- Cardano fell 0.11% to $0.2696 as open curiosity fell 3.02% to $421 million and quantity declined 29.83% amid post-crash consolidation.

- Charles Hoskinson revealed that the corporate had unrealized losses of greater than $3 billion throughout the financial downturn, and emphasised the long-term dedication to constructing a decentralized system quite than short-term worth fluctuations.

- A restoration would require a return to $0.3076, however a detailed beneath $0.26 opens the draw back for a crashing low of $0.23.

Cardano worth is buying and selling round $0.2696 as we speak after consolidating positive aspects from the rebound from the crash low of $0.23. The token is down 73% from its August excessive of over $1.00, however founder Charles Hoskinson’s disclosure of $3 billion in private unrealized losses highlights that even insiders are feeling the ache of this bear market.

Hoskinson reveals $3 billion in unrealized losses

Cardano founder Charles Hoskinson revealed greater than $3 billion in unrealized losses throughout a dwell broadcast from Tokyo, offering a uncommon perspective on his private publicity throughout the market downturn. The exposé claims that cryptocurrency founders are shielded from losses that have an effect on retail traders.

Hoskinson confused that though he may have accessed the money, he selected to stay centered on constructing the ecosystem. He characterised the financial downturn not as a breaking level however as a transition interval for the monetary system to adapt to new expertise.

The founders cited Cardano-based initiatives corresponding to Starstream and Midnight as examples of long-term developments centered on information integrity and privateness purposes. He stated he has no plans to exit any positions and sees the decline as a part of a long-term cycle.

Derivatives information signifies completion of deleveraging

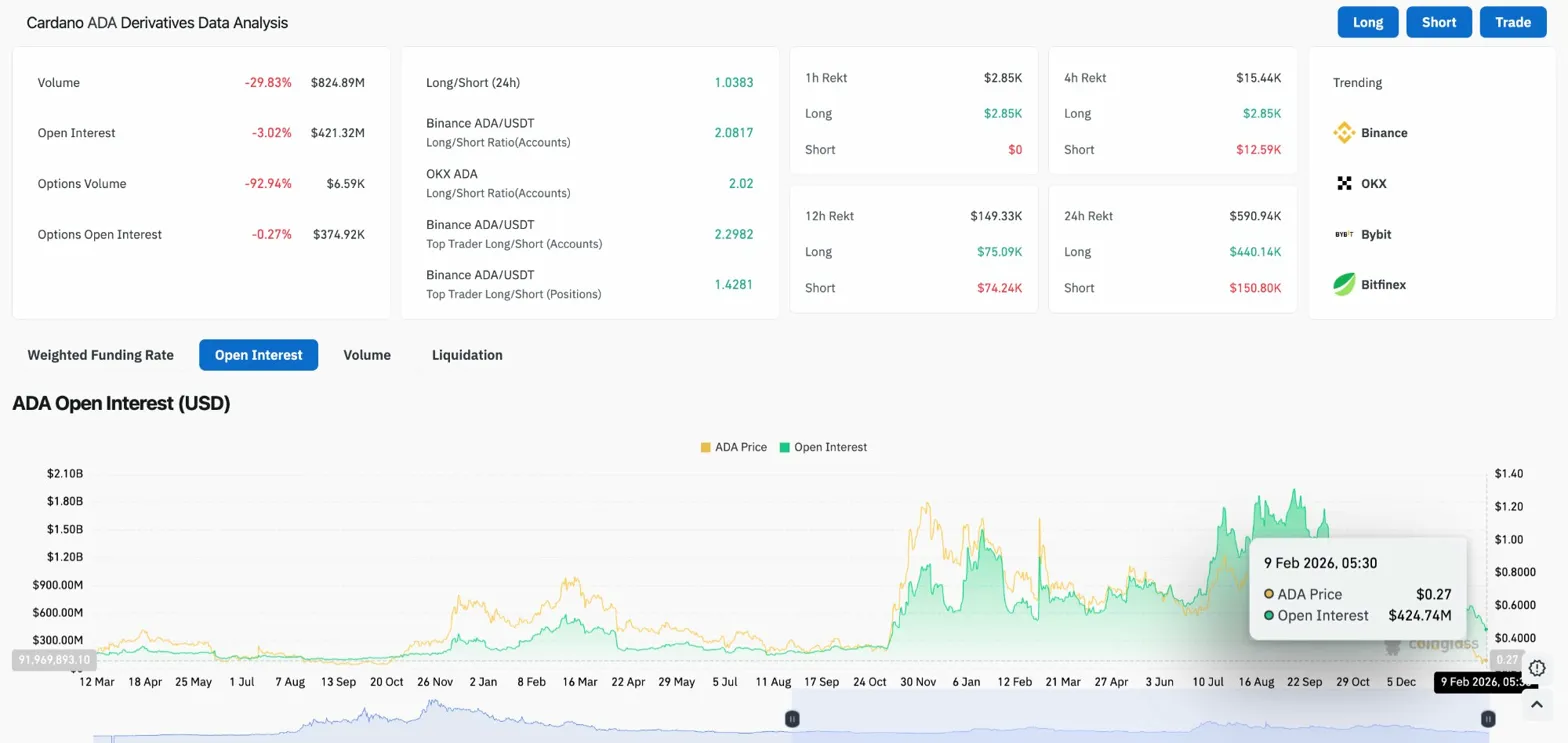

Open curiosity decreased by 3.02% to $421.32 million, and buying and selling quantity decreased by 29.83% to $824.89 million. Choices quantity plummeted 92.94% to simply $659,000, reflecting the exhaustion in buying and selling exercise following the spike in volatility.

The lengthy/brief ratio has remained at 1.03, and has been roughly balanced after the leveraged longs have been unwound after the crash. On Binance, prime merchants preserve a ratio of two.29 per account, indicating {that a} bullish bias stays among the many massive gamers.

Associated: ASTER Value Prediction: ASTER Rebound Aligns with Provide Zone as Leverage Continues to Fall

Within the final 24 hours, $590,94,000 positions have been liquidated, of which $440,14,000 have been lengthy and $150,80,000 have been brief. The comparatively low quantity of liquidations in comparison with the height of the crash means that leverage has been successfully faraway from the system.

The open curiosity chart exhibits that ADA’s open curiosity has fallen from a peak of over $2 billion throughout the rally to its present stage of roughly $424.74 million. This deleveraging removes the compelled promoting stress that fuels the crash and creates circumstances for extra steady worth motion.

Every day chart exhibits descending channel construction

On the each day chart, Cardano is buying and selling inside a descending channel that has guided worth motion since August. At the moment, the resistance of the channel is all the way down to round $0.35 and the help is round $0.20.

Value is buying and selling effectively beneath all 4 main EMAs. The twentieth is $0.3076, the fiftieth is $0.3522, the one centesimal is $0.4219, and the 2 hundredth is $0.5203. The Supertrend indicator stays bearish at $0.3414.

The $0.50 horizontal resistance zone highlighted on the chart represents the primary main provide space if the restoration develops. The present worth of $0.27 is about 73% beneath the August excessive of over $1.00.

Quick-term chart exhibits a consolidating triangle

On the 30-minute chart, Cardano fashioned a consolidation sample between $0.26 and $0.29 after rebounding from the crash lows. The downtrend line from the February sixth excessive has risen to round $0.275.

At 48.14, the RSI is in impartial territory with room to maneuver in both route. The MACD has converged round zero, reflecting the sideways worth actions throughout the consolidation.

Associated: Solana Value Prediction: SOL defends $87 after 20% soar as ETFs proceed to retreat

Integral patterns are resolved with directional motion. A break above $0.28 would sign a continuation in the direction of the $0.30 zone, whereas a break beneath $0.26 would goal a retest of the crash low at $0.23.

Outlook: Will Cardano Rise?

Traits stay bearish whereas costs commerce inside a descending channel, however deleveraged markets and founder commitments counsel that circumstances for a restoration are forming.

- Bullish case: If the each day shut is above $0.3076, the 20-day EMA will probably be regained and the crash low will sign a capitulation. If broad sentiment improves, the launch of CME futures and midnight developments will function structural catalysts.

- Bearish case: If the worth closes beneath $0.26, it would break the consolidation help and goal for a crash low of $0.23. Hoskinson has $3 billion in unrealized losses, and additional declines will take a look at even essentially the most devoted holders.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply