- Cardano stays in a short-term downtrend, with the bears strongly controlling the momentum.

- Though the discount in open curiosity in derivatives signifies decrease leverage danger, the promoting continues.

- Hoskinson stays dedicated to Cardano regardless of $3 billion in losses and market volatility.

Cardano value motion continues to mirror vital stress as technical weak spot, diminished derivatives exercise, and cautious spot flows form near-term expectations. Whereas the broader crypto market stays risky, Cardano is exhibiting restricted indicators of an instantaneous restoration in a shorter timeframe. On the similar time, the founder’s feedback emphasize long-term beliefs regardless of heavy losses available in the market, including a contrasting narrative to the present value pattern.

Cardano’s value construction suggests continued stress

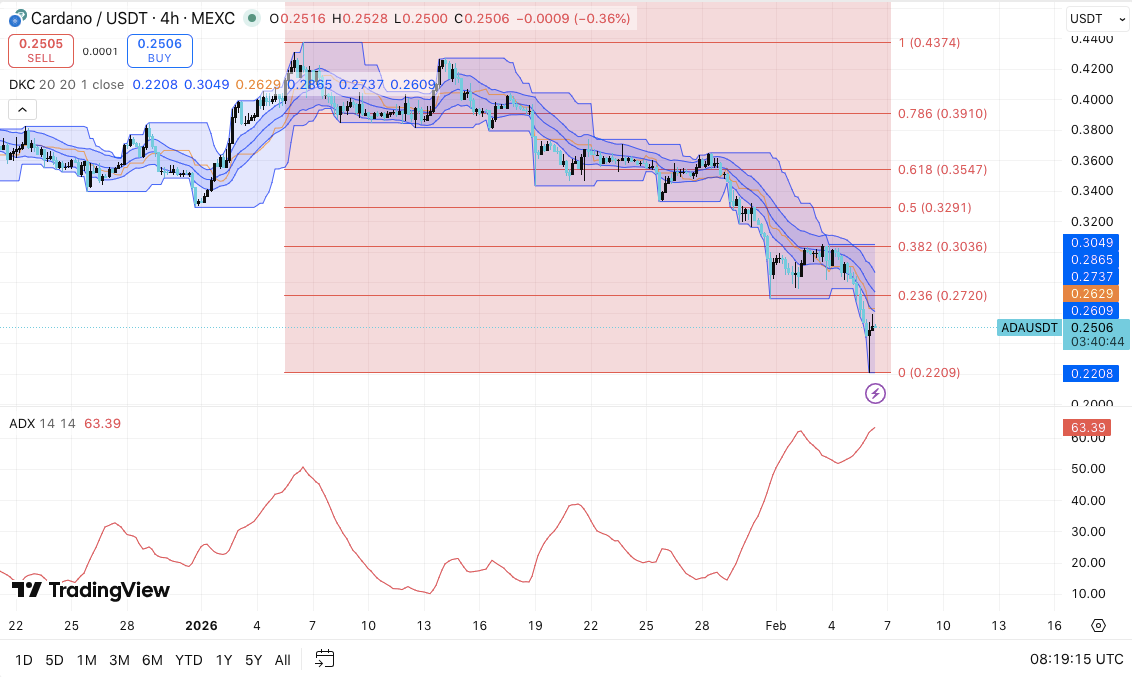

On the 4-hour chart, Cardano remains to be locked in a transparent short-term downtrend. Costs proceed to make decrease highs and decrease lows. Along with that, ADA is buying and selling under the downward volatility channel, confirming sustained promoting curiosity.

The pattern power remains to be rising and ADX is near excessive ranges, indicating that the bears are nonetheless in command of the momentum. Due to this fact, merchants proceed to deal with rebounds as corrections quite than pattern adjustments.

Fast assist is close to $0.25, and the value might try a short lived stabilization. Nonetheless, if this zone fails to carry, the earlier breakdown space close to $0.236 might be uncovered. Because of this, a deeper decline might take a look at the cycle low close to $0.22.

Associated: Solana Worth Prediction: SOL Downtrend Deepens Regardless of Slowing Promoting Stress

Upwards, the resistive layers stay stacked. The $0.265 zone limits an early rebound, and the $0.286 space marks the primary stage wanted to alleviate draw back stress. A broader pattern change would require a sustained rally above $0.30, however that’s nonetheless a great distance off.

Spinoff resets and spot flows mirror danger aversion

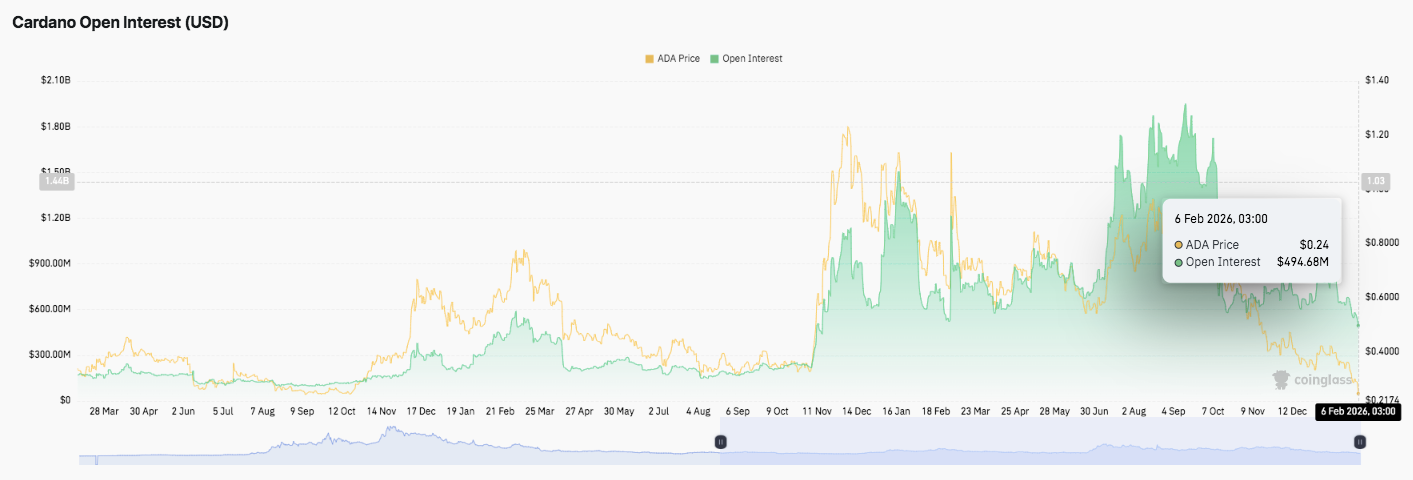

Open curiosity information means that derivatives markets have already absorbed a lot of the current stress. Through the rally thus far, leveraged positions expanded quickly, with open curiosity exceeding $1.8 billion.

However every surge was accompanied by a pointy liquidation. Lately, open curiosity has declined to just about $500 million, despite the fact that the value has been hovering close to native lows. Importantly, this contraction means that leverage is being flushed out, lowering the danger of a pressured promote.

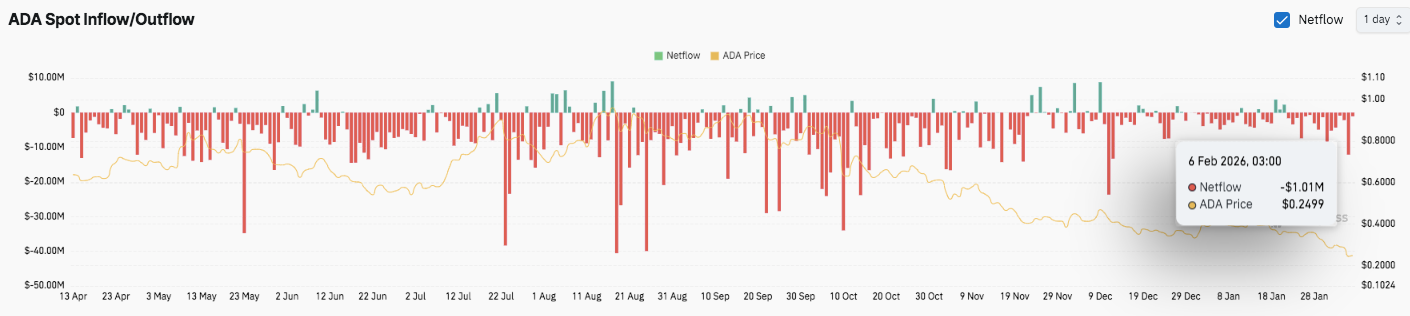

Spot stream information reinforces our cautious view. Sustained web outflow dominates most periods, indicating a steady distribution quite than accumulation. Moreover, the surge in inflows seems to be short-lived, stopping bigger adjustments in route. Because of this, the market displays defensive positioning, with patrons remaining selective and sellers capitalizing on the rebound to exit publicity.

Hoskinson underlines dedication regardless of loss

Amid the financial downturn, Charles Hoskinson addressed market sentiment on a livestream. He stated he stays dedicated to Cardano’s mission regardless of enduring losses of over $3 billion.

He additionally emphasised that long-term improvement, not short-term income, is the driving power behind his involvement. He additionally highlighted ongoing progress throughout Cardano’s infrastructure, governance, and commercialization roadmap.

Technical outlook for Cardano (ADA) value

Cardano trades inside a strong short-term downtrend on the 4-hour chart, so the important thing ranges stay well-defined.

The upside stage lies at $0.2620-$0.2650 as the primary hurdle for restoration. A sustained transfer above this zone might open room for a transfer in the direction of $0.2730-$0.2750 after which the important thing provide space of $0.2860-0.2900. A decisive retracement of the $0.3040-$0.3060 space across the 0.382 retracement can be wanted to point a broader pattern change.

On the draw back, fast assist lies between $0.2500 and $0.2480, which might result in short-term stabilization. If this zone can’t be maintained, the earlier breakdown space of $0.2360 to $0.2320 might be uncovered. Shedding this stage dangers widening losses in the direction of the present cycle low and key structural assist at $0.2210-$0.2200.

Technical situations recommend that ADA stays underneath bearish management, with value buying and selling under its descending volatility channel. The power of the pattern remains to be up and favors continuation except it’s negated by a robust rebound in resistance.

Will Cardano go up?

Cardano’s near-term value outlook is dependent upon whether or not patrons can defend the $0.2500 space lengthy sufficient to problem the $0.2650-$0.2750 resistance cluster. Continued compression inside a downtrend alerts elevated volatility forward.

If the bullish momentum strengthens together with sturdy spot demand, ADA might try a restoration in the direction of $0.2860. Nonetheless, if the value can not preserve $0.2360, draw back stress will enhance and $0.2200 is prone to be uncovered. For now, ADA stays within the vital zone and requires affirmation earlier than the following directional leg.

Associated: Shiba Inu value prediction: SHIB recovers 15% from crash as Bitcoin dips under $65,000

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply