is $86,262, 100 days is $91,452, and 200 days is $96,435. The distinction between the present worth of $64,670 and the closest EMA of $80,431 signifies the severity of the breakdown.

The $54,469 stage marked on the chart represents the subsequent main assist if $60,000 fails. This zone coincides with the summer season 2024 consolidation space the place Bitcoin traded earlier than rising to all-time highs.

Worry index is at its lowest because the collapse of Terra

On Friday, the Crypto Worry & Greed Index fell to 9 out of 100, its lowest studying since mid-2022, when the market was reeling from the collapse of the Terra blockchain. A studying of utmost concern means that feelings have reached a stage of give up.

CryptoQuant CEO Ki Younger Ju identified that every one Bitcoin analysts are at the moment bearish and the unanimous view is that this might generally be a turning level. However whale dumping and ETF outflows recommend there may be basic assist for this pessimism.

Associated: Solana Worth Prediction: SOL Downtrend Deepens Regardless of Slowing Promoting Stress

The geopolitical backdrop continues to place strain on cryptocurrencies. The mixture of the U.S. detention of Venezuelan President Maduro, Trump’s threats in opposition to Greenland, and the Warsh Fed nomination despatched buyers scrambling for conventional safe-haven property akin to gold and silver to document highs.

Brief-term chart reveals resistance on the downtrend line

On the 30-minute chart, Bitcoin is buying and selling beneath the downtrend line that has led to its decline since February third. The development line is now above $66,000, offering rapid resistance to any restoration makes an attempt.

The RSI has recovered from the closely oversold stage to 46.47, indicating some stability after the crash to $60,001. The MACD has turned optimistic and the histogram is widening, suggesting short-term momentum could also be altering.

A rebound from $60,001 to $64,670 represents a 7.8% restoration and would require a break above $63,000 to point significant stabilization. A rejection on the downtrend line would lead to a retest of the $60,000 low.

Outlook: Will Bitcoin Rise?

Developments stay bearish whereas whale distribution and institutional capital outflows proceed.

- Bullish case: A detailed of the day above $77,950 will reinstate the supertrend, and a low of $60,000 will sign a capitulation. Excessive Worry Index readings of 9, when mixed with stabilizing flows, have traditionally preceded rebounds.

- Bearish case: A detailed beneath $60,000 would verify the breakdown and goal the $54,469 assist zone. The historic bear cycle setup that Santiment describes stays energetic as whales launch 81,000 BTC and retail accumulates.

Associated: Shiba Inu worth prediction: SHIB recovers 15% from crash as Bitcoin dips beneath $65,000

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply