- Bitcoin fell 1.84% to $68,811 after rebounding from session lows close to $68,000 as Bernstein reiterated his year-end value goal of $150,000.

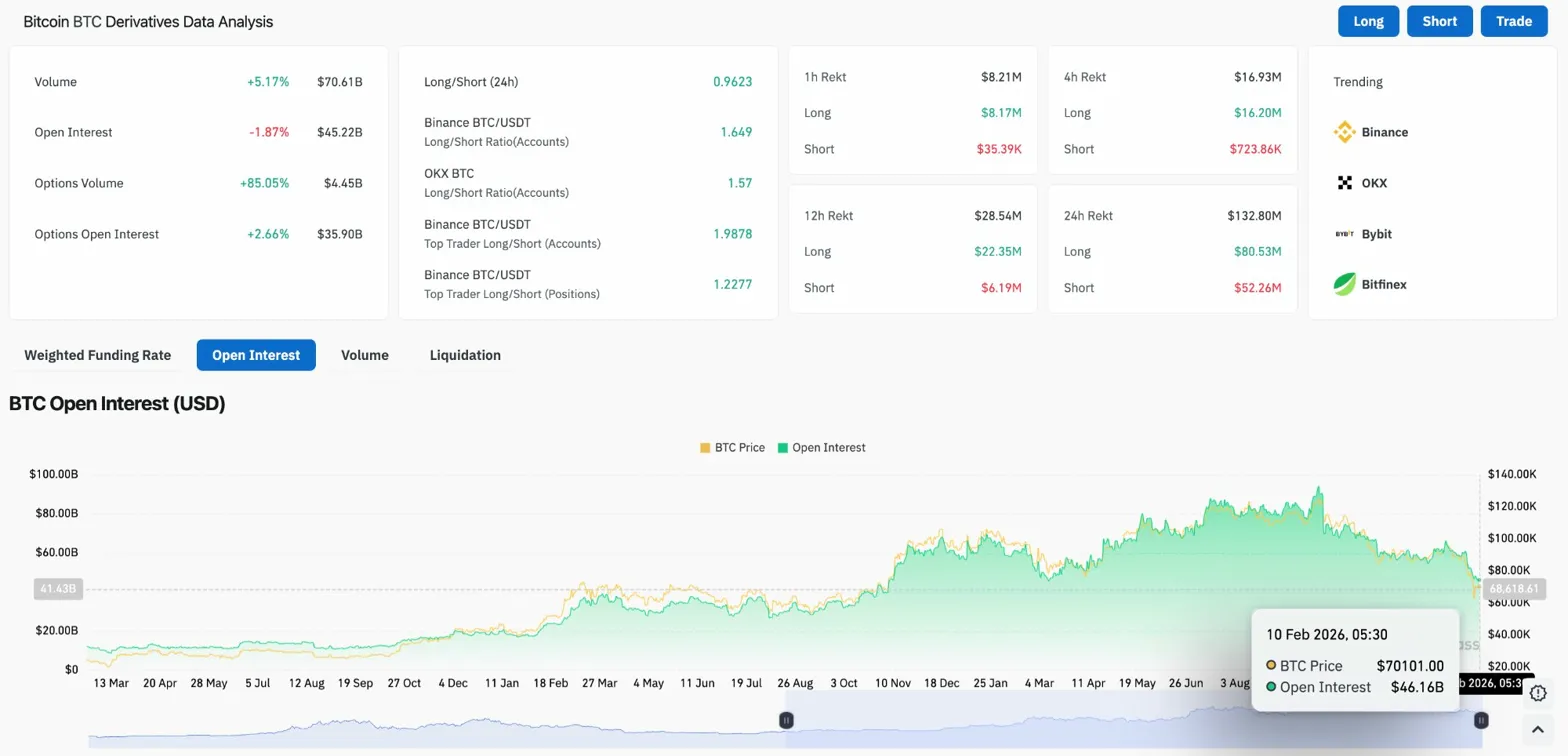

- Open curiosity fell 1.87% to $45.22 billion, whereas choices quantity surged 85.05% as merchants have been cautious of volatility.

- A restoration would require a return to $77,227, however an in depth beneath $68,000 opens the draw back to the crash low of $60,000.

Bitcoin value immediately is buying and selling round $68,811 after recovering from an early session stoop by which the token briefly fell in direction of $68,000. The rally comes as Wall Avenue’s Bernstein insists that what the market is experiencing represents the weakest Bitcoin bear market in historical past and reiterates his bullish year-end goal of $150,000.

Bernstein calls this the weakest bear incident in historical past.

Bernstein analyst Gautam Chughani strongly disputed the bearish sentiment, sustaining his year-end value goal of $150,000 for the inventory regardless of the inventory’s 45% decline from October highs.

Chugani insisted that nothing essentially broke with the adjustments. Analysts famous that when all the celebrities align, the Bitcoin neighborhood creates a self-imposed disaster of confidence. He stated the skeleton won’t ever come free and the media is as soon as once more writing obituaries for Bitcoin.

The analyst famous the cyclical nature of sentiment fluctuations which have traditionally preceded vital recoveries, and concluded that Bitcoin time stays a flat circle.

The bullishness rests on structural components that stay in place, together with institutional adoption, regulatory evolution, and maturing market infrastructure. From this attitude, the present drawdown represents a shopping for alternative reasonably than a basic change in principle.

Mining problem data greatest decline since 2021

Schwab’s Jim Ferraioli supplied technical background for figuring out market bottoms and pointed to Bitcoin mining dynamics as a key indicator.

Earlier declines have usually bottomed out round Bitcoin’s manufacturing prices. Miners utilizing inefficient tools usually shut down operations quickly throughout vital drawdowns. This capitulation manifests itself via an adjustment in mining problem that decreases as miners depart the community.

CoinDesk reported that Bitcoin mining problem has dropped to its highest stage since 2021 as a minimum of some miners succumbed to the value plunge. When the problem begins to rise once more, it is a sign that we could also be at all-time low.

The tip-of-mining sign is in step with the deleveraging seen in derivatives markets, suggesting that the market could also be approaching a depletion part previous to restoration.

Each day Chart Take a look at $73,375 Help Zone

On the each day chart, Bitcoin is buying and selling beneath all 4 main EMAs inside a descending construction. The 20-day EMA is $77,227, the 50-day EMA is $83,994, the 100-day EMA is $89,879, and the 200-day EMA is $95,439.

The Supertrend indicator stays bearish at $81,644. The $73,375 horizontal assist zone marked on the chart represents fast assist, and the $75,000 stage served as a pivot all through the consolidation.

The present value is down about 45% from October’s all-time excessive of round $126,000. Regardless of the severity of the drawdown, Bernstein’s paper suggests it is a shopping for alternative with vital upside to their $150,000 goal.

Hourly chart reveals assist for the uptrend line

On the hourly chart, Bitcoin has shaped an uptrend line from its crash low of $60,000 on February sixth. This trendline at the moment offers assist close to $68,000, which held throughout immediately’s early session drop.

The RSI has recovered from oversold circumstances at 39.49, however stays beneath impartial. The MACD stays unfavourable, however steady, with no indicators of reversal but, suggesting that the draw back is weakening.

The $72,000 stage represents a direct resistance stage that the value has struggled to interrupt because the rally on February seventh. A continued rise above this stage would counsel a attainable continuation in direction of the $75,000 zone.

Derivatives present blended indicators as volatility positioning will increase

Open curiosity decreased by 1.87% to $45.22 billion, however buying and selling quantity elevated by 5.17% to $70.61 billion. Choices quantity elevated 85.05% to $4.45 billion, indicating that merchants are bracing for vital value strikes.

The lengthy/brief ratio is 0.96, indicating a slight brief bias throughout the market. On Binance, high merchants keep a ratio of 1.98 per account, indicating that bullish positioning stays amongst massive gamers.

Previously 24 hours, $132.8 million in positions have been liquidated, of which $80.53 million have been lengthy and $52.26 million have been brief. In comparison with the very long-biased flush through the crash, a extra balanced liquidation profile suggests the market is normalizing.

Open curiosity in choices elevated 2.66% to $35.9 billion, reflecting elevated hedging exercise and directional bets on either side of the market.

Outlook: Will Bitcoin Rise?

The development stays bearish whereas costs stay beneath all EMAs, however the mine subsidence and Wall Avenue convictions counsel circumstances for a backside are forming.

- Bullish case: If the value closes above $77,227 for the day, it can mark the restoration of the 20-day EMA and the underside of the crash low. Bernstein’s $150,000 goal implies an upside of 118% from present ranges, and the corporate maintains that each one structural catalysts stay intact.

- Bearish case: A detailed beneath $68,000 will break the assist of the uptrend line and goal a crash low of $60,000. Regardless of the bullish view from monetary establishments, the technical construction stays bearish till we regain the EMA cluster.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply