- Shiba Inu fell 1.48% to $0.00000601 whilst its burn fee rose 2,097% to 2.63 million SHIB up to now 24 hours.

- As promoting stress exhibits indicators of drying up, spot outflows have fallen dramatically to only $443.74 million, the smallest outflow in latest weeks.

- A restoration would require a return to $0.00000681, however a detailed beneath $0.0000055 would open the draw back in direction of the $0.0000040 demand zone.

Shiba Inu worth at the moment is buying and selling round $0.00000601 after final week’s sell-off, which noticed it rise above the $0.000006 help stage and consolidate to $0.000005. This stabilization is accompanied by a dramatic spike in burn exercise and a major discount in spot outflows, however the token stays trapped inside a year-long downward channel.

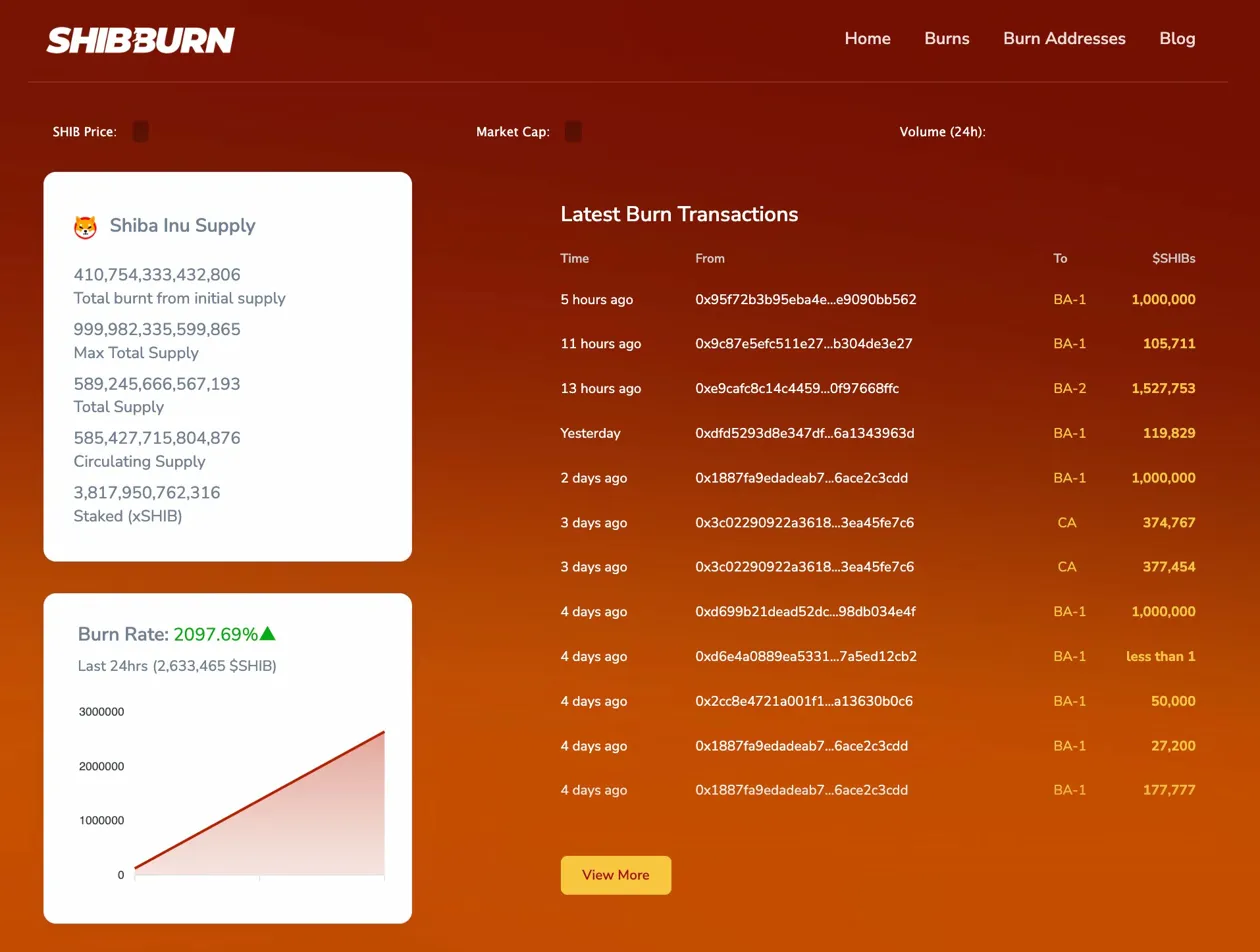

Shivburn information reveals a dramatic spike in burn actions with burn fee growing by 2,097.69% within the final 24 hours. The group transferred 2.63 million SHIB to the disabled pockets. This was a major improve from the lower than 1 million fires per day seen throughout the crash.

The overall provide has decreased from the preliminary 1,000 trillion SHIB to 589.24 trillion SHIB, and 410.75 trillion SHIB of tokens have been burned since launch. The quantity of circulating provide is $585.42 trillion, and $3.81 trillion is invested as xSHIB.

Latest write transactions have proven constant exercise, with 1 million SHIB writes occurring a number of occasions over the previous few days. Though these quantities are small in comparison with the whole provide, the accelerated burn fee means that group involvement is returning after the give up section.

The providing reduces spot outflows to $443,000.

In keeping with information from Coinglass, spot outflows on February 9 have been simply $443.74 million, a major lower from the multi-million greenback outflows seen throughout the crash. The restraint on capital outflows means that short-term promoting stress could also be exhausted.

The circulate sample by February exhibits a transparent trajectory from massive outflows throughout the crash to step by step smaller outflows throughout the consolidation. If costs are steady whereas outflows are slowing, it’s a signal that weak fingers have virtually capitulated.

The distinction with massive cap tokens like XRP, which noticed $19.57 million in outflows on the identical day, highlights SHIB’s relative resilience throughout the latest market downturn. Low costs and low outflows recommend stronger perception within the remaining holder base.

Day by day chart exhibits descending channel for the yr

On the day by day chart, Shiba Inu is buying and selling inside a descending channel that has contained worth motion for the reason that starting of 2025. Resistance within the channel is at the moment round $0.0000068, with help close to $0.000004.

Worth stays in a bearish construction and is buying and selling beneath all 4 main EMAs. The 20-day EMA is $0.00000681, the 50-day EMA is $0.00000748, the 100-day EMA is $0.00000827, and the 200-day EMA is $0.00000971.

Bollinger Bands offers speedy help with a 20-day SMA of $0.00000695 and a decrease band of $0.0000055. The present worth is round $0.0000060, between these ranges reflecting the continuing consolidation.

Hourly chart exhibits resistance of downtrend line

On the hourly chart, SHIB is at the moment buying and selling beneath the downtrend line from the January 29 excessive that continues to $0.0000065. This trendline has capped any makes an attempt to maneuver increased for the reason that crash started.

The RSI is at 40.77, recovering from closely oversold ranges however nonetheless beneath impartial. The indicator exhibits stabilization with out sturdy directional conviction. The MACD stays unfavorable however has stopped falling, suggesting that the downward momentum is weakening.

The crash low of $0.000005 on February sixth established help that held by subsequent testing. The value has shaped the next low sample on the hourly timeframe, discovering help at progressively increased ranges with every rebound.

Outlook: Will the Shiba Inu enhance?

The development stays bearish whereas costs commerce inside a descending channel, however easing outflows and a pointy improve in burns recommend that stabilizing circumstances are forming.

- Bullish case: A day by day shut above $0.00000681 will retrace the 20-day EMA and break the resistance of the downtrend line. A 2,097% burn fee improve and $443,000 in spill management point out a return to group perception.

- Bearish case: A detailed beneath $0.0000055 will break the Bollinger Band help and goal the $0.0000040 demand zone on the channel flooring. Absent a catalyst to vary Memecoin sentiment, the bearish construction will stay intact.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply