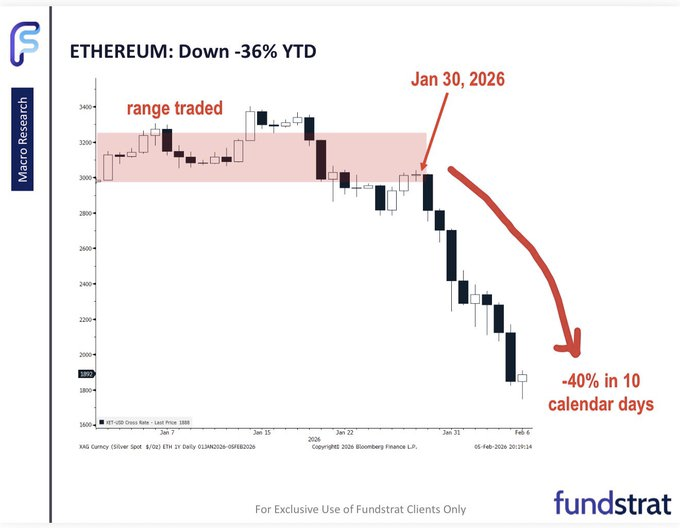

- Ethereum broke out of a serious value vary in late January as promoting pushed the worth to round $1,900.

- After leverage restrictions had been lifted, file volumes in IBIT ETF choices matched losses in crypto property.

- BitMine has elevated its ETH stash regardless of the drop, holding 4.28 million ETH with zero debt.

The 2026 Ethereum value decline intensified from late January to early February as promoting pushed the worth properly beneath its earlier buying and selling vary. Market commentary and stability sheet disclosures printed throughout this era point out a sudden rise quite than an adjustment, with exercise concentrated throughout US buying and selling hours and related to elevated derivatives buying and selling volumes.

In line with a chart shared by Fundstrat, Ethereum has already fallen about 36% year-to-date, dropping beneath the $3,000-$3,200 vary round January 30, 2026. The value then fell to round $1,900 in about 10 days, an extra drop of about 40%.

Fundstrat’s Thomas Lee famous that drawdowns of this magnitude have occurred repeatedly since 2018, with Ethereum experiencing declines of greater than 60% in most calendar years. He added that the decline in 2026 unfolded in parallel with an enchancment in on-chain exercise, in distinction to the sooner crypto winter when utilization declined.

ETF choice quantity and timing

Additional consideration targeted on unusually excessive buying and selling exercise related to the Spot Bitcoin ETF. In our commentary, we referenced IBIT’s file every day quantity and choice premiums. Many observers famous that exchange-imposed choices contract caps had been lifted in late January, rising the leverage accessible throughout main Bitcoin and Ethereum ETFs.

There has but to be a proper disclosure confirming the identification of the massive holders concerned, and any filings that might reveal publicity won’t be made public till a subsequent reporting window.

Monetary exercise and staking knowledge

Amid the decline, BitMine Immersion Applied sciences reported continued good points. The corporate mentioned it added 41,788 ETH within the latest week, rising its whole holdings to 4,285,125 ETH together with 193 Bitcoin and $586 million in money. The corporate disclosed zero debt and famous that roughly two-thirds of its ETH holdings are staked, producing staking revenue at prevailing community charges.

BitMine additionally reported that Ethereum’s every day transactions and energetic addresses reached file ranges in early 2026, at the same time as the worth fell from round $3,000 to low $2,000.

Associated: Ethereum Value Prediction: ETH Downtrend Continues as Builders Face Demand for Actual Innovation

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply