- DOGE stays below promoting strain and is buying and selling beneath all main EMAs with a transparent downtrend.

- The short-term pullback lacks follow-through, highlighting the diminishing bullish conviction close to resistance.

- Derivatives and spot flows present weaker confidence amongst merchants, indicating cautious market sentiment.

Dogecoin continues to battle to achieve traction as short-term value motion displays sustained promoting strain. On the 4-hour chart, DOGE is buying and selling inside a transparent bearish construction, that includes constant highs and lows. This sample exhibits that sellers nonetheless management the course of the market.

Because of this, every tried pullback attracts new provide fairly than robust follow-through shopping for. Market individuals at the moment are specializing in key technical zones for early clues as as to if stabilization is coming or additional draw back growth.

Bearish construction limits restoration makes an attempt

DOGE is buying and selling beneath all main exponential transferring averages, reinforcing the present downtrend. As well as, the transferring averages are in a bearish order, confirming that the draw back momentum continues. The 200-period EMA across the $0.125 to $0.126 vary continues to suppress value motion. Due to this fact, this zone acts as an essential barrier to pattern adjustments.

The short-term rebound lacks power and has not been in a position to break previous document highs. Due to this fact, these actions mirror a corrective rebound fairly than new accumulation. Sellers proceed to aggressively defend the resistance zone and include any makes an attempt to maneuver increased. Importantly, the rejection of costs near earlier help ranges highlights waning bullish conviction on the shorter timeframe.

Fast resistance lies between $0.118 and $0.120, marking the earlier breakdown zone. Moreover, continued buying and selling beneath this vary maintains vendor confidence. A broader restoration would require a decisive transfer above the $0.125 EMA space. With out that restoration, momentum stays fragile.

On the draw back, we consider DOGE has short-term help close to $0.112 to $0.110. Patrons try to sluggish the decline on this space. Nevertheless, a failure right here might speed up the loss in the direction of $0.105. Moreover, the $0.100 to $0.098 zone represents psychological and structural help in case of elevated promoting strain.

Notes on derivatives and spot information indicators

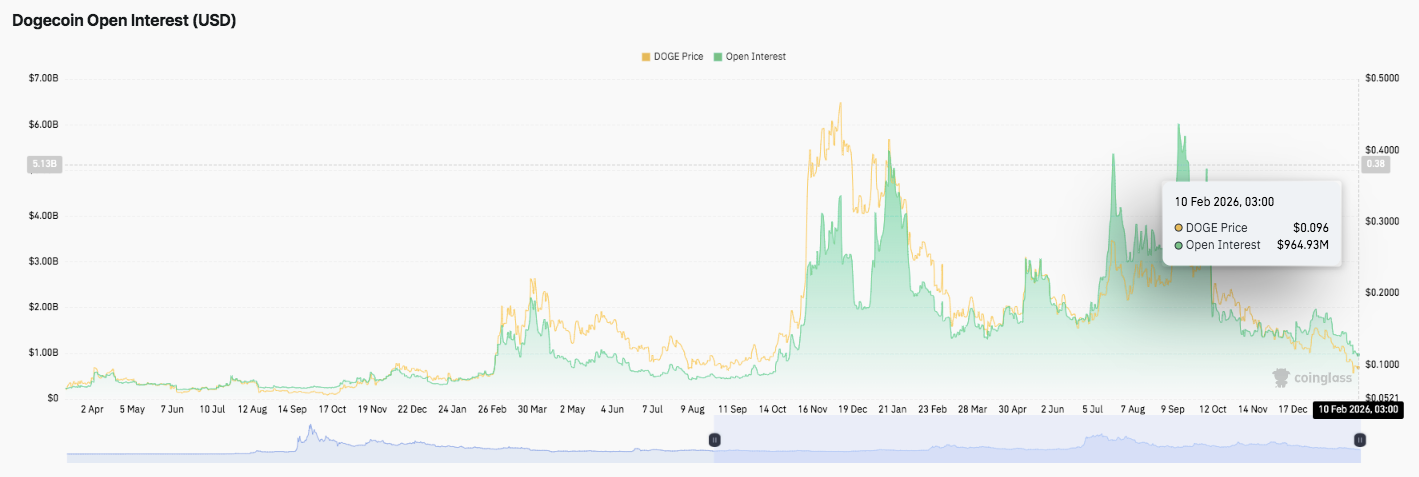

Spinoff information raises additional considerations. Dogecoin’s open curiosity beforehand soared throughout a powerful rally, reflecting robust leverage and speculative positioning. Nevertheless, every growth led to a pointy contraction related to liquidation.

Latest open curiosity ranges have hovered round $1 billion. Because of this, leverage seems to be subdued and dealer confidence stays weak. Traditionally, such compression usually precedes volatility, however the course will depend on new participation.

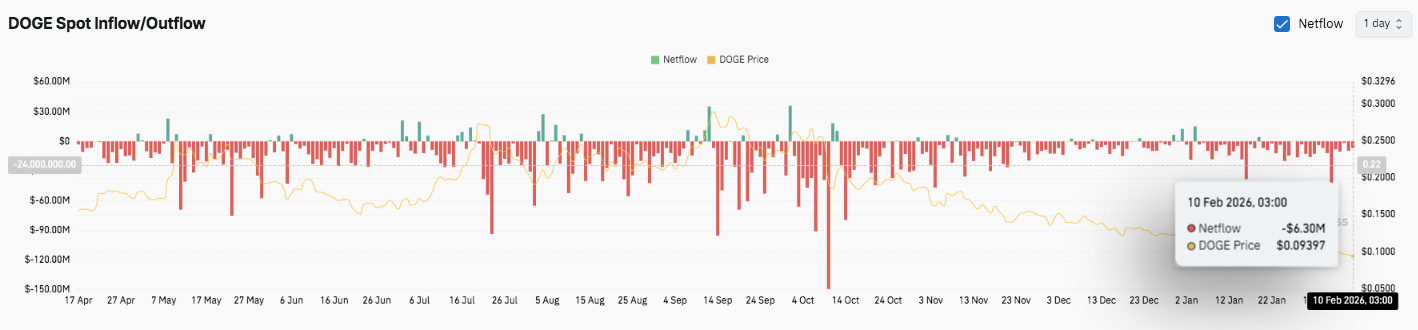

Spot movement information additional helps the cautious outlook. Web outflows dominated most periods, indicating continued distributional strain. Moreover, sudden spikes in outflows usually coincide with value declines fairly than accumulation phases. Brief-term bursts of inflows can’t change broader traits. Because of this, sentiment stays defensive even into February.

Technical outlook for Dogecoin (DOGE) value

Dogecoin value motion continues to be tightly structured because it trades inside an outlined short-term bearish vary. On the 4-hour chart, DOGE continues to make new highs and preserve draw back strain.

The upside stage stays nicely outlined, with $0.118 to $0.120 appearing as the primary resistance cluster. A stronger push would goal the $0.125-$0.126 zone the place the 200-period EMA limits the value and serves as the important thing stage that the bulls should reclaim. If a breakout above this EMA is confirmed, it might open room for $0.135 and $0.140.

On the draw back, $0.112-$0.110 stays the speedy help space, with patrons trying to stabilize the value. If we fully lose this zone, the draw back threat will increase in the direction of $0.105, adopted by the psychological space between $0.100 and $0.098. The broader technical image means that DOGE is consolidating inside a bearish construction fairly than forming a reversal base.

Will Dogecoin go up?

Dogecoin’s near-term outlook will depend on whether or not patrons can defend the $0.110 help lengthy sufficient to problem the overhead resistance. So long as the value stays beneath $0.125, the rally is more likely to appropriate. Nevertheless, the continued compression between help and resistance signifies a rise in volatility forward.

If the bullish momentum strengthens together with enchancment in capital inflows, DOGE might attempt to get well in the direction of the $0.135 zone. Nevertheless, in case you are unable to carry $0.110, you threat accelerating your losses in the direction of $0.100. For now, DOGE stays at a key inflection level, and affirmation from value and flows will decide its subsequent course.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply