- XRP stays underneath short-term stress and is struggling to regain its misplaced technological base.

- Overhead resistance and a bearish trendline cap the upside and restrict the potential for a pullback.

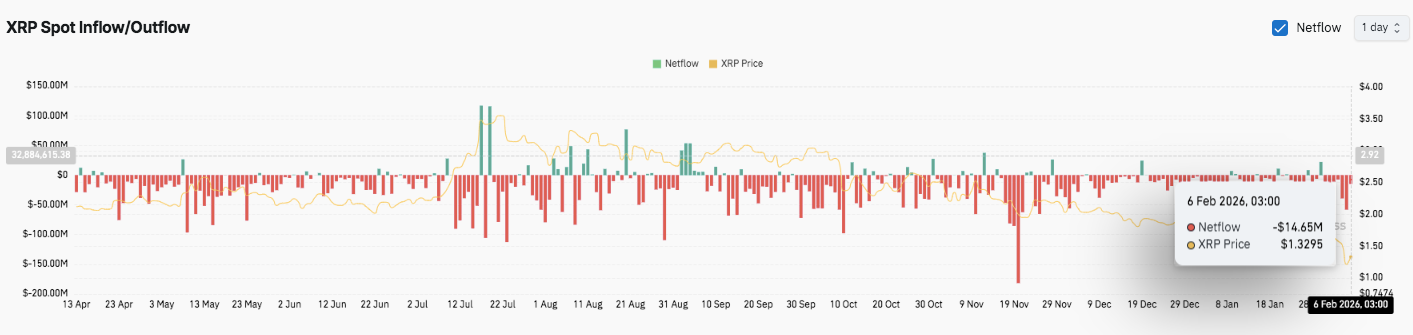

- Derivatives and spot flows point out cautious sentiment, favoring promoting over accumulation.

XRP continues to commerce underneath clear short-term stress as market members reassess dangers following the sharp selloff. After collapsing from the $1.90 to $2.00 vary, the token briefly dipped under $1.15 earlier than rebounding.

However that backlash hasn’t modified the broader construction. Relatively, latest value actions recommend a response to oversold circumstances fairly than a sustained change in development. Consequently, merchants stay cautious as XRP struggles to regain misplaced technical floor on the 4-hour chart.

Bearish construction limits upside makes an attempt

Importantly, XRP continues to be under the Ichimoku cloud, persevering with to constrain any makes an attempt to maneuver increased. The cloud is at the moment performing as an overhead resistance line, reinforcing the dominant downtrend.

Moreover, short-term and medium-term development strains have decrease slopes, reflecting sustained bearish momentum. Costs recovered to round $1.30, however sellers shortly reasserted management close to the overhead provide zone.

Moreover, resistance ranges are at the moment concentrated nicely above the value. The $1.38-$1.40 space represents the primary technical barrier. Above that, the $1.52-$1.55 zone coincides with broader development resistance.

Due to this fact, in the event you prolong the upside earlier than the structural scenario improves, you’ll face sturdy promoting stress. Analysts recommend that solely a definitive shut above $1.52 will cut back draw back danger within the close to time period.

Momentum indicators proceed to replicate sturdy bearish management. The directional motion index exhibits that whereas the energy of the development continues to be rising, sellers keep their benefit.

Associated: Cardano Worth Prediction: ADA Worth Weak point Will get Deeper as Hoskinson Urges Focus Past Crimson Days

Consequently, market members favor to promote on a pullback fairly than chase an upside. Volatility has brought about a pointy pullback, however the momentum scenario exhibits no indicators of the development drying up.

Along with momentum, assist ranges stay fragile. The $1.30 zone acts as fast assist.

Under that, the $1.21-$1.15 vary turns into extraordinarily essential. A breakdown of this space reveals a cycle low of $1.12. Analysts have warned {that a} break under this stage might speed up the continued decline.

Derivatives and spot flows replicate weak beliefs

Moreover, derivatives knowledge highlights modifications in dealer conduct. XRP open curiosity expanded aggressively in the course of the late 2025 rally. Nonetheless, it then entered a long-term contraction section.

Associated: Solana Worth Prediction: SOL Downtrend Deepens Regardless of Slowing Promoting Stress

Open curiosity at the moment stands at practically $2.4 billion, suggesting widespread deleveraging. This development means that merchants are exiting positions fairly than initiating new directional bets.

Spot stream knowledge helps this cautious outlook. Web outflows predominate in most periods, indicating continued distribution. Even throughout restoration makes an attempt, quick bursts of influx weren’t sustained. Moreover, outflows stay close to latest lows, indicating restricted curiosity accumulation.

Technical outlook for XRP value

The important thing ranges are nonetheless clearly outlined as XRP trades in a fragile restoration section on the 4H chart.

Upside ranges lie on the first hurdle at $1.38-$1.40, adopted by apparent resistance at $1.52-1.55. A sustained breakout might open the door to $1.62, with a broader reversal zone between $1.77 and $1.92.

On the draw back, $1.30 acts as fast assist. Under that, $1.21 to $1.15 stays a key demand zone. Failure right here dangers retesting the cycle low of $1.12.

Technical circumstances recommend that XRP will stay under the Ichimoku cloud, heading for consolidation or renewed weak spot. Momentum indicators stay bearish, indicating a bull market promoting scenario.

Will XRP recuperate?

XRP’s near-term prospects rely upon whether or not patrons can defend $1.30 and recuperate $1.38-$1.40. If the value sustains above $1.52, the draw back stress will ease.

Nonetheless, if the assist will not be maintained, there’s a danger that the value will as soon as once more have room to maneuver under $1.21. For now, XRP stays at a key inflection level, and volatility might enhance if the value breaks out of this vary.

Associated: Shiba Inu value prediction: SHIB recovers 15% from crash as Bitcoin dips under $65,000

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply